Huntington (HBAN) Intends to Expand Its Footprint in Texas

Huntington Bancshares Incorporated HBAN plans to expand its commercial banking business in Texas to further extend its reach in the Lone Star State. This was followed by the company’s expansion efforts in the Dallas-Fort Worth area earlier this year.

Currently, Texas is one of the biggest and fastest-growing markets in the United States. On a stand-alone basis, Texas holds the eighth position among the world’s largest economies, providing a tremendous number of opportunities for out-of-state banks that are seeking growth.

Clint Bryant (managing director and Texas market’s president) stated, “Again, it's a good market for not only companies but for talent, and I think we'll be able to attract both.”

Texas is a very business-friendly state, which attracts a significant number of companies and individuals to move into the state, leading to a substantial inflow of newcomers. Hence, Texas presents an attractive market for HBAN’s growth objectives.

Markedly, Huntington has been expanding its footprint and capabilities in a number of verticals through acquisitions in the past few years. In 2022, the company acquired Capstone Partners to bolster its capital market business and Torana to enhance its digital capabilities and enterprise payments strategy.

In 2021, HBAN completed the merger with TCF Financial to form one of the top 25 U.S. bank holding companies. The acquisition strengthened Huntington’s position in existing markets, established presence in new markets and combined complementary businesses, which will further enable it to realize meaningful revenue synergies and fuel growth.

Primarily driven by strategic acquisitions and expansions, the bank’s total deposits witnessed a four-year compound annual growth rate (CAGR) of 16.4% (2019-2023). Additionally, driven by a strong performance of the commercial and consumer portfolios, the total loan balance saw a four-year CAGR of 12.8% in 2023. Management expects loans to grow in the range of 3-5% in 2024. Concurrently, deposits are anticipated to grow in the range of 2-4% on the back of sustained client acquisition and deepening primary bank customer relationships.

These efforts to grow inorganically will continue to support the bank further to gain significant market share and enhance its profitability. However, continued long-term investments in key growth initiatives are expected to keep its expenses elevated.

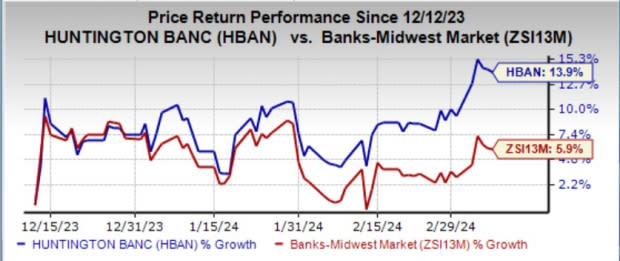

Over the past three months, HBAN’s shares have gained 13.9% compared with the industry’s growth of 5.9%.

Image Source: Zacks Investment Research

Currently, HBAN carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Finance Firms Taking Similar Steps

Morgan Stanley MS recently announced the opening of a new office in Abu Dhabi with the aim of enhancing its presence in the Middle East region. This move aligns with MS’ strategic focus on United Arab Emirates with new opportunities in the capital markets business.

In February, Sumitomo Mitsui Financial Group, Inc. SMFG announced that it is considering further expansion of its alliance with the U.S. investment bank Jefferies Financial Group Inc. JEF. Per a Bloomberg report, SMFG’s new CEO, Toru Nakashima, is mulling to further widen the bank’s alliance with JEF into Asia in an effort to compete with its Japan rivals, who have been moving rapidly to build out their investment banking overseas.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Jefferies Financial Group Inc. (JEF) : Free Stock Analysis Report

Sumitomo Mitsui Financial Group Inc (SMFG) : Free Stock Analysis Report