Hut 8 Corp (HUT) Reports Substantial Growth in Earnings and Adjusted EBITDA

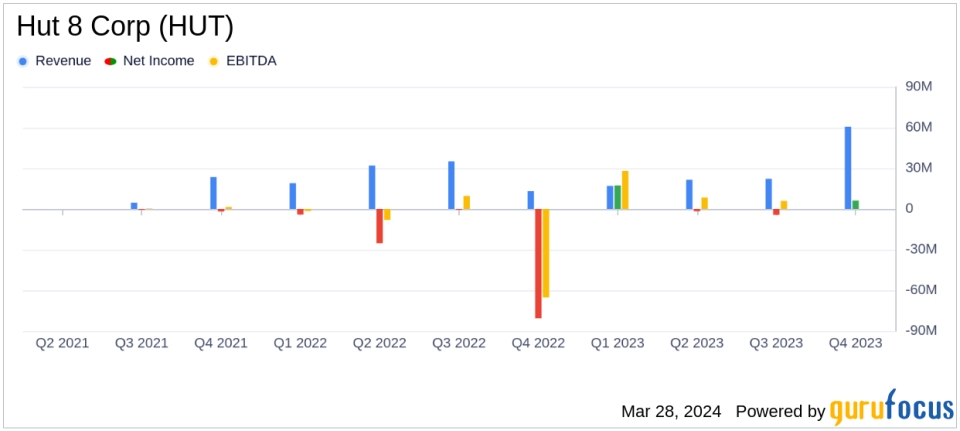

Revenue: Increased by 32% to $60.6 million, with significant contributions from Managed Services.

Net Income: Improved to $6.2 million, a notable recovery from a net loss in the prior year period.

Adjusted EBITDA: Soared by 386% to $62.3 million, including gains from new accounting rules adoption.

Bitcoin Holdings: Held 9,195 Bitcoin with a market value of approximately $388.1 million as of December 31, 2023.

Energy Capacity: Managed 839 MW, supporting the company's growth in self-mining and managed services.

On March 28, 2024, Hut 8 Corp (NASDAQ:HUT) released its 8-K filing, revealing its operating and financial results for the six months ended December 31, 2023. The period was marked by a significant increase in revenue to $60.6 million, and an impressive net income of $6.2 million, a stark contrast to the net loss reported in the previous year. Adjusted EBITDA also saw a substantial increase, reaching $62.3 million.

Hut 8 Corp is an innovative leader in data infrastructure, focusing on large-scale energy infrastructure to maximize value for customers and shareholders. With a strong executive team, Hut 8 is committed to building computing infrastructure for Bitcoin mining, traditional data centers, and future technologies like AI and machine learning.

The company's financial achievements are particularly noteworthy in the capital markets industry, where Hut 8's diversified business and robust balance sheet position it as a competitive player. The reported revenue and net income are crucial indicators of the company's ability to generate profit and manage its operations effectively, especially in the volatile cryptocurrency mining sector.

Key metrics from Hut 8's financial statements include a 32% increase in revenue and a significant turnaround to a $6.2 million net income from the previous net loss. The cost to mine a Bitcoin was $18,815, and the company managed to mine 1,244 Bitcoin during the period. Hut 8's energy cost per MWh was $44.52, reflecting its efficiency in managing energy expenses.

CEO Asher Genoot commented on the results:

"Our results this period demonstrate the strength and potential of the new Hut 8. Our goal is to continue building a profitable, diversified business during fiscal year 24. With this in mind, we will continue to focus on driving topline revenue growth and cost reduction across the business."

The company's balance sheet strength is evident in its Bitcoin holdings, with 9,195 Bitcoin valued at approximately $388.1 million as of December 31, 2023. This asset base provides Hut 8 with a significant market value and potential for future revenue generation.

Analyzing the company's performance, Hut 8's strategic focus on driving efficiencies and restructuring has paid off, leading to a robust increase in revenue and net income. The company's ability to pivot and adapt to market conditions while maintaining a strong balance sheet with manageable debt levels is commendable. Hut 8's focus on growth and cost reduction is expected to continue to be a central theme in its strategy moving forward.

Hut 8's earnings report is a testament to the company's resilience and strategic execution. Investors and market watchers will likely keep a keen eye on Hut 8's future endeavors, especially as the company navigates the dynamic cryptocurrency mining landscape and expands its energy infrastructure operations.

For more detailed information on Hut 8 Corp's financial performance and future outlook, interested parties are encouraged to join the company's Q4 2023 webcast or visit Hut 8's investor relations page.

Explore the complete 8-K earnings release (here) from Hut 8 Corp for further details.

This article first appeared on GuruFocus.