Humana (HUM) Sees Insurance Costs at Upper Limit of Guidance

Humana Inc. HUM recently reaffirmed its 2023 adjusted earnings guidance at $28.25 per share minimum, which suggests minimum growth of 11.9% from the 2022 figure of $25.24. The Zacks Consensus Estimate is also currently pegged at $28.25 per share. However, the company now predicts its benefit expense ratio for the year to drift toward the upper limit of the projected range of 86.3-87.3%.

Last Friday, it joined health insurer UnitedHealth Group Incorporated UNH, signaling a higher-than-expected spike in non-inpatient utilization trends. Tim Noel, UnitedHealth’s chief executive officer for Medicare and Retirement, said at the Goldman Sachs Global Healthcare Conference that seniors are now undergoing delayed elective surgeries post-pandemic. Demand for procedures like hip and knee surgeries is rising again, which will leave fewer premiums in hand after paying for the procedures for the health insurers.

Most health insurers witnessed a clear drop in share price last week, following the news of the resumption of pent-up elective procedures. On the flip side, it lifted the share prices of hospital operators and medical device players.

In its latest filing, Humana pointed out the increased demand for outpatient surgeries, emergency room and dental services. Despite the rising demand for elective procedures, it stuck to its earnings guidance. HUM expects transaction and integration costs to be at 41 cents per share for the full year.

Earlier, with the first-quarter results, it provided an outlook stating that it expects revenues to be within $104.4-$106.4 billion, the mid-point of which indicates an improvement of 13.5% from the 2022 figure of $92.9 billion. Also, management anticipated individual Medicare Advantage membership to witness a minimum growth of 775,000 members in 2023, suggesting a jump of 17% from the 2022-end figure.

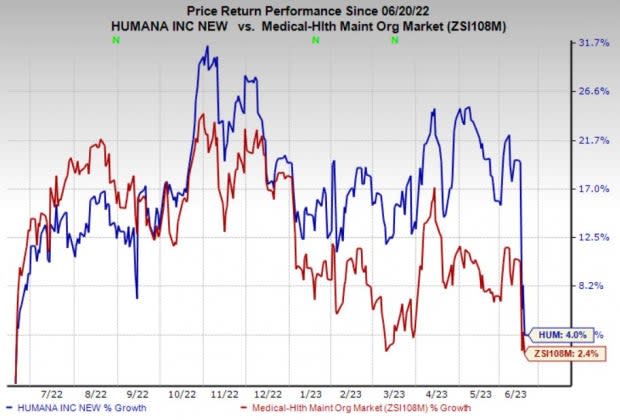

Price Performance

Humana’s shares have gained 4% in the past year compared with the 2.4% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

The company currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical space are Apyx Medical Corporation APYX and Boston Scientific Corporation BSX, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Apyx Medical’s 2023 earnings indicates a 38.8% improvement from the year-ago reported figure. The consensus estimate for APYX’s 2023 revenues signals 37.3% year-over-year growth.

The Zacks Consensus Estimate for Boston Scientific’s 2023 bottom line predicts a 14% improvement from the 2022 levels. BSX has witnessed 12 upward estimate revisions in the past 60 days against none in the opposite direction.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Apyx Medical Corporation (APYX) : Free Stock Analysis Report