Huntsman Corp (HUN) Reports Q4 2023 Earnings: Challenges Persist Amid Lower Revenues and Net Loss

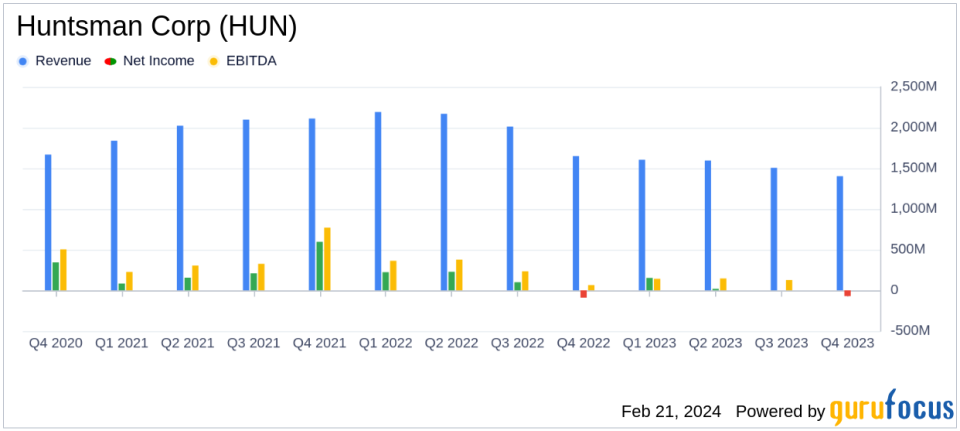

Revenue: Q4 revenue decreased to $1,403 million from $1,650 million in Q4 2022.

Net Loss: Reported a net loss of $71 million in Q4 2023, compared to a net loss of $91 million in Q4 2022.

Adjusted EBITDA: Adjusted EBITDA fell to $44 million from $87 million year-over-year.

Free Cash Flow: Free cash flow from continuing operations was $83 million, down from $211 million in the prior year.

Capital Expenditures: Capital expenditures were $83 million, with an expectation to spend approximately $200 million in 2024.

Effective Tax Rate: The effective tax rate was 65%, with an adjusted effective tax rate of 34%.

Huntsman Corp (NYSE:HUN) released its 8-K filing on February 21, 2024, detailing the financial results for the fourth quarter of 2023. The company, a US-based manufacturer of differentiated organic chemical products, reported a decrease in revenues to $1,403 million from $1,650 million in the same quarter of the previous year. The net loss attributable to Huntsman Corporation was $71 million, an improvement from a net loss of $91 million in the fourth quarter of 2022. Adjusted net loss was $36 million, compared to an adjusted net income of $8 million in the prior year's quarter.

Performance and Challenges

Chairman, President, and CEO Peter R. Huntsman commented on the moderate improvement from the lows experienced in the fourth quarter of 2023, while also acknowledging the uncertainty in timing for a market recovery. He expressed confidence in the company's positioning to benefit from volume leverage and cost control measures once the market improves. The company's focus remains on financial strength, considering both internal and external investments, as well as returning cash to shareholders through dividends and buybacks.

The portfolio changes we have made over the past several years have placed Huntsman in a position to withstand one of the toughest demand environments we have seen in well over a decade. The financial strength of our Company remains our priority as we consider both internal and external investments as well as returning cash to shareholders through our dividend and buybacks.

Segment Analysis and Financial Achievements

The Polyurethanes segment saw a decrease in revenues primarily due to lower MDI average selling prices, lower sales volumes, and an adverse sales mix, with an unplanned outage in the Rotterdam facility impacting sales volumes. The Performance Products segment experienced lower revenues mainly due to decreased average selling prices and slightly lower sales volumes. The Advanced Materials segment also reported decreased revenues, attributed to lower sales volumes and selling prices in response to lower raw material costs.

The company's liquidity and capital resources remain robust, with approximately $1.7 billion of combined cash and unused borrowing capacity as of December 31, 2023. Free cash flow from continuing operations was $83 million for the quarter, a decrease from $211 million in the same period of 2022. Capital expenditures for the quarter were $83 million, and the company expects to spend approximately $200 million on capital expenditures in 2024.

Income Statement and Balance Sheet Highlights

The income statement reflects the challenges faced by the company, with a gross profit of $152 million compared to $190 million in the prior year's quarter. Operating expenses were $195 million, and the company reported an operating loss of $54 million. The balance sheet remains solid, with the company maintaining a strong cash position and manageable levels of debt.

In conclusion, Huntsman Corp (NYSE:HUN) faced a challenging quarter with decreased revenues and a net loss. However, the company's strategic positioning and cost control measures, along with a strong balance sheet, provide a foundation for future growth as market conditions improve. Investors will be watching closely for signs of recovery in the company's end markets and the impact of Huntsman's strategic initiatives on its financial performance.

Explore the complete 8-K earnings release (here) from Huntsman Corp for further details.

This article first appeared on GuruFocus.