Iamgold's (IAG) Earnings Beat Estimates in Q3, Decrease Y/Y

Iamgold Corp. IAG posted an adjusted loss of 1 cent per share in the third quarter of 2023, beating the Zacks Consensus Estimate of a loss of 2 cents. The company reported a loss of 5 cents in the year-ago quarter.

Including one-time items, IAG reported break-even earnings per share against the prior-year quarter’s loss per share of 10 cents.

Revenues decreased 11.8% year over year to $225 million in the third quarter of 2023. The decline was driven by lower sales volume, partially offset by higher realized gold prices.

Operational Performance

Attributable gold production was 109,000 ounces for the quarter, down 40.8% year over year. The company sold 106,000 ounces of gold (on an attributable basis) in the third quarter, compared with 187,000 ounces in the third quarter of 2022.

The cost of sales was $219.9 million in the reported quarter, down 5.1%. The gross profit fell 79.8% year over year to $4.6 million. The gross margin came in at 2% in the reported quarter, down from the prior-year quarter’s 9%.

Iamgold Corporation Price, Consensus and EPS Surprise

Iamgold Corporation price-consensus-eps-surprise-chart | Iamgold Corporation Quote

Financial Review

Net cash from operating activities was $37.5 million, down from $117.7 million in the prior-year quarter. Cash and cash equivalents were $549 million as of Sep 30, 2023, up from $408 million as of Dec 31, 2023.

Outlook

The company reaffirms its attributable gold production guidance for 2023. It expects gold production to be in the range of 410,000-470,000 ounces.

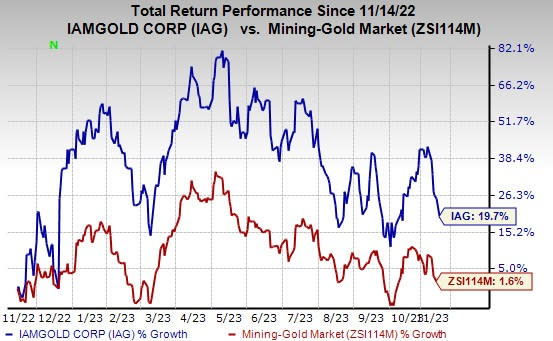

Price Performance

Shares of Iamgold have gained 19.7% in a year’s time compared with the industry’s growth of 1.6%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Iamgold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Universal Stainless & Alloy Products, Inc. USAP and The Andersons Inc. ANDE. CRS sports a Zacks Rank #1 (Strong Buy) and USAP and ANDE carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 14.3%. The Zacks Consensus Estimate for CRS’ fiscal 2024 earnings is pegged at $3.57 per share. The consensus estimate for 2024 earnings has moved 3% north in the past 60 days. Its shares have gained 65% in a year.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pinned at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP’s shares gained 96% in the last year.

The consensus estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 32% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Iamgold Corporation (IAG) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report