Hyatt Hotels Corp (H) Announces Delay in Earnings Release, Highlights Q4 and Full Year 2023 ...

Dividend Announcement: Hyatt declares a quarterly cash dividend of $0.15 per share for Q1 2024.

Earnings Release Delay: Additional time needed to finalize accounting for Unlimited Vacation Club deferred cost activity.

Free Cash Flow: Reported a robust free cash flow of $602 million for the year ended December 31, 2023.

Operating Activities: Net cash provided by operating activities stood at $800 million for the same period.

Capital Expenditures: Capital expenditures totaled $198 million, reflecting ongoing investments in the business.

On February 14, 2024, Hyatt Hotels Corp (NYSE:H) released its 8-K filing, announcing a delay in the publication of its fourth quarter and full year 2023 earnings report and investor conference call, which were initially scheduled for February 15, 2024. The postponement is due to additional time required to finalize accounting matters related to the Unlimited Vacation Club deferred cost activity within its Apple Leisure Group segment, a process that has no impact on cash flow.

Hyatt is an operator of owned and managed and franchise properties across approximately 20 upscale luxury brands, including vacation brands and the recently acquired Apple Leisure Group. With a global presence, the company's portfolio is diversified across the Americas, Asia-Pacific, and other regions, with a significant portion of its rooms managed or franchised, emphasizing its asset-light business model.

The company also took this opportunity to announce a first quarter 2024 dividend of $0.15 per share, payable on March 12, 2024, to shareholders of record as of February 28, 2024. This dividend declaration underscores Hyatt's commitment to returning value to its shareholders and reflects confidence in its financial stability and cash flow generation.

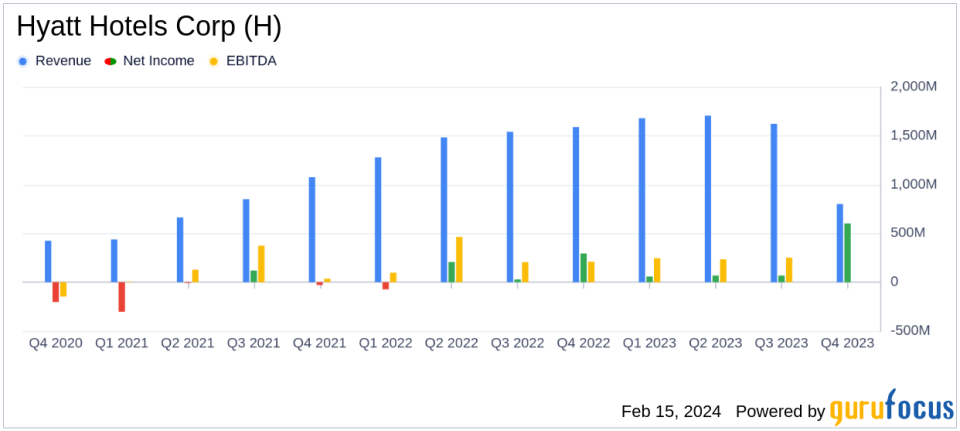

Hyatt's financial achievements, particularly the reported free cash flow of $602 million for the year, are significant indicators of the company's operational efficiency and its ability to generate cash beyond capital expenditures. This metric is particularly important in the travel and leisure industry, where companies must balance the need for continuous investment in property and services with the ability to fund growth initiatives and return capital to shareholders.

The company's strong cash flow performance is supported by a net cash provided by operating activities of $800 million, offset by capital expenditures of $198 million. These figures demonstrate Hyatt's ability to maintain a healthy cash flow while investing in its properties and services, which is crucial for long-term growth and competitiveness in the hospitality industry.

Hyatt's performance is also reflected in its key metrics such as Net Package RevPAR and RevPAR, which are essential for evaluating hotel performance and regional trends. These metrics provide insights into the company's ability to fill rooms at profitable rates and are closely watched by investors and industry analysts.

In the context of the broader economic and industry challenges, including geopolitical tensions, natural disasters, and market volatility, Hyatt's financial resilience is noteworthy. The company's ability to navigate such uncertainties while maintaining operational performance and shareholder returns speaks to the strength of its business model and management.

While the delay in the earnings release may raise questions among investors, the company's proactive communication and transparency, coupled with its solid financial highlights, should provide reassurance about its ongoing performance and strategic direction.

Hyatt's commitment to growth and innovation, as evidenced by its expansion of the World of Hyatt loyalty program and the Unlimited Vacation Club paid membership program, positions it well for future success in the evolving hospitality landscape.

As we await the rescheduled earnings release, investors and stakeholders can take comfort in Hyatt's demonstrated ability to generate cash and its strategic focus on delivering value through both operational excellence and shareholder returns. Stay tuned to GuruFocus.com for further updates and in-depth analysis of Hyatt Hotels Corp's financial performance.

Explore the complete 8-K earnings release (here) from Hyatt Hotels Corp for further details.

This article first appeared on GuruFocus.