Hudson Pacific Properties Inc Reports Mixed Q4 Results and Provides 2024 Outlook

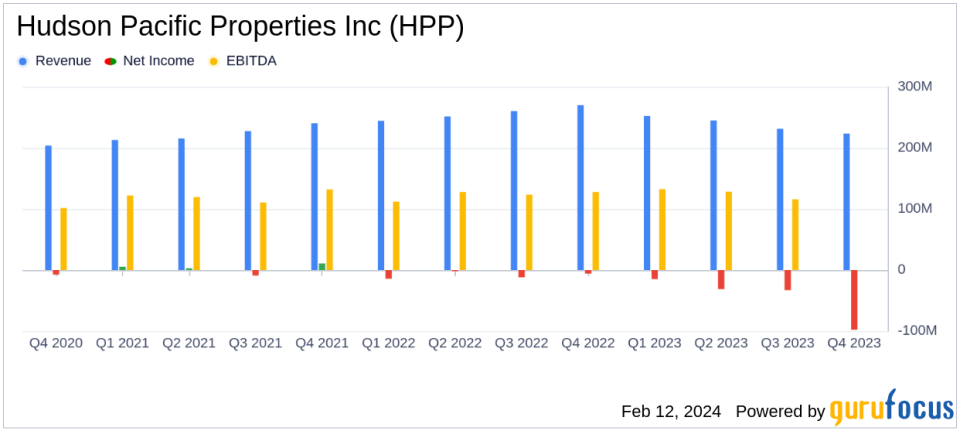

Total Revenue: Decreased to $223.4 million in Q4 2023 from $269.9 million in Q4 2022.

Net Loss: Widened to $98.0 million, or $0.70 per diluted share, compared to a net loss of $12.0 million, or $0.09 per diluted share.

FFO: Declined to $19.6 million, or $0.14 per diluted share, excluding specified items.

AFFO: Stood at $21.5 million, or $0.15 per diluted share.

Leasing Activity: Executed 77 new and renewal leases totaling 431,980 square feet.

Dispositions: Completed $889 million, including sales of key properties and debt tranches.

2024 Outlook: FFO guidance set between $1.00 and $1.10 per diluted share.

On February 12, 2024, Hudson Pacific Properties Inc (NYSE:HPP), a prominent real estate investment trust, released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, known for its portfolio of office and studio properties catering to tech and media tenants on the West Coast, faced a challenging quarter marked by reduced revenues and a significant net loss.

Hudson Pacific's total revenue for the quarter was $223.4 million, a notable decline from the $269.9 million reported in the same period the previous year. This decrease was largely attributed to property sales, tenant move-outs, and a reduction in studio service revenue due to union strikes. The net loss attributable to common stockholders expanded to $98.0 million, or $0.70 per diluted share, from a net loss of $12.0 million, or $0.09 per diluted share in Q4 2022.

Financial Performance and Strategic Moves

Funds From Operations (FFO), excluding specified items, stood at $19.6 million, or $0.14 per diluted share, a decrease from $70.2 million, or $0.49 per diluted share, in the prior year's quarter. Adjusted Funds From Operations (AFFO) also saw a decline, coming in at $21.5 million, or $0.15 per diluted share. Same-store cash Net Operating Income (NOI) was $116.1 million, down from $127.4 million, reflecting the impact of tenant move-outs and the strike-related studio space vacate.

Despite these challenges, Hudson Pacific executed 77 new and renewal leases, totaling 431,980 square feet. However, GAAP and cash rents decreased from prior levels, primarily due to two mid-size tenant renewals in the San Francisco Bay Area. The company's in-service office portfolio ended the quarter at 80.8% occupied and 81.9% leased.

On the disposition front, Hudson Pacific completed $889 million in property sales, including the strategic sale of One Westside and Westside Two office redevelopment for $700 million. These dispositions are part of the company's broader strategy to strengthen its balance sheet and focus on core operations.

Balance Sheet and Dividends

As of December 31, 2023, Hudson Pacific maintained a strong liquidity position with $808.4 million available, including unrestricted cash and undrawn credit facilities. The company's net debt to undepreciated book value ratio was 36.5%, with the majority of its debt fixed or capped and no maturities until late 2025. Additionally, the Board of Directors declared and paid a dividend on its 4.750% Series C cumulative preferred stock.

Environmental, Social, and Governance (ESG) Recognition

Hudson Pacific was honored with multiple ESG recognitions, including top rankings in the 2023 GRESB Real Estate Assessment and Nareit's Leader in the Light: Office Award. These accolades underscore the company's commitment to sustainability and responsible corporate practices.

Looking Ahead

For 2024, Hudson Pacific anticipates FFO to range between $1.00 and $1.10 per diluted share. The guidance reflects management's expectations regarding rental rates, occupancy levels, and the impact of recent events. However, it excludes potential effects from new acquisitions, dispositions, and other capital market activities.

The company's outlook, while cautious, is based on a series of assumptions that include a decrease in same-store property cash NOI and general and administrative expenses estimated between $80,000 and $86,000. Interest expense is projected to range from $170,000 to $180,000, and the company expects to see FFO contributions from unconsolidated joint ventures.

Investors and stakeholders will be watching closely as Hudson Pacific navigates the evolving real estate market, with a strategic focus on leasing and cost control to drive improved financial performance in the year ahead.

For more detailed information, please refer to the supplemental financial information available on the Investors section of Hudson Pacific's website and join the company's conference call scheduled for February 13, 2024.

Explore the complete 8-K earnings release (here) from Hudson Pacific Properties Inc for further details.

This article first appeared on GuruFocus.