Hurco Companies Inc (HURC) Faces First Quarter Challenges with Net Loss and Sales Decline

Net Loss: Reported a net loss of $1.65 million, or $0.25 per diluted share.

Sales Decline: Sales and service fees decreased by 18% to $45.06 million.

Geographic Performance: Sales dropped in the Americas and Europe but increased in the Asia Pacific region.

Orders: Total orders decreased by 6%, with mixed results across regions.

Gross Profit: Gross profit margin slightly declined to 22% of sales.

Balance Sheet: Cash and cash equivalents decreased, while working capital saw a slight increase.

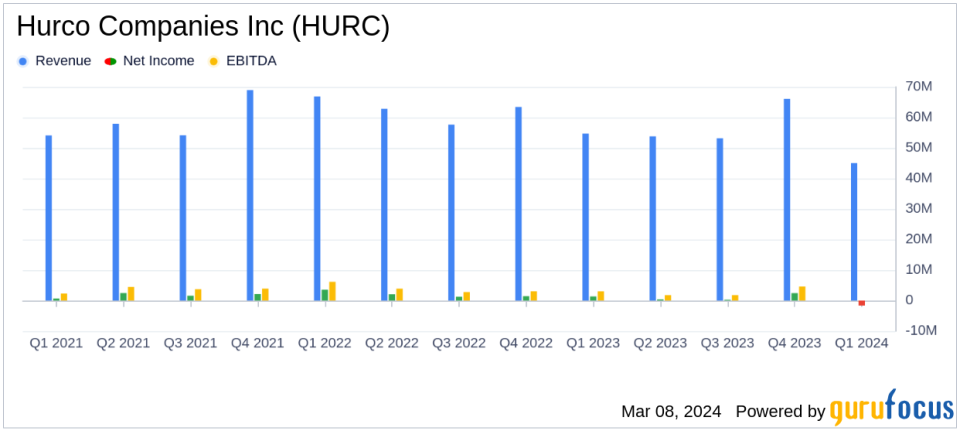

On March 8, 2024, Hurco Companies Inc (NASDAQ:HURC) released its 8-K filing, detailing the financial results for the first fiscal quarter ended January 31, 2024. The company, a leading industrial technology firm specializing in computerized machine tools, faced a challenging quarter with a reported net loss and a decline in sales and service fees.

Hurco Companies Inc (NASDAQ:HURC) is known for its innovative computer control systems designed for both skilled and unskilled operators. The company's primary revenue comes from its Computerized Machine Tools product, with a significant market presence in the United States.

Financial Performance and Challenges

The first quarter saw Hurco recording a net loss of $1.65 million, or $0.25 per diluted share, a stark contrast to the net income of $1.33 million, or $0.20 per diluted share, in the same period last year. Sales and service fees fell to $45.06 million, an 18% decrease from the previous year, despite a favorable currency impact. The decline in sales was primarily due to reduced shipments across various product lines, particularly in the Americas and Europe.

CEO Greg Volovic expressed disappointment with the quarter's results but remains optimistic about the future, citing positive order trends in the Americas and Asia Pacific regions. He emphasized the company's ongoing investment in cutting-edge technology and strategic initiatives, such as the relocation of Milltronics to Indianapolis, to enhance customer service and support.

We were disappointed with first quarter results but are continuing to invest in the future growth of our business. I am particularly heartened by the positive shift we witnessed in both the Americas and the Asian Pacific regions this quarter. Seeing orders in these regions surpass sales and outpace prior year figures is a promising sign.

Financial Achievements and Importance

Despite the overall decline, Hurco saw a 39% increase in sales in the Asia Pacific region, indicating a strong demand for its products in emerging markets. The company's focus on innovation and technology, particularly in autonomous machining and next-generation controls, positions it well for future growth in the industrial products sector.

Key Financial Metrics

Hurco's gross profit for the quarter was $9.7 million, or 22% of sales, slightly down from 23% in the previous year. Selling, general, and administrative expenses increased as a percentage of sales to 26%, up from 21% last year, due to lower sales volumes. The effective tax rate decreased to 27% from 31%, reflecting changes in the geographic mix of income and losses.

The balance sheet shows a decrease in cash and cash equivalents to $37.9 million from $41.8 million at the end of the previous quarter. However, working capital increased to $196.3 million, up from $193.3 million, driven by changes in inventories, prepaid assets, and liabilities.

Analysis of Company Performance

Hurco's performance in the first quarter reflects the cyclical nature of the machine tool industry and the impact of global economic conditions. The company's strategic investments and positive order trends in key regions suggest a potential rebound, but the decreased sales and net loss highlight the challenges it faces. The focus on innovation and customer service could be pivotal in navigating through the current market dynamics and leveraging the anticipated recovery in the global machine tool market.

For value investors, Hurco's balance sheet strength and liquidity position are critical factors to consider, as they provide the company with the flexibility to capitalize on market opportunities. The company's commitment to technological advancement and strategic initiatives may also offer long-term growth prospects despite short-term headwinds.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing from Hurco Companies Inc (NASDAQ:HURC).

Explore the complete 8-K earnings release (here) from Hurco Companies Inc for further details.

This article first appeared on GuruFocus.