Hydrogen rises at CES

In an event ruled by battery-electric trucks, hydrogen made a splash at the Advanced Clean Transportation Expo last May. It happened again this week at the massive Consumer Electronics Show in Las Vegas.

The universe’s most common element got a lot of attention around fuel cells and direct use in the typically gasoline- or diesel-powered internal combustion engine (ICE).

Was this newsletter forwarded to you? Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on Truck Tech at 3 p.m. Wednesdays on the FreightWaves YouTube channel.

Hydrogen everywhere

Global automakers like Hyundai and Tier 1 suppliers like Robert Bosch talked about how they plan to incorporate hydrogen to power fuel cells and directly into engines.

In Hyundai’s case, it envisions a logistics ecosystem using Xcient fuel cell-powered trucks to move parts into and haul finished electric vehicles out of its Metaplant in Ellabell, Georgia, near Savannah. That includes making hydrogen on-site through electrolysis using electricity and water. Hyundai also sees hydrogen as a fuel for its energy-intense heavy-duty equipment business.

When powered by green hydrogen made from renewable sources like solar and wind, an H2 ICE engine is practically carbon-neutral.

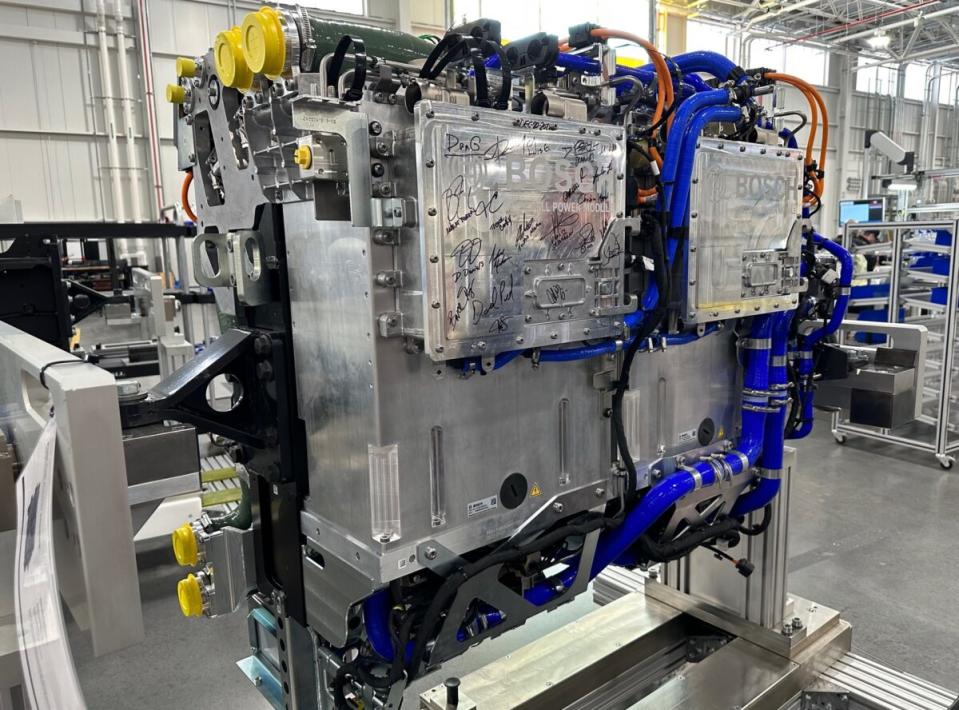

Bosch claims fuel cell orders from European, Chinese and U.S. truck makers. Outside the mobility- and transportation-themed West Hall of the Las Vegas Convention Center, Nikola gave short demonstration rides in its fuel cell electric truck powered with Bosch’s fuel cell system.

The German supplier is also working on components for an ICE that converts hydrogen fuel directly into energy without first converting it into electricity as it does in a fuel cell. It plans to debut its H2 ICE this year.

Getting governments on board

Enthusiasm for hydrogen engines can be traced to Europe’s acceptance of H2 ICE as a zero-emissions technology because of the absence of carbon dioxide. Burning hydrogen creates small amounts of nitrogen oxides. European governments seem willing to look the other way. In the U.S. — and especially California — NOx emissions are a focus of coming regulations.

“The indication from EPA is that it will qualify as a zero-emission CO2 technology. California does not allow H2 ICE currently under the ACT [Advanced Clean Trucks] rule. That’s something we have discussed with them,” said Carl Hergart, Paccar senior director of powertrain planning.

Cummins Inc. first promoted an H2 ICE engine as part of a fuel-agnostic makeover of its engine families. It has committed a billion dollars in plant makeovers and has orders from fleets including Werner Enterprises for delivery in 2027.

Volvo Group, Daimler Truck and Paccar. — the only major truck maker with a significant presence at CES — are all pursuing hydrogen-fueled engines by later this decade.

Paccar displayed its Kenworth T680 fuel cell truck with a second-generation Toyota fuel cell system that goes on sale next year. Paccar has paid deposits from more than 550 customers between Kenworth and Peterbilt. Fuel cell trucks for both brands will be assembled at Kenworth’s Renton, Washington, plant.

