Hyatt (H) Gears Up to Report Q4 Earnings: What's in Store?

Hyatt Hotels Corporation H is scheduled to report fourth-quarter 2023 results on Feb 15, before the opening bell. In the last reported quarter, the company reported an earnings surprise of 16.7%.

The Trend in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter earnings per share is pegged at 38 cents, indicating a decline of 85.1% from $2.55 reported in the year-ago quarter.

For revenues, the consensus mark is pegged at approximately $1.56 billion. The metric suggests a decrease of 1.5% from the year-ago quarter’s figure.

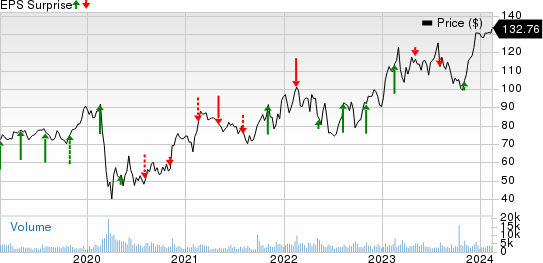

Hyatt Hotels Corporation Price and EPS Surprise

Hyatt Hotels Corporation price-eps-surprise | Hyatt Hotels Corporation Quote

Let's look at how things have shaped up in the quarter.

Factors to Note

Hyatt’s fourth-quarter 2023 performance is likely to have benefited from robust leisure travel demand, favorable pricing and ongoing airlift activities. The strength in net package revenue per available room (RevPAR), group pace (for the Americas full service managed properties) and increased membership contracts (for Apple Leisure Group’s [ALG] Unlimited Vacation Club) are likely to have aided the company’s performance in the to-be-reported quarter.

For the to-be-reported quarter, we expect comparable systemwide hotels’ RevPAR to increase 9.8% year over year to $138.7. This reflects our expectations for average daily rate and occupancy rates to increase 4.9% to $208.6 and 500 bps to 66.5% year over year.

Increased focus on distribution capabilities, end-to-end booking processes, operational efficiency and integrated experiences with ALG programs are likely to have aided the company’s performance in the fourth quarter.

Our model predicts adjusted fourth-quarter revenues of ASPAC Management and Franchising and ALG segments to increase 28.7% (to $34.8 million) and 4.9% (to $329.3 million), respectively, on a year-over-year basis. We anticipate fourth-quarter revenues from Franchise, License and Other Fees to increase 4.2% year over year to $68.8 million.

Solid owner attraction for newbuilds and conversion opportunities are likely to have paved a path for development expansion in the to-be-reported quarter. We anticipate fourth-quarter total managed and franchised properties to increase 7.9% year over year to 1,471.

Elevated labor costs are likely to have negatively impacted the bottom line in the fourth quarter. A challenging financing environment (particularly in the United States) is likely to have hurt the company’s operations in the to-be-reported quarter.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Hyatt this time around. A stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to beat earnings. But that's not the case here.

Earnings ESP: Hyatt has an Earnings ESP of -13.94%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks Poised to Beat Earnings Estimates

Here are some stocks from the Zacks Consumer Discretionary space that investors may consider, as our model shows that these have the right combination of elements to post an earnings beat.

Six Flags Entertainment Corporation SIX has an Earnings ESP of +21.85% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

SIX’s earnings for fourth-quarter 2023 are expected to decrease 15.6% year over year. It reported better-than-expected earnings in one of the trailing four quarters and missed on the other three occasions, the negative average being 9.3%.

Cedar Fair, L.P. FUN currently has an Earnings ESP of +3.94% and a Zacks Rank of 2.

FUN’s earnings for fourth quarter 2023 are expected to decrease 35.1% year over year. It reported better-than-expected earnings in three of the trailing four quarters and missed on one occasion, the average surprise being 67.3%.

Choice Hotels International, Inc. CHH currently has an Earnings ESP of +1.48% and a Zacks Rank of 3.

CHH’s earnings for fourth quarter 2023 are expected to increase 7.1% year over year. It reported better-than-expected earnings in three of the trailing four quarters and missed on one occasion, the average surprise being 5.2%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Cedar Fair, L.P. (FUN) : Free Stock Analysis Report

Six Flags Entertainment Corporation New (SIX) : Free Stock Analysis Report