Is Hudson Pacific Properties (HPP) Too Good to Be True? A Comprehensive Analysis of a Potential ...

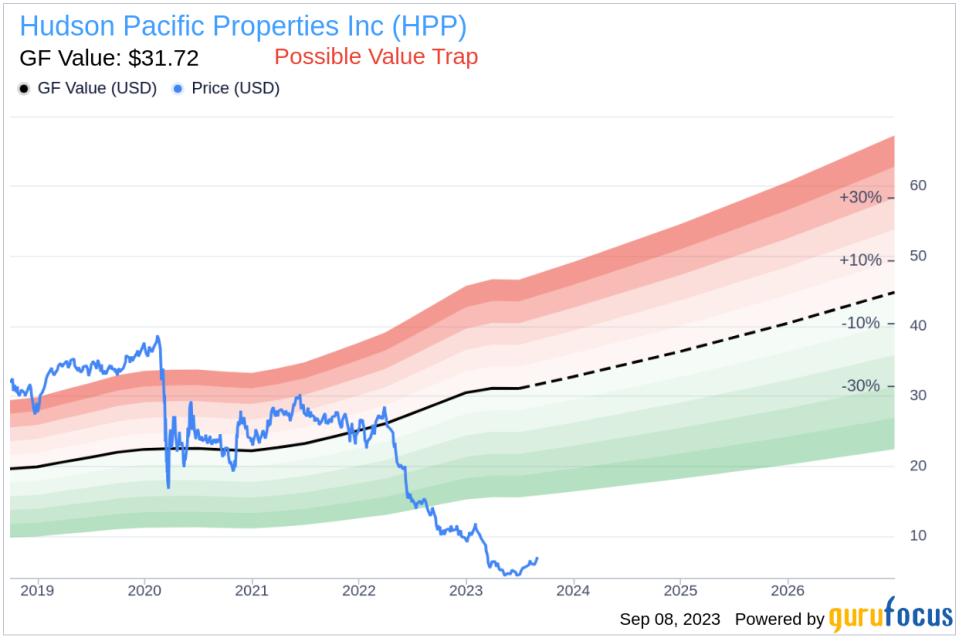

Value-focused investors are continually scouting for stocks priced below their intrinsic value. One such stock that warrants attention is Hudson Pacific Properties Inc (NYSE:HPP). Currently priced at 7.1, the stock recorded a daily loss of 4.05% and a 3-month increase of 38.67%. The stock's fair valuation, as indicated by its GF Value, is $31.72.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page provides an overview of the fair value at which the stock should be traded. It is calculated based on historical multiples, the GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

However, a deeper analysis is needed before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Hudson Pacific Properties should not be overlooked. These risks are primarily reflected through its low Altman Z-score of 0.23. These indicators suggest that Hudson Pacific Properties, despite its apparent undervaluation, might be a potential value trap. This complexity underscores the importance of thorough due diligence in investment decision-making.

What is the Altman Z-score?

The Altman Z-score is a financial model that predicts the probability of a company entering bankruptcy within a two-year timeframe. The Altman Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Company Overview

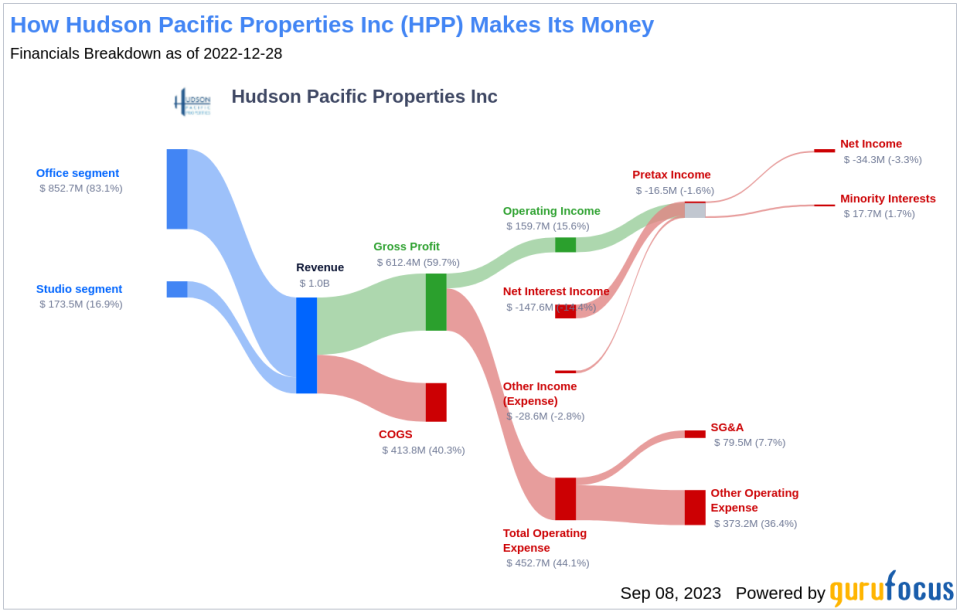

Hudson Pacific Properties Inc is a real estate investment trust that acquires, operates, and owns office buildings and media and entertainment properties, such as sound stages, on America's West Coast. The company focuses on developed, urban markets in Northern California, Southern California, and the Pacific Northwest. The majority of Hudson Pacific's real estate portfolio is composed of office properties located in the Greater Seattle, San Francisco, and Los Angeles areas. The company operates in two reportable segments: office properties & related operations, and studio properties & related operations. The majority of revenue is derived from the office properties & related operations segment.

Hudson Pacific Properties's Low Altman Z-Score: A Breakdown of Key Drivers

A dissection of Hudson Pacific Properties's Altman Z-score reveals that Hudson Pacific Properties's financial health may be weak, suggesting possible financial distress.

Conclusion

Despite its seemingly attractive valuation, Hudson Pacific Properties may be a potential value trap due to its low Altman Z-Score, indicating possible financial distress. Thorough due diligence is crucial before making an investment decision.

GuruFocus Premium members can find stocks with high Altman Z-Score using the following Screener: Walter Schloss Screen .

This article first appeared on GuruFocus.