i3 Verticals Inc (IIIV) Posts Strong First Quarter 2024 Results with Revenue and Net Income Growth

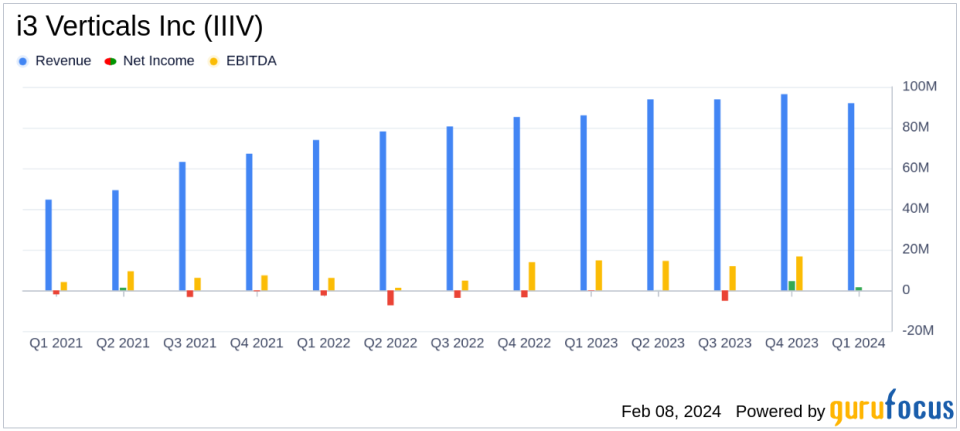

Revenue Growth: i3 Verticals Inc (NASDAQ:IIIV) reported a 6.9% increase in revenue, reaching $92.0 million.

Net Income Surge: Net income rose significantly to $1.5 million, compared to $0.2 million in the same quarter last year.

Earnings Per Share: Diluted net income per share for Class A common stock was $0.04, improving from a net loss per share of $0.01.

Adjusted EBITDA: Adjusted EBITDA grew by 6.6% to $25.2 million, maintaining a consistent margin of 27.4%.

Annualized Recurring Revenue: ARR increased by 9.2%, indicating a strong growth trajectory for the company's services.

Software Services Revenue: Software and related services revenue accounted for 47.4% of total revenue, highlighting the company's strategic focus.

Leverage Ratios: The company reported a consolidated interest coverage ratio of 4.40x and a total leverage ratio of 3.60x.

On February 8, 2024, i3 Verticals Inc (NASDAQ:IIIV), a provider of integrated payment and software solutions, released its 8-K filing, announcing financial results for the first quarter ended December 31, 2023. The company, which serves small and medium-sized businesses across strategic vertical markets, including education, healthcare, and the public sector, reported a revenue increase to $92.0 million, up 6.9% from the previous year's first quarter. Net income saw a substantial rise to $1.5 million, compared to $0.2 million in the prior year, with net income attributable to i3 Verticals Inc at $1.1 million.

Financial Performance and Strategic Decisions

The company's performance reflects its focus on recurring revenue streams, with Annualized Recurring Revenue (ARR) growing by 9.2% to $316.9 million. This growth is indicative of the company's healthy business trajectory and its emphasis on software-as-a-service (SaaS) and other recurring revenue sources. The consistent Adjusted EBITDA margin of 27.4% demonstrates i3 Verticals' ability to maintain profitability while expanding its revenue base.

Amidst this financial growth, i3 Verticals has announced its intention to explore the sale of its Merchant Services Business, a move aimed at focusing on its vertical software businesses and enhancing shareholder value. Greg Daily, Chairman and CEO, stated:

"The decision to explore a sale of our Merchant Services Business reflects the next evolution in i3s long-term strategy to focus on our vertical software businesses, and to grow those software businesses through organic growth initiatives as well as through targeted M&A activity."

Revised 2024 Outlook and Conference Call

The company has revised its outlook for the fiscal year ending September 30, 2024, with revenue projections adjusted to a range of $385 million to $400 million and Adjusted EBITDA expected to be between $109 million and $115 million. These projections exclude the impact of potential sales of the Merchant Services Business, reflecting the company's confidence in its core operations.

i3 Verticals will provide further details during its conference call on February 9, 2024. The call will offer insights into the company's operational strategies and the potential sale of the Merchant Services Business.

The company's financial achievements, particularly the growth in revenue and net income, are significant for investors and industry observers. The strong performance in the software segment and the increase in ARR highlight i3 Verticals' commitment to its strategic vertical markets and its potential for sustainable growth. The exploration of the sale of the Merchant Services Business could further streamline the company's focus on its core competencies, potentially unlocking additional value for shareholders.

For detailed financial information and the full earnings report, please refer to the company's 8-K filing.

Value investors and potential GuruFocus.com members interested in following i3 Verticals Inc's journey and financial developments can find comprehensive analysis and updates on GuruFocus.com.

Explore the complete 8-K earnings release (here) from i3 Verticals Inc for further details.

This article first appeared on GuruFocus.