Hypoport SE (ETR:HYQ) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Hypoport SE (ETR:HYQ) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 85%.

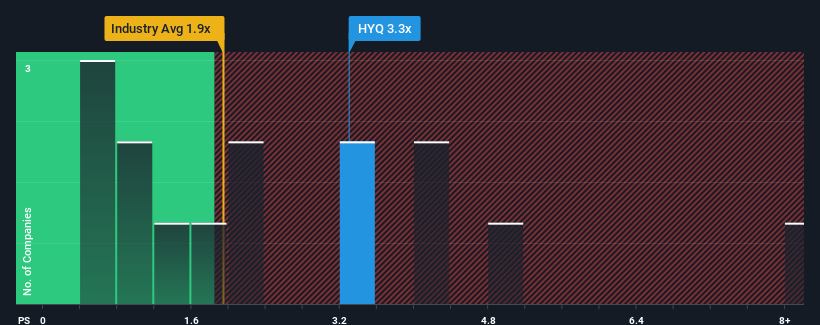

After such a large jump in price, when almost half of the companies in Germany's Diversified Financial industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Hypoport as a stock probably not worth researching with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Hypoport

What Does Hypoport's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Hypoport has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hypoport's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Revenue Growth Forecasted For Hypoport?

Hypoport's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 5.2% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should demonstrate the company's robustness, generating growth of 13% each year as estimated by the five analysts watching the company. Meanwhile, the broader industry is forecast to contract by 6.3% per year, which would indicate the company is doing very well.

With this information, we can see why Hypoport is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What Does Hypoport's P/S Mean For Investors?

The large bounce in Hypoport's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hypoport's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hypoport that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.