Humana (HUM), DUOS Unveil Program to Improve Veterans' Health

Humana Inc. HUM recently teamed up with the 2020-established digital health company, DUOS, to roll out a program in a bid to bring about improved health outcomes for Veteran members of the health insurer in Louisiana, who are enrolled in a Medicare Advantage plan. Launched this month itself, the program will run till the end of 2024.

Veterans suffering from chronic diseases will be able to reap the benefits of the program and undergo an evaluation of their health-related requirements and goals. After this, DUOS will connect the Medicare Advantage beneficiaries with the tailored services, availed through one’s Medicare Advantage plan and/or Veterans’ benefits, that promise to bring an enhanced healthcare experience.

To impart a better understanding of the cultural backgrounds of military and Veteran communities, USAA, one of Humana’s partners, has trained DUOS personal assistants before the commencement of the newly launched program. A comprehensive understanding of one’s physical or mental health challenges, as well as cultural background by healthcare professionals and systems enables them to offer personalized healthcare services to patients.

Concurrently, it also encourages patients to be present for appointments, sincerely follow treatment plans and be more confident in sharing health-related needs.

Presently, Humana administers health benefits to around 6 million on-duty military and retirees across the United States and the recent pursuit of a collaborative approach followed with DUOS is likely to infuse more lucrativeness within its Medicare Advantage plans. Further, USAA, which rendered training to DUOS assistants, joined forces with HUM in 2022 to launch a Medicare Advantage plan to address the diversified healthcare needs of U.S. veterans and their families.

Therefore, such tie-ups may serve as a means to retain existing customers, as well as attract new ones under HUM’s individual Medicare Advantage business line. This, in turn, may boost medical membership growth for Humana and derive higher premium revenues in return. Humana’s continuous efforts to bring diversified health benefits for its Medicare Advantage members seem to be time opportune considering a greying U.S. population and also since the concerned business line contributes the most (nearly 78% in 2023) to HUM’s overall premiums. Being a health insurer, premiums account for the most significant chunk of HUM’s consolidated top line.

Management anticipates the individual Medicare Advantage business to witness a minimum growth of around 100,000 in 2024. Recently, Humana inked a value-based care multi-state deal with the renowned U.S. kidney care provider, Strive Health, to offer high-quality kidney care to its Medicare Advantage members.

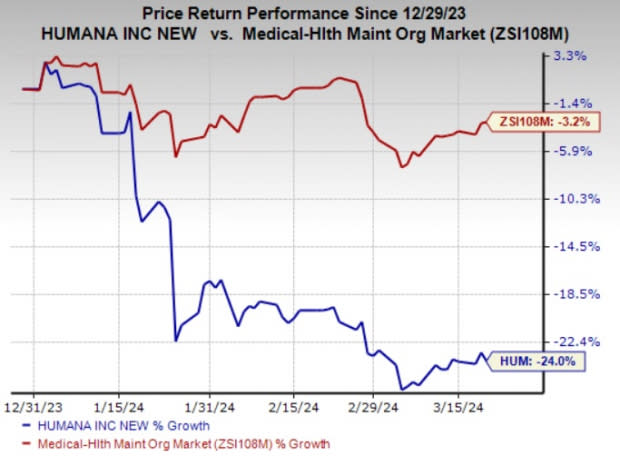

Shares of Humana have declined 24% year to date compared with the industry’s 3.2% fall.

Image Source: Zacks Investment Research

HUM currently has a Zacks Rank #5 (Strong Sell).

Stocks to Consider

Some better-ranked stocks in the Medical space are Collegium Pharmaceutical, Inc. COLL, Elevance Health, Inc. ELV and The Pennant Group, Inc. PNTG. While Collegium Pharmaceutical sports a Zacks Rank #1 (Strong Buy), Elevance Health and Pennant carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Collegium Pharmaceutical’s earnings surpassed estimates in three of the last four quarters and matched the mark once, the average surprise being 7.54%. The Zacks Consensus Estimate for COLL’s 2024 earnings indicates a rise of 15%, while the consensus mark for revenues suggests an improvement of 2.8% from the respective year-earlier actuals. The consensus mark for COLL’s 2024 earnings has moved 5.9% north in the past 30 days.

The bottom line of Elevance Health outpaced estimates in each of the trailing four quarters, the average beat being 3.08%. The Zacks Consensus Estimate for ELV’s 2024 earnings indicates a rise of 12.1%, while the same for revenues suggests an improvement of 1.3% from the respective year-earlier actuals. The consensus mark for ELV’s 2024 earnings has moved 0.3% north in the past 60 days.

Pennant’s earnings surpassed estimates in two of the last four quarters, matched the mark once and missed the same in the remaining one occasion, the average beat being 1.11%. The Zacks Consensus Estimate for PNTG’s 2024 earnings indicates a rise of 17.8%, while the consensus mark for revenues suggests an improvement of 11.5% from the respective year-earlier actuals. The consensus mark for PNTG’s 2024 earnings has moved 4.9% north in the past 30 days.

Shares of Collegium Pharmaceutical, Elevance Health and Pennant have gained 26.1%, 8.9% and 46.4%, respectively, year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Collegium Pharmaceutical, Inc. (COLL) : Free Stock Analysis Report

The Pennant Group, Inc. (PNTG) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report