Can Huntington (HBAN) Retain Its Beat Streak in Q4 Earnings?

Huntington Bancshares HBAN is slated to report fourth-quarter and 2023 results on Jan 19 before the opening bell. The company’s quarterly revenues and earnings are expected to have declined year over year.

In the last reported quarter, the bank recorded a positive earnings surprise of 12.5%. The results benefited from increases in non-interest income. HBAN also reported lower provisions for credit losses despite a challenging economic backdrop. However, a fall in net interest income (“NII”) and elevated expenses were headwinds.

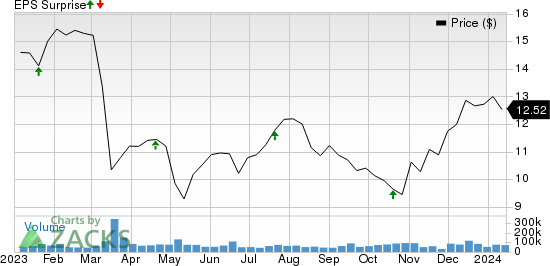

Huntington has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 5.8%.

Huntington Bancshares Incorporated Price and EPS Surprise

Huntington Bancshares Incorporated price-eps-surprise | Huntington Bancshares Incorporated Quote

The Zacks Consensus Estimate for HBAN’s fourth-quarter earnings of 26 cents per share has been revised marginally downward over the past week, reflecting the bearish sentiments of analysts. The figure indicates a 40% decline from the year-ago reported number.

The consensus estimate for revenues of $1.75 billion suggests a year-over-year decrease of 11%.

For 2023, earnings estimates of $1.35 indicate a year-over-year decline of 10%, while the same for revenues of $7.39 billion suggests a rise of 1.5%.

Key Development During the Quarter

On Dec 19, 2023, the bank completed a synthetic Credit Risk Transfer transaction related to a $3-billion portfolio of on-balance sheet prime indirect auto loans. The transaction is expected to result in $4 million of related expenses, which will be recognized in the December-end quarter, and $19 million of premium expenses, which will be reflected as a contra-revenue in fee income for 2023.

Nonetheless, the transaction is expected to reduce risk-weighted assets by $2.4 billion. This is anticipated to increase common equity tier 1 (CET1) capital by 17 basis points (bps).

The bank projects to record $214 million of expenses in fourth-quarter 2023 for its share of the FDIC's Deposit Insurance Fund Special Assessment from the banking turmoil in March. This is expected to reduce HBAN's CET1 capital ratio by 12 bps.

The net of both moves is expected to benefit CET1 by 5 bps in fourth-quarter 2023.

The bank also terminated its pay-fixed swaption program, which started in March 2023 to protect its securities market value from rising interest rates. The program totaled $15.5 billion in notional exposure as of the third-quarter end and would have protected 35-45% of securities market value under rate shock scenarios.

However, given the Fed hinting to end the rate hike cycle, the bank fully terminated all of the notional exposure as of Dec 21, 2023.

Net of cumulative mark-to-market, the total economic cost of the program was $24 million at the close of the transaction.

Key Factors & Estimates for Q4

Loans: Banks’ lending activities are likely to have been affected in the fourth quarter amid a challenging macroeconomic backdrop and high interest rates. The demand for consumer loans declined, whereas commercial real estate loans experienced softer demand in the quarter under review than the third-quarter 2023-end.

Specifically, the demand for commercial and industrial loans, and residential real estate loans improved in the fourth quarter, per Fed’s latest data. Given HBAN’s significant exposure to commercial loans, the company’s loan growth in the fourth quarter is likely to have improved.

Management projects 1% year-over-year growth in fourth-quarter 2023 average loans and deposits. It expects loan growth of 5% for 2023.

NII: Though the Federal Reserve did not raise rates in the quarter, the policy rate stands at a 22-year high of 5.25-5.5% at present. Such high rates are likely to have a positive impact on the company’s NII.

Despite this, softer loan demand, inverted yield curve and higher funding costs are anticipated to have negatively impacted NII and the net interest margin in the quarter to be reported.

