Huntsman's (HUN) Q4 Earnings Miss Estimates, Revenues Beat

Huntsman Corporation HUN logged fourth-quarter 2023 net loss of $71 million or 41 cents per share compared with a loss of $91 million 48 cents per share in the year-ago quarter.

Barring one-time items, adjusted loss per share came in at 21 cents per share for the reported quarter. It was wider than the Zacks Consensus Estimate of a loss of 14 cents.

Revenues were $1,403 million, down around 15% year over year. The top line, however, beat the Zacks Consensus Estimate of $1,324 million. HUN witnessed lower sales across its segments in the quarter on reduced prices and volumes.

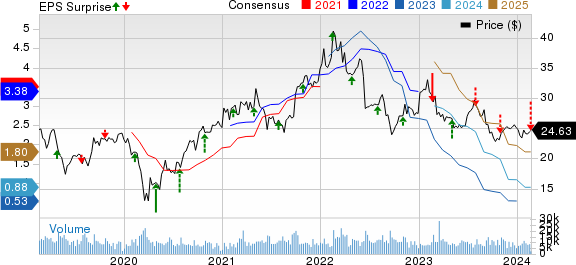

Huntsman Corporation Price, Consensus and EPS Surprise

Huntsman Corporation price-consensus-eps-surprise-chart | Huntsman Corporation Quote

Segment Highlights

Polyurethanes: Revenues from the segment declined 16% year on year to $895 million in the reported quarter, owing to lower MDI average selling prices, fewer sales volumes and an adverse sales mix. It was above our estimate of $881 million. MDI average selling prices fell in the quarter due to less favorable supply and demand dynamics.

Performance Products: Revenues fell 15% to $260 million as a result of a decline in average selling prices and modestly lower sales volumes. It was above our estimate of $246 million. Sales volumes fell due to slow construction activities and soft demand in fuel and lubes and other industrial markets.

Advanced Materials: Revenues from the unit declined 10% to $251 million due to reduced sales volumes and lower average selling prices. It was higher than our estimate of $243 million. Sales volumes fell mainly due to lower customer demand in industrial and commodity markets.

FY23 Results

Earnings for full-year 2023 were 57 cents per share compared with earnings of $2.27 per share a year ago. Net sales fell around 24% year over year to $6,111 million.

Financials

Huntsman ended 2023 with cash of $540 million, down around 17% year over year. Long-term debt was $1,676 million, flat year over year.

Net cash provided by operating activities from continuing operations was $166 million in the fourth quarter while free cash flow from continuing operations was $83 million.

Huntsman repurchased approximately 2.1 million shares for roughly $50 million in the fourth quarter. Its board approved a 5% increase to its quarterly dividend.

Outlook

Huntsman said that it witnessed a modest improvement in demand in early 2024 from the lows experienced in the fourth quarter. Although HUN is yet to see a clear inflexion point in demand, it remains optimistic about the future. The company is well-placed to gain significantly from volume leverage once its end markets improve and as it continues to control costs, HUN noted.

Price Performance

Shares of Huntsman have lost 14.9% in the past year against a 16.9% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

HUN currently has a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth a look in the basic materials space include, Carpenter Technology Corporation CRS, Alpha Metallurgical Resources Inc. AMR and Hawkins, Inc. HWKN.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $4.00, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 12.2%. The company’s shares have gained around 34% in the past year. CRS currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alpha Metallurgical Resources’ current-year earnings has been revised upward by 8.8% in the past 60 days. It currently carries a Zacks Rank #1. AMR delivered a trailing four-quarter earnings surprise of roughly 9.6%, on average. AMR shares are up around 129% in a year.

The consensus estimate for Hawkins’ current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26.2%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised 4.3% upward in the past 30 days. HWKN, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 30.6%. The company’s shares have rallied roughly 68% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Huntsman Corporation (HUN) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report