IBEX Ltd (IBEX) Faces Headwinds: Q2 Fiscal 2024 Earnings Dip Amid Client Volume Softness

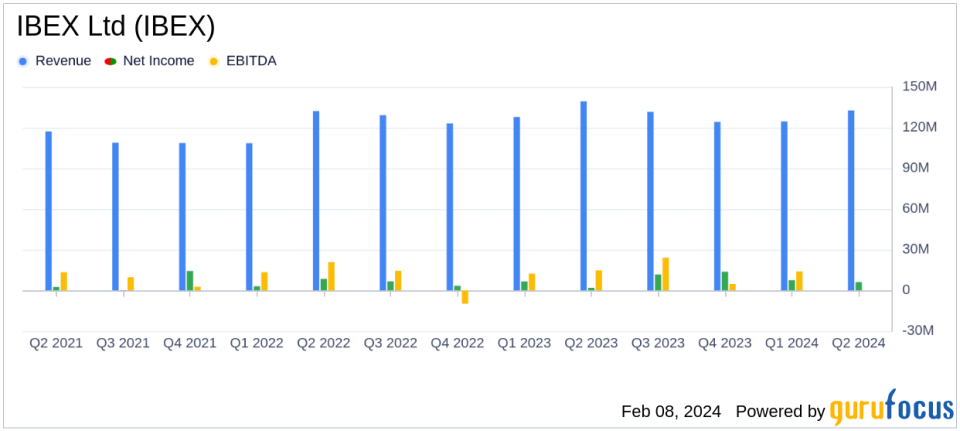

Revenue: Decreased by 4.8% year-over-year to $132.6 million.

Net Income: Dropped to $6.1 million from $9.3 million in the prior year quarter.

Diluted Earnings Per Share (EPS): Fell to $0.33 from $0.49 year-over-year.

Adjusted EBITDA: Declined to $14.3 million from $19.4 million in the prior year quarter.

Free Cash Flow: Decreased to a negative $4.5 million from a negative $2.7 million year-over-year.

Share Repurchase: IBEX repurchased 488,803 shares at a total cost of $8.4 million in Q2.

Guidance: Full-year revenue expected to be between $505 and $510 million with adjusted EBITDA margin of 12-13%.

On February 8, 2024, IBEX Ltd (NASDAQ:IBEX) released its 8-K filing, detailing financial results for the second quarter of fiscal year 2024 ended December 31, 2023. The company, a global leader in business process outsourcing and customer engagement technology solutions, reported a decrease in revenue and net income compared to the same quarter in the previous year. This performance reflects challenges in client volumes and strategic investments aimed at future growth.

IBEX operates through the Business process outsourcing segment, offering services in Digital and omni-channel Customer Experience (ibex Connect), Digital Marketing and E-Commerce (ibex Digital), and Digital CX surveys and analytics (ibex CX). The company serves a diverse range of industries, including telecommunications, cable, financial services, and healthcare.

Financial Performance Analysis

The company's revenue for the quarter was $132.6 million, a 4.8% decrease from the previous year's quarter, primarily due to lower volumes in certain verticals and a shift of delivery from onshore to offshore regions. The net income for the quarter was $6.1 million, down from $9.3 million in the prior year, with a net income margin of 4.6%, compared to 6.7% in the prior year quarter. Diluted earnings per share also decreased to $0.33 from $0.49.

Adjusted EBITDA was $14.3 million, a decline from $19.4 million in the prior year quarter, with the adjusted EBITDA margin falling to 10.8% from 13.9%. This decline was attributed to the deferral of $2.3 million in training revenue and strategic investments in technology and sales & marketing.

IBEX's balance sheet reflected a cash and cash equivalents balance of $49.0 million as of December 31, 2023, compared to $57.4 million as of June 30, 2023. The decrease in cash is primarily due to the company's share repurchase program. The net cash position was $48.0 million, down from $56.4 million as of June 30, 2023.

"We delivered against a number of our key objectives in the second quarter, highlighted by the eight new client wins in the quarter, totaling twelve in the first half of the fiscal year versus seven in the prior year period," commented Bob Dechant, CEO of ibex. "That being said, softness in volumes with several of our clients have put recent pressure on our top and bottom line and our second quarter reflected that."

Looking Ahead

Despite the challenges faced in the second quarter, IBEX is making strategic investments to position itself for future growth. The company has expanded its sales organization and enhanced its AI capabilities, which are expected to contribute to an improved performance trajectory. IBEX anticipates that its new client ramps will reach scale in the fourth quarter, leading to an inflection towards growth.

For the full fiscal year 2024, IBEX has updated its guidance, expecting revenues to be between $505 and $510 million and an adjusted EBITDA margin in the range of 12-13%. Capital expenditures are projected to be between $15 and $20 million.

Value investors and potential GuruFocus.com members may find IBEX's commitment to strategic growth initiatives and the updated full-year guidance to be of interest, particularly as the company navigates the current economic landscape and invests in technology to enhance its service offerings.

For more detailed financial information and future updates on IBEX Ltd (NASDAQ:IBEX), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from IBEX Ltd for further details.

This article first appeared on GuruFocus.