Q&A: Hergart on batteries, hydrogen and SuperTruck 2

Hergart talked about how the Bellevue, Washington, parent of Kenworth, Peterbilt and DAF Trucks views hydrogen and a battery-making joint venture with rival Daimler and supplier/competitor Cummins, as well as what it is learning from SuperTruck 2 projects at Peterbilt and Kenworth. The following is edited for clarity and conciseness.

TRUCK TECH: Paccar is involved in the federal hydrogen hub project in the Northwest. But you stop short of participating in the creation of hydrogen infrastructure.

HERGART: All our trucks are connected so we know where the trucks are. We can provide data on where it makes sense to establish fueling stations. We’re not in the business of building fuel stations or producing hydrogen. But we can be active in this dialogue with the producers, the customers and people operating fuel stations.

TRUCK TECH: How important is green hydrogen made from renewable sources like solar, wind and water?

HERGART: From a sustainability perspective, of course we want to see green hydrogen. But there’s a lot of misconceptions about green and gray and blue hydrogen. Most of the hydrogen produced today, even gray hydrogen [from natural gas] is 99.999% pure. So whether it’s gray hydrogen produced from steam methane reforming or green hydrogen produced through electrolysis, for the most part both are suitable to run a fuel cell or a hydrogen ICE.

TRUCK TECH: Using hydrogen in an internal combustion engine eliminates greenhouse gasses but still creates NOx emissions. Is that an acceptable trade-off?

HERGART: When you have nitrogen and oxygen reacting at high temperatures, you’re going to form NOx. But there are ways of addressing that. The [DAF Trucks HD] demonstrator in Europe shows that there’s potential to get down to very low levels of NOx. We don’t want the perfect to be the enemy of the good here.

TRUCK TECH: How did you choose lithium-iron phosphate chemistry for your battery-making joint venture with Daimler Truck North America and Cummins?

HERGART: You have a much better cycle life from an LFP cell chemistry than nickel, manganese and cobalt. NMC may have a little bit better energy density. But you have a worse cycle life, so durability is one aspect. Thermal stability is important. And you get away from the challenging materials like nickel and cobalt. So that’s what really makes it the best fit for truck applications.

TRUCK TECH: The Peterbilt SuperTruck 2 achieved 132% freight ton efficiency. What technologies from that are most likely to find their way into production?

HERGART: The 48-volt mild-hybrid system is significant because you can power auxiliaries electrically rather than running them off of the front-wheel drive. You really have to take a holistic view of the power consumption on the truck. Ultimately the value of 48-volt is that you reduce the current. And when you reduce the current, you reduce the amount of copper. So you reduce cost and you make it more efficient as well. The question is, do you introduce a third [electronic] bus? It’s a matter of making the business case work, but it’s clear there’s an efficiency potential benefit by adding 48-volt.

Xos Trucks and ElectraMeccanica get married

Talk about a marriage of convenience. Startup Los Angeles-based electric truck maker Xos and Canada’s ElectraMeccanica completed some quick nuptials that provides a $48.5 million cash infusion to Xos while giving ElectraMeccanica shareholders about 20% ownership in Xos.

ElectraMeccanica gave up on its tiny three-wheel Solo electric vehicle last year, recalling and buying back the vehicles from customers. In August, it announced a merger with U.K. electric truck maker Tevva. ElectraMeccanica got cold feet and claimed Tevva didn’t disclose everything it should. Tevva responded by filing a suit seeking $75 million.

One beau gone, another found

“Based on our diligence, which included discussions with key customers, we believe that Xos is well-positioned in the rapidly growing commercial electric vehicle market,” Dietmar Ostermann, ElectraMeccanica’s strategic committee chair, said in a news release.

“By leveraging ElectraMeccanica’s balance sheet to accelerate Xos’ growth and leadership position, the proposed transaction provides ElectraMeccanica’s shareholders with the opportunity to participate in Xos’ exciting future prospects.”

Xos has delivered more than 600 electric vehicles to fleets since 2020. It went public via a special purpose acquisition company merger with NextGen Acquisition Corp. in August 2021. Xos received $575 million in proceeds at a valuation of $2 billion.

In a market that still mostly avoids investing in unprofitable startups, ElectraMeccanica’s dowry is welcome. To avoid delisting from the Nasdaq, Xos conducted a 1:30 reverse stock split in December.

“Leveraging ElectraMeccanica’s assets will strengthen Xos’ leadership position in the robust commercial truck market and allow Xos to scale profitable vehicle sales,” Xos CEO and Chairman Dakota Semler said.

The merger is expected to close in the first half of the year.

Briefly noted …

TeraWatt Infrastructure will get $63.8 million in a federal grant to pursue its buildout of an electric truck charging corridor across Interstate 10 in the Southwest.

The Energy Infrastructure Incentives for Zero-Emission Commercial Vehicles Project is distributing more than $100 million in zero-emission vehicle charging infrastructure incentives to qualified applicants across California.

Melissa Wade of Aurora Innovation will chair the Autonomous Vehicle Industry Association board of directors.

Bonus Content: Nikola’s Steve Girsky at CES

That’s it for this week. Thanks for reading. We value your feedback. Please write to aadler@freightwaves.com with suggestions and comments on Truck Tech.

The post Hydrogen rises at CES appeared first on FreightWaves.