Hyster-Yale Materials Handling: Good Growth and Attractive Valuation

About the company

Hyster-Yale Materials Handling (NYSE:HY) is a global leader in the manufacturing of lift trucks, offering a comprehensive range of products and solutions. Apart from lift trucks, Hyster-Yale provides a diverse portfolio of offerings such as lift truck attachments, telematics systems, automation solutions, fleet management services and hydrogen fuel cell power products. With three distinct operating segments - Lift Truck, Bolzoni and Nuvera - Hyster-Yale caters to various market demands and serves customers worldwide.

Under the Lift Truck segment, Hyster-Yale manufactures and markets lift trucks across the Americas, EMEA and Asia-Pacific regions, solidifying its presence in key markets globally. In the Bolzoni segment, Hyster-Yale specializes in the production and distribution of a wide array of attachments, forks and lift tables. The Nuvera segment focuses on the design, manufacturing and sales of hydrogen fuel cell stacks and engines.

In 2022, Hyster-Yale's revenue composition highlighted the significance of the lift truck segment, accounting for 73% of the company's total revenue. Parts constituted 15% of the revenue, while services, rentals and other sources contributed 7%. The Bolzoni segment accounted for 5% of the revenue, reflecting its importance in providing valuable attachments and related solutions. The Nuvera segment, still in its early stages, contributed less than 1% to the company's revenue, but it showcases the potential for growth in the hydrogen fuel cell market.

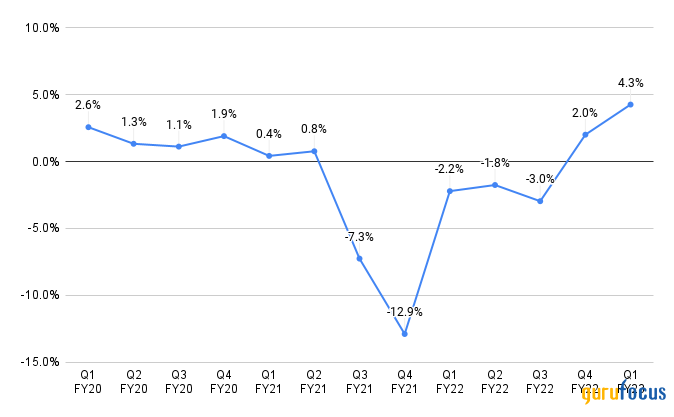

In the first quarter of 2023, Hyster-Yale witnessed a notable surge in revenue, reporting a 21% year-over-year increase to reach $999.30 million, surpassing the consensus estimate of $941.59 million. The company's operating margins also experienced substantial improvement, rising to 4.3% in the quarter from -2.2% in the first quarter of 2022. This positive development can be attributed to several factors, including a reduction in lower-margin orders, enhanced supply chain efficiency and higher price realization.

Top-line outlook

Despite lower shipments in the first quarter of 2023, Hyster-Yale experienced a modest increase in revenue. This growth was primarily attributed to higher prices and an upsurge in aftermarket parts volume. The demand for Hyster-Yale's lift trucks remained robust in 2023, surpassing pre-pandemic levels. This can be attributed to resilient global demand across various industries and the company's strategic focus on securing orders with solid profit margins. However, it's worth noting that Hyster-Yale has been witnessing a decline in bookings over the past four quarters.

Unit bookings for lift trucks declined by approximately 37% year-over-year, totaling 22,300 units. Consequently, the backlog also decreased by 13% year-over-year, amounting to 99,200 units.

Looking ahead, I believe that the lower year-over-year booking trend in the lift truck business will persist due to a slowdown in global economic activity in 2023, leading to a return to more normalized market levels. While there is mixed sentiment regarding the likelihood and severity of a recession, Hyster-Yale's current backlog of higher-margin trucks provides a buffer if bookings decline more sharply than anticipated in 2023. This backlog extends through 2023 production schedules and into 2024, ensuring a degree of stability. On the other hand, the Nuvera business segment continues to make progress in terms of product demonstrations and bookings. I believe sales should increase throughout the remainder of 2023 due to the fulfillment of booked orders from existing customers.

In the medium to long term, the lift truck business is anticipated to benefit from the introduction of new modular and scalable products, as well as the electrification of trucks. In 2022, Hyster-Yale introduced its initial set of modular scalable lift trucks in the EMEA and Americas markets, with plans to launch them in the JAPIC market in mid-2023. Notably, the company is also testing a hydrogen fuel cell-powered container handler that utilizes Nuvera fuel cell engines in the Port of Los Angeles. Furthermore, Hyster-Yale's Lift Truck business is developing an electrified fuel cell reach stacker, scheduled for testing in the first half of 2023 at the Port of Valencia, Spain.