The Zacks Consensus Estimate for NII is pegged at $1.31 billion, suggesting a 4.2% decline sequentially. The company expects NII to decline 4-5% in the fourth quarter from that posted in the third quarter. NIM is anticipated to be 3.05-3.10% for the same span.

Non-Interest Income: In the quarter under review, mortgage rates started to decrease, with the rate on a 30-year fixed mortgage declining to 6.62% as of Dec 31, 2023, from the 7.31% recorded at the beginning of the quarter. Though mortgage rates declined, they remained sufficiently high, keeping home buyers on the sidelines. This is likely to have led to a smaller origination market, both purchase and refinancing, compared with the prior quarter. These factors are likely to have weighed on HBAN’s mortgage banking income. The Zacks Consensus Estimate for mortgage banking revenues of $25.87 million suggests a 4% sequential decline.

Global deal-making witnessed a slight rebound in the fourth quarter, and green shoots were observed in the capital markets and issuance activities. The stabilizing interest rate environment was the major factor driving a better picture. Thus, the company’s capital market fees are likely to have been positively impacted. Also, the Zacks Consensus Estimate for the same of $53 million indicates 8.2% growth sequentially.

The high inflation is expected to have increased card transactions, thereby supporting HBAN’s card and payment processing income in the quarter. The Zacks Consensus Estimate for card and payment processing income of $104 million implies a marginal sequential increase.

The consensus estimate for service charges on deposit accounts for the fourth quarter is pegged at $94 million, hinting at a decline of 3.1% on a sequential basis. The consensus mark for trust and investment management fees is pegged at $67 million, indicating a sequential decrease of 1.5%.

The consensus mark for insurance income of $31.89 million implies a marginal sequential rise.

Overall, the consensus mark for total non-interest income of $456 million indicates a 10.4% sequential fall.Management expects relatively stable sequential non-interest income (excluding notable items and marked-to-market PF swaptions).

Expenses: Huntington’s long-term investments in digital capabilities, marketing and hiring personnel to aid growth are anticipated to have raised its costs in the fourth quarter.

The bank projects to record $214 million of expenses in fourth-quarter 2023 for its share of the FDIC's Deposit Insurance Fund Special Assessment from the banking turmoil in March. This is expected to reduce HBAN's CET1 capital ratio by 12 bps.

Huntington anticipates completing its staffing efficiencies and corporate real estate consolidation moves in the fourth quarter. This is projected to result in $12 million of non-recurring expenses in the to-be-reported quarter compared with the $10 million mentioned previously.

Management expects expenses (excluding notable items) to climb 4-5% sequentially in the fourth quarter, primarily driven by revenue-related expenses associated with expected growth in capital markets, a seasonal increase in medical claims, and sustained investment in new and enhanced capabilities.

Asset Quality: HBAN is expected to have set aside substantial money for potential bad loans, given expectations of an uncertain macroeconomic outlook and slower GDP growth. Reserves built during the quarter are expected to have weighed on HBAN’s bottom-line growth.

The Zacks Consensus Estimate for total non-performing assets of $642 million implies a 1.3% increase from that reported in the prior quarter.

What Our Quantitative Model Reveals

Our proven model does not predict an earnings beat for Huntington this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Earnings ESP: The Earnings ESP for Huntington is -3.16%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Huntington currently has a Zacks Rank #3.

Stocks That Warrant a Look

Here are a couple of bank stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around.

Bank OZK OZK is slated to report fourth-quarter and 2023 results on Jan 18. It has an Earnings ESP of +5.97% and a Zacks Rank #3 at present.

Over the past week, the Zacks Consensus Estimate for OZK’s quarterly earnings per share has moved marginally south to $1.45.

Synovus Financial SNV is scheduled to release fourth-quarter and 2023 earnings on Jan 17. The company, which sports a Zacks Rank #1 at present, has an Earnings ESP of +1.18%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for SNV’s quarterly earnings has been revised marginally upward at 94 cents per share over the past week.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synovus Financial Corp. (SNV) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report