Hyatt (H) Focuses on Strategic Expansion Across Americas

Hyatt Hotels Corporation H has been focusing on strategic growth of its luxury and lifestyle brand footprint through its solid development pipeline. Its pipeline comprises more than 30 hotels and resorts planned in the Americas through 2025, including the expansion of Hyatt brands into new markets.

Hyatt is considered to have the fastest growing luxury portfolio, with luxury, lifestyle, and resort hotels making up more than 40% of its portfolio. In the last five years, the company has doubled its number of luxury rooms, tripled the number of resort rooms, and quadrupled the number of lifestyle rooms, globally and is still maintaining the growth momentum.

Hyatt’s Strategic Footprint Expansion

Accretive Acquisitions

Recently, Hyatt completed the acquisition of Mr & Mrs Smith, a London-based platform, which offers direct booking access to more than 1500 boutique and luxury properties across the globe, primarily Western Europe. This will offer World of Hyatt members with varied options in rewarding stays and experiences to choose from.

Furthermore, the early acquisition of Dream Hotel Group, a vivid portfolio of lifestyle hotel brands including Dream Hotels, The Chatwal, The Time New York and Unscripted Hotels, will help Hyatt to expand its brand presence across destinations like Nashville, Hollywood, South Beach and New York City. With the upcoming property, Dream Valle de Guadalupe, the company will be able to expand its presence in the new leisure market of Mexico in 2024.

New Property Openings

Hyatt is all set to expand its brand portfolio through new openings across the United States, Canada, Latin America and Caribbean. The openings are classified under its three collection portfolios, which will enable World of Hyatt members and customers to experience its signature luxury and lifestyle brands.

Boundless Collection: Under this collection, the Thompson Hotels brand will soon be debuting in top leisure locations across the United States and Mexico. The new openings include Thompson Houston in 2023, Thompson Palm Springs and South Beach in 2024, and Thompson Monterrey in 2025.

The new openings under this brand collection in 2024 include Caption by Hyatt Chattanooga Downtown, Hyatt Centric Escazu San Jose, Hyatt Centric Santo Domingo, and Cas en Bas Beach Resort. The new openings in the year 2025 comprises Hyatt Centric Querétaro, Andaz Toronto-Yorkville, Andaz Miami Beach, and Andaz Turks & Caicos at Grace Bay.

Timeless Collection: The hotels under this brand collection provides homely comfort and an elevated experience to its members and guests. The new openings under this collection comprises Park Hyatt Los Cabos at Cabo del Sol and Grand Hyatt Scottsdale Resort & Spa in 2024 as well as Park Hyatt Mexico City, Grand Hyatt Cancún Beach Resort, and Grand Hyatt Grand Cayman Hotel & Residences in 2025.

Inclusive Collection: This brand collection is anticipated to welcome new resorts in the Caribbean and Mexico, including the Secrets St. Lucia Resort & Spa in 2024. Other new openings under this collection comprises Secrets Tulum Resort & Beach Club, Secrets Playa Blanca Costa Mujeres and Secrets Playa Esmerelda in Punta Cana; Dreams Estrella Del Mar Mazatlan Golf & Spa Resort, Dreams Grand Island in Cancun, and Dreams Playa Esmerelda in Punta Cana; and the debut of the Hyatt Vivid Hotels & Resorts brand with Hyatt Vivid Grand Island in Cancun.

Rewarding Loyalty Programs

Hyatt’s loyalty program, World of Hyatt, is offering its members a new global promotion to help the travelers make the most of their getaways around the globe. The members can now register to 3,000 bonus points for every three eligible nights completed between Oct 6, 2023 and Nov 30, 2023. This facility is available at more than 1,250 Hyatt hotels and resorts, globally.

Price Performance

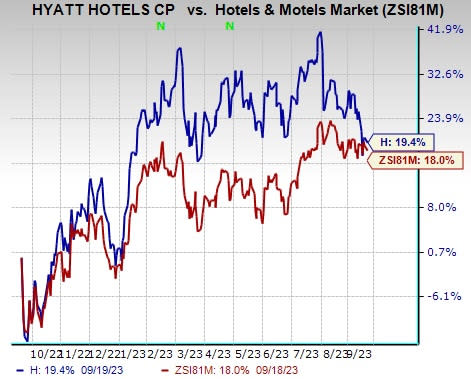

Shares of Hyatt have gained 19.4% in the past year, outperforming the Zacks Hotels and Motels industry’s 18% growth. The uptrend is attributable to solid leisure transient demand and recovery in business travel demand along with increased system-wide group travel and favorable pricing.

Image Source: Zacks Investment Research

Going forward, the company intends to maintain its growth momentum by focusing on its expansion initiatives and loyalty programs. The Zacks Consensus Estimate for 2023 earnings is pegged at $2.52 per share, implying 411.1% year-over-year growth.

Zacks Rank

Hyatt currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Consumer Discretionary sector are Royal Caribbean Cruises Ltd. RCL, Live Nation Entertainment, Inc. LYV and Guess?, Inc. GES.

Royal Caribbean presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The stock has surged 93.8% in the past year. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates growth of 55.1% and 182.1%, respectively, from the year-ago period’s levels.

Live Nation presently sports a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6%, on average. The stock has declined 4.3% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Guess currently sports a Zacks Rank of 1. GES has a trailing four-quarter earnings surprise of 43.4%, on average. Shares of the company have increased 37.7% in the past year.

The Zacks Consensus Estimate for GES’ fiscal 2023 sales and EPS implies improvements of 3.7% and 9.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report