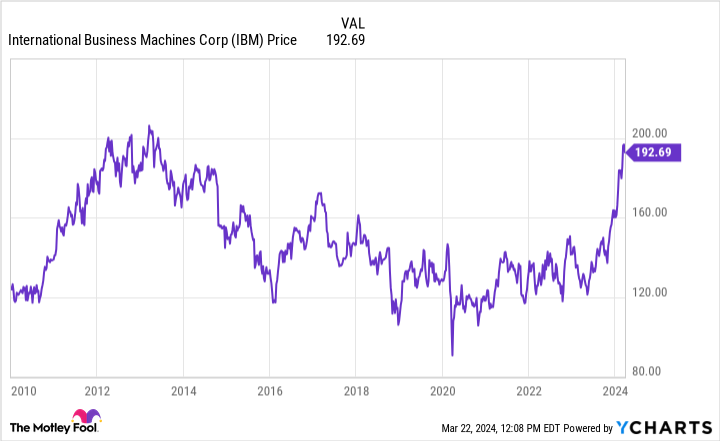

IBM Stock's "Lost Decade" Is Finally Over

Written off just a few years ago, International Business Machines (NYSE: IBM) is enjoying a renaissance. Shares of the tech giant peaked in 2013, and it's taken until now for the stock to approach that all-time high.

IBM has undergone some major changes over the past decade. The company has divested, spun off, or otherwise exited a wide range of businesses, including semiconductor manufacturing, commodity server systems, and managed infrastructure services. It's also made some big acquisitions, notably the $34 billion purchase of Red Hat.

IBM's decadelong turnaround has been a slog, with progress occurring in fits and starts, and with setbacks around every corner. But the task of transforming a sprawling company that was caught flat-footed by the cloud computing revolution is now mostly complete. The stock has surged more than 50% over the past year, and that may be just the beginning as the tech giant's strategy bears fruit.

A platform provider with critical advantages

It's taken more than a decade, but IBM has homed in on a successful strategy for winning in the cloud computing and artificial intelligence (AI) markets. The company has built two platforms, each of which is bolstered by its vast consulting arm. The hybrid cloud platform has Red Hat software at its core, while the AI platform is built around watsonx.

The consulting business is one of IBM's key competitive advantages. While consulting services aren't nearly as profitable as software, both businesses feed into each other. IBM's customers need solutions, not just software. As IBM CEO Arvind Krishna said during the most recent earnings call, "Consulting is a core driver of our value proposition for clients."

The power of the consulting business can be clearly seen as IBM ramps up its generative AI business. In the fourth quarter of 2023, roughly two-thirds of bookings related to generative AI were consulting signings. Large enterprises looking to make use of generative AI, particularly those operating in heavily regulated industries, can't afford to throw caution to the wind. Guidance and expertise plus a capable software platform is a potent combination that will drive business for IBM's generative AI offerings.

A second key advantage is IBM's willingness to deeply integrate products and services from other companies into the solutions it delivers to clients. In the cloud computing segment, IBM has strategic partnerships with tech giants including Amazon Web Services and Microsoft. The company has booked billions of dollars' worth of business through these partnerships, much of which likely would have not occurred if IBM didn't embrace competing platforms and products.

A new era has begun

While demand for some types of services and software ebbs and flows with the state of the economy, IBM is seeing persistent demand for projects that aim to increase productivity and decrease costs. Both the hybrid cloud platform and the AI platform can deliver those goals to clients.

IBM's growth isn't earth-shattering, but the company's results should hold up well in most economic environments. IBM expects mid-single-digit revenue growth after adjusting for currency in 2024, along with free cash flow of about $12 billion. That's a solid gain from the $11.2 billion in free cash flow generated in 2023.

IBM stock has become pricier as it's rallied, but it's still not expensive. With a market capitalization of about $176 billion, the stock trades for less than 15 times expected free cash flow. IBM shares aren't the bargain they once were, but the valuation remains reasonable.

The past decade has been a painful ride for investors, but there's finally a light at the end of the tunnel. With IBM's platform strategy in place, centered around hybrid cloud computing and AI, the stock looks like a solid long-term investment.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Timothy Green has positions in International Business Machines. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

IBM Stock's "Lost Decade" Is Finally Over was originally published by The Motley Fool