Huntington Bancshares Inc (HBAN) Reports Decline in Q4 Earnings Amidst Market Challenges

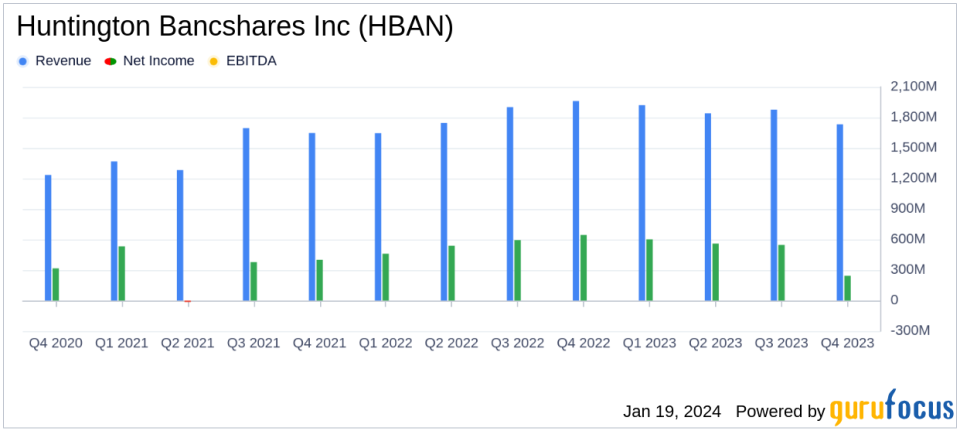

Net Income: Reported $243 million for Q4, a decrease from $645 million year-over-year.

Earnings Per Share (EPS): Q4 EPS at $0.15, down from $0.42 in the same quarter last year.

Net Interest Income: Decreased by 10% year-over-year to $1,316 million in Q4.

Noninterest Income: Fell by 19% year-over-year, impacted by mark-to-market on pay-fixed swaptions.

Average Total Loans and Leases: Increased by 2% from the year-ago quarter to $121.2 billion.

Common Equity Tier 1 (CET1): Increased by 15 basis points to 10.25%.

Credit Quality: Net charge-offs at 0.31% of average total loans and leases for the quarter.

Huntington Bancshares Inc (NASDAQ:HBAN) released its 8-K filing on January 19, 2024, detailing the financial outcomes for the fourth quarter of 2023. The regional bank holding company, headquartered in Columbus, Ohio, with a network across eight Midwestern states, reported a decrease in net income and earnings per share compared to the same quarter in the previous year. The bank's performance was influenced by various challenges, including a special FDIC Deposit Insurance Fund assessment and a mark-to-market loss on its hedging program.

Financial Performance and Challenges

The bank's earnings per common share for the quarter were $0.15, a decrease from the prior quarter and year-ago quarter. The decline was attributed to notable items, primarily related to the FDIC Deposit Insurance Fund special assessment and the mark-to-market of the pay-fixed swaptions hedging program, which reduced pre-tax income by $74 million. Net interest income and noninterest income also saw declines from the prior quarter and year-ago quarter.

Capital and Liquidity Strength

Huntington's capital ratios improved, with the CET1 risk-based capital ratio increasing to 10.25%. The bank also reported robust liquidity, with cash and cash equivalents and available contingent borrowing capacity totaling $93 billion at the end of the quarter. This capital expansion is significant for the bank and the industry, as it provides a buffer against potential losses and supports future growth.

Income Statement and Balance Sheet Highlights

The bank's average total deposits and loans showed growth from the prior quarter and year-ago quarter, indicating continued momentum in consumer deposit gathering and loan origination. However, net interest income decreased due to a lower net interest margin, reflecting higher cost of funds and an increase in deposits held at the Federal Reserve Bank. Noninterest income was affected by the unfavorable mark-to-market on the pay-fixed swaptions program.

"We are pleased to deliver fourth quarter results highlighted by the continuation of our organic growth efforts with sustained deposit and loan growth as well as the further expansion of common equity tier 1 capital, said Steve Steinour, chairman, president, and CEO.

Analysis of Company Performance

Despite the challenges faced in the fourth quarter, Huntington Bancshares Inc (NASDAQ:HBAN) managed to grow its loan portfolio and maintain strong credit quality, with net charge-offs of 0.31% of average total loans and leases. The bank's strategic initiatives, including expanding into new markets and focusing on customer relationships, have positioned it for potential growth opportunities in the coming year.

For a more detailed analysis of Huntington Bancshares Inc (NASDAQ:HBAN)'s financial performance, including full financial tables and metrics, please visit the 8-K filing.

Investors and stakeholders are encouraged to review the complete earnings report and consider the bank's strategic positioning and capital strength when evaluating its performance and potential for value creation.

Explore the complete 8-K earnings release (here) from Huntington Bancshares Inc for further details.

This article first appeared on GuruFocus.