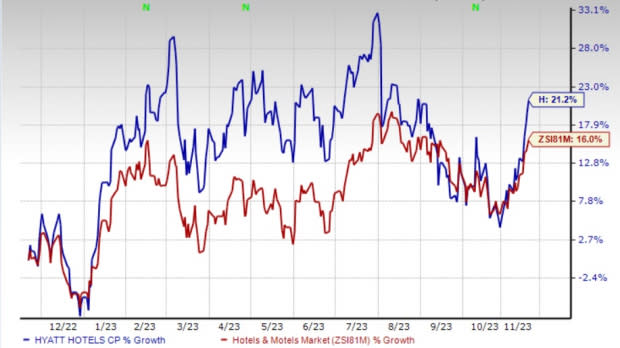

Hyatt (H) Stock Rises 21% in a Year: What's Driving It?

Hyatt Hotels Corporation H has jumped 21.2% over the past year, outpacing the industry's 16% growth. Strong expansion initiatives, high demand, emphasis on loyalty program and improving revenue per available room (RevPAR) resulted in this uptick.

The Zacks Rank #3 (Hold) company’s earnings in 2023 and 2024 is likely to rise 388.9% and 32.9%, respectively, year over year.

Let’s delve deeper.

Growth Drivers

To fuel growth, the company persists in expanding its footprint. During the third quarter of 2023, 20 new hotels (or 3,262 rooms) joined Hyatt's system. As of Jun 30, 2023, H had a pipeline of executed management or franchise contracts of approximately 600 hotels (or 123,000 rooms). In September 2023, it unveiled Andaz Macau, the world's largest Andaz-branded property with 715 rooms.

During the third quarter of 2023, leisure transient revenues increased 4% year over year. Also, leisure travel remained elevated, up 22% from third-quarter 2019 levels. In September, there was a notable 30% rise from 2019 figures. Management is optimistic that demand will remain robust for the remainder of 2023.

Sequential and year-over-year improvements in business transient demand have been aiding H’s performance. During third-quarter 2023, it stated that system-wide business transient revenues improved 19% year over year and reached 90% from September 2019 levels.

During the quarter, Hyatt registered a rise in system-wide group bookings, which grew 10% year over year. It continues to witness an outstanding quarter in group production for America's full-service managed properties, securing bookings of around $450 million, up 17% year over year.

On the other hand, the company's loyalty program continues to record impressive growth, adding nearly 8 million new members in the past 12 months. This signifies an increase of about 24%, bringing the total membership to over 42 million. During the first nine months of 2023, room night penetration expanded 100 basis points year over year for legacy Hyatt properties.

It is also benefiting from improving RevPAR. During third-quarter 2023, system-wide comparable RevPAR improved 8.9% year over year owing to a gain in occupancy and average daily rate. The upside was primarily backed by strong leisure transient trends, increased group travel and improved business activity.

Hyatt witnessed solid RevPAR gains in Europe, China, the Americas and the Caribbean markets region owing to strong leisure demand. Management now anticipates system-wide 2023 RevPAR to increase 15-16% (previously expected 14-16%) from 2022 levels.

Image Source: Zacks Investment Research

Concerns

The hotel industry is highly competitive, as major hospitality chains with well-established and recognized brands are continuously expanding their global presence. Hyatt is continuously facing intense competition from both large hotel chains and smaller independent local hospitality providers. It also faces increasing competition from new channels of distribution in the travel industry.

Key Picks

Below we present some better-ranked stocks from the Zacks Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3% on average. Shares of RCL have surged 70.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 57.5% and 186.9%, respectively, from the year-ago levels.

DraftKings Inc. DKNG carries a Zacks Rank #2 (Buy) at present. It has a trailing four-quarter earnings surprise of 13.2% on average. Shares of DKNG have soared 149.2% in the past year.

The Zacks Consensus Estimate for DKNG’s 2023 sales and EPS implies a gain of 65.2% and 51.3%, respectively, from the prior-year numbers.

Skechers U.S.A., Inc. SKX currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 50.3% on average. Shares of SKX have gained 27.9% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS suggests 8.2% and 44.1% growth, respectively, from the year-earlier figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report