Nuvera remains focused on placing 45-kilowatt and 60-kilowatt fuel cell engines in niche heavy-duty vehicle applications where battery-only solutions are inadequate. These applications present a promising potential for near-term fuel cell adoption. Additionally, Nuvera is actively working on the development of a heavy-duty 125-kilowatt engine capable of meeting the power demands of more demanding applications. In 2022, Nuvera announced several projects with third parties involved in testing or planning to test Nuvera engines in heavy-duty applications. Furthermore, Nuvera is set to launch two new products: a 360-kilowatt and a 470-kilowatt fuel cell power generator. These modular zero-emission power solutions cater to commercial and industrial stationary applications, offering a sustainable energy alternative.

Bottom-line outlook

Hyster-Yale has observed an improvement in operating margins over the past two quarters, thanks to favorable material costs and a strong product mix. These factors have contributed to better product margins, bolstering the company's financial performance. However, these positive developments have been partially offset by unfavorable currency translation effects and persistent supply chain constraints. While third-party component shortages and production impacts continue to pose challenges, their impact has lessened compared to the previous year. As a result, shipments in the first quarter of 2023 increased by 5% year-over-year, benefiting from reduced component shortages.

Despite this progress, Hyster-Yale still faces obstacles such as skilled labor availability issues in the Americas and ongoing component shortages in Europe. These challenges have led to a decrease in production rates. Looking forward, I believe that the component shortages in Europe will continue to impact margins for the next two quarters. Furthermore, rising labor and material costs in the region should further affect margins. However, these headwinds should be offset through price increases, leveraging its market position and strong customer relationships.

In the Americas region, the improvement in supply chain challenges should enhance manufacturing efficiencies, leading to margin improvements in the upcoming quarter. Hyster-Yale is actively focused on securing higher-margin orders to enhance profitability. By prioritizing the construction and shipment of lower-margin units, the company has been able to increase its average unit margins within the remaining backlog. This strategic approach should drive margins throughout the remainder of 2023, bolstering Hyster-Yale's financial performance.

Valuation

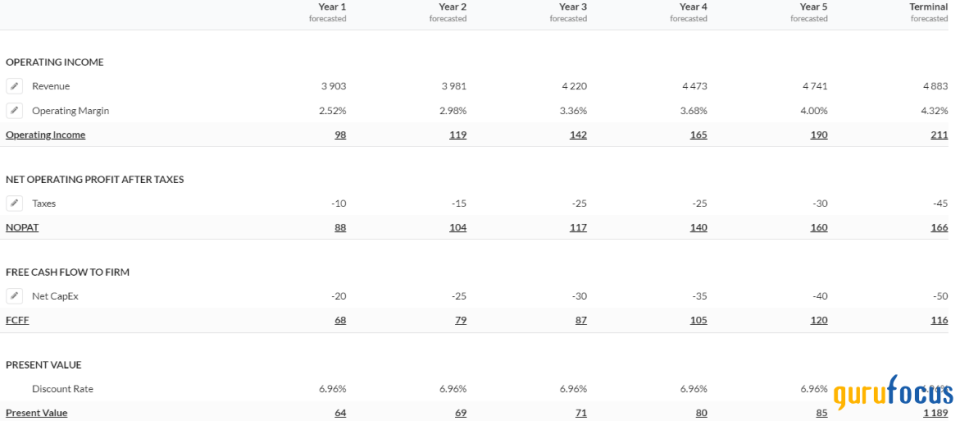

In my discounted cash flow (DCF) analysis, I have taken into account several factors to estimate the fair value of Hyster-Yale. Based on the healthy order backlog and strong bookings, I project revenue growth to be in the low-double digits for 2023. Looking beyond 2023, I anticipate more moderate growth in the mid-single digits, considering the continued demand for lift trucks and parts driven by the company's large installed base. To calculate the fair value estimate, I employed a discount rate of 6.96%. Taking all these factors into consideration, my analysis yields a fair value estimate of $74.44 for Hyster-Yale.

Using the relative valuation, the stock is currently trading at a forward price-earnings ratio of 12.21 given the analysts' consensus earnings per share estimate of $4.24 for 2023, which increases to 12.18 when looking at the fiscal 2024 consensus estimate of $4.25. This is well below the five-year average forward price-earnings ratio of 34.33.

Conclusion

In conclusion, Hyster-Yale has demonstrated resilience and progress in the face of ongoing challenges. Despite labor availability issues, component shortages and unfavorable currency translation, the company has experienced improved operating margins due to favorable material costs, a strong product mix and reduced supply chain constraints. Hyster-Yale's focus on booking higher-margin orders and optimizing its product mix should improve margins throughout the remainder of 2023. Considering the positive trajectory of Hyster-Yale's bottom line and its attractive valuations, I believe the company presents an appealing value proposition.

This article first appeared on GuruFocus.