Huntington (HBAN) Q1 Earnings Beat Estimates as Revenues Rise

Huntington Bancshares’ HBAN first-quarter 2021 earnings per share of 48 cents surpassed the Zacks Consensus Estimate of 33 cents. Also, the bottom line increased substantially from 3 cents reported in the prior-year quarter.

Notably, the stock appreciated 2.5% in pre-market trading, reflecting investors’ optimism with the results. The full-day trading session will display a clearer picture.

Increase in revenues aided by high net interest and non-interest income supported the results. Rise in mortgage banking revenues and increase in average earnings assets acted as driving factors. Improvement in deposits and negative credit provisions were other positives. However, results were adversely impacted by lower loans balance and elevated expenses.

The company reported net income of $532 million in the quarter compared with $48 million in the year-ago quarter.

Revenues Up, Expenses Escalate

Total revenues climbed 19% year over year to $1.37 billion in the first quarter. Also, the top line surpassed the consensus estimate of $1.23 billion.

Net interest income (FTE basis) was $978 million, up 23% from the prior-year quarter. The upside resulted from an increase in average earnings assets (12%), partly offset by a lower net interest margin (NIM), which contracted 34 basis points (bps) to 3.48%.

Non-interest income climbed 9% year over year to $395 million. This upside mainly stemmed from an increase in mortgage banking income, card and payment processing, insurance income along with trust and investment management services income.

Non-interest expenses rose 22% on a year-over-year basis to $756 million. This was chiefly due to higher professional services costs, outside data processing and other service costs, occupancy and equipment expenses, and marketing expenses. On an adjusted basis, costs increased 18%.

Efficiency ratio was 57%, up from the prior-year quarter’s 55.4%. A rise in ratio indicates a fall in profitability.

As of Mar 31, 2021, average loans and leases at Huntington decreased 1% on a sequential basis to $80.3 billion. However, average total deposits increased 3% from the prior quarter to $99.3 billion.

Credit Quality: A Mixed Bag

Net charge-offs were $64 million or an annualized 0.32% of average total loans in the reported quarter, down from the $117 million or an annualized 0.62% recorded in the prior year. Furthermore, the quarter-end allowance for credit losses rose 8.6% to $1.74 billion.

In the first quarter, the company reported negative credit provisioning on improving economic conditions of $60 million compared with provision expenses of $441 million. In addition, total non-performing assets totaled $544 million as of Mar 31, 2021, down 7.2%.

Capital Ratios

Common equity tier 1 risk-based capital ratio and regulatory Tier 1 risk-based capital ratio were 10.33% and 13.32%, respectively, compared with the 9.47% and 10.81% reported in the year-ago quarter. Tangible common equity to tangible assets ratio was 7.11%, down from 7.52% as of Mar 31, 2020.

Return on average assets and average common equity was 1.76% and 18.7%, respectively, compared with 0.17% and 1.1% recorded in the prior-year quarter.

Outlook for 2021

The company has raised guidance for full-year 2021.

Revenues are expected to increase 3-5% from 2020 compared with 1-3% projected previously. Non-interest expenses are likely to be up 7-9% year over year compared with 3-5% projected before.

Management expects average loans and leases to climb 1-3%, down from 2% to 4%. Average total deposits are expected to jump 9-11%, up from 5-7%.

Asset quality is anticipated to remain strong. Net charge-offs are expected to be 30-40 bps compared with 35-55 bps expected earlier. Some moderate quarterly volatility is likely to be witnessed.

The effective tax rate for 2021 is expected, as before, to be in the range of 16% to 17%.

Our Viewpoint

Huntington put up a decent performance during the March-ended period. Though the company displayed continued efforts in increasing loan and deposit balances, margin pressure and elevated expenses remain concerns. However, improvement in credit metrics on lower provisions due to the recovering economy is a tailwind.

Also, the acquisition of TCF Financial is expected to boost the company’s long-term growth. Additionally, higher net interest income, despite low rates, and mortgage banking income will likely remain driving factors.

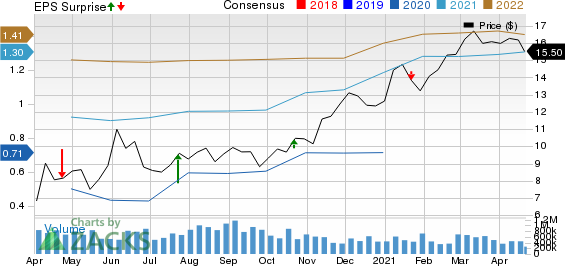

Huntington Bancshares Incorporated Price, Consensus and EPS Surprise

Huntington Bancshares Incorporated price-consensus-eps-surprise-chart | Huntington Bancshares Incorporated Quote

Currently, Huntington carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Results of Other Banks

M&T Bank Corporation MTB reported first-quarter 2021 positive earnings surprise of 15%. Net operating earnings per share of $3.41 beat the Zacks Consensus Estimate of $2.96. Also, the bottom line compared favorably with the $1.95 per share reported in the year-ago quarter.

Comerica CMA delivered a first-quarter 2021 positive earnings surprise of 76.1%. Earnings per share of $2.43 easily surpassed the Zacks Consensus Estimate of $1.38. Also, the bottom line compared favorably with a loss of 46 cents reported in the prior-year quarter.

PNC Financial PNC pulled off first-quarter 2021 positive earnings surprise of 49.1% on substantial reserves release. Earnings per share of $4.10 surpassed the Zacks Consensus Estimate of $2.75. Also, the bottom line compared favorably with $1.59 in the prior-year quarter.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comerica Incorporated (CMA) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.