Icahn Enterprises LP Reports Mixed Results Amidst Market Volatility

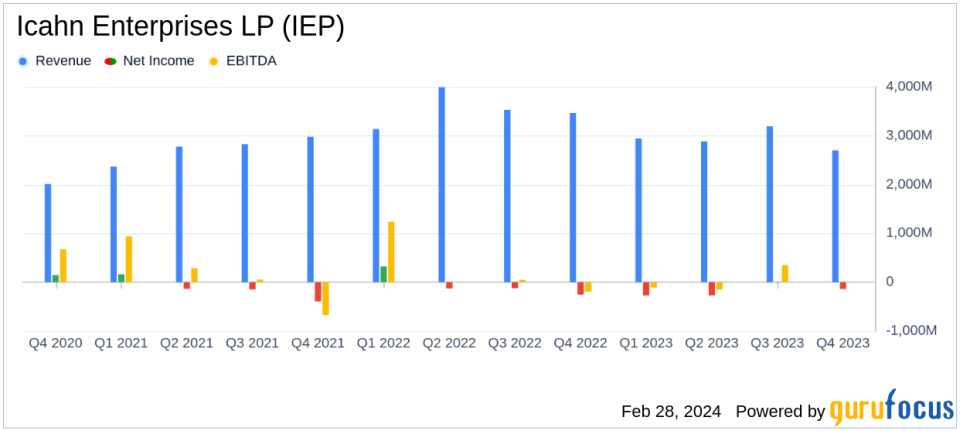

Revenue: Q4 2023 revenue decreased to $2.7 billion from $3.1 billion in Q4 2022.

Net Loss: Q4 2023 net loss narrowed to $139 million compared to a net loss of $255 million in Q4 2022.

Adjusted EBITDA: Q4 2023 Adjusted EBITDA was $9 million, a significant improvement from a loss of $75 million in Q4 2022.

Full-Year Performance: Full-year 2023 revenue was $10.8 billion with a net loss of $684 million, compared to $14.1 billion in revenue and a net loss of $183 million in 2022.

Dividend: Quarterly distribution declared at $1.00 per depositary unit, payable on April 18, 2024.

NAV Decrease: Indicative net asset value decreased by $411 million from September 30, 2023.

On February 28, 2024, Icahn Enterprises LP (NASDAQ:IEP) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. IEP, a diversified holding company with operations spanning Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion, and Pharma, faced a challenging year marked by volatility in its investment funds and hedging strategies.

Financial Performance Overview

IEP's revenues for Q4 2023 stood at $2.7 billion, a decrease from $3.1 billion in the same quarter of the previous year. The net loss for the quarter was $139 million, or a loss of $0.33 per depositary unit, showing an improvement from a net loss of $255 million, or $0.74 per depositary unit, in Q4 2022. Adjusted EBITDA for the quarter was positive at $9 million, compared to a loss of $75 million in the prior year's quarter.

For the full year, IEP reported revenues of $10.8 billion and a net loss of $684 million, or $1.75 per depositary unit. This compares to revenues of $14.1 billion and a net loss of $183 million, or $0.57 per depositary unit, for 2022. The company's Adjusted EBITDA for the year was $361 million, a decrease from $679 million in the previous year.

Challenges and Strategic Moves

IEP's performance was significantly impacted by losses from shorts in the investment funds, which are utilized for hedging purposes. The company's indicative net asset value also experienced a decrease of $411 million compared to the third quarter of 2023, primarily due to these shorts and distributions to unitholders.

Despite these challenges, IEP's Chairman, Carl C. Icahn, remains confident in the company's activist investment strategy, which has historically yielded high returns. IEP continues to seek value-creating opportunities, such as the recent investments in American Electric Power Company, Inc. and JetBlue Airways Corp.

Financial Statements Highlights

IEP's balance sheet as of December 31, 2023, shows total assets of $20.858 billion, with cash and cash equivalents totaling $2.951 billion. The company's total liabilities stood at $14.785 billion, and total equity was reported at $6.073 billion.

The company's cash position, which includes various segments and holding company cash, amounted to $2.7 billion. The Board of Directors declared a quarterly distribution of $1.00 per depositary unit, demonstrating a commitment to returning value to unitholders despite the net loss for the year.

Looking Ahead

While IEP's investment segment faced headwinds, the company's diversified business model and proactive management strategies position it to navigate market volatility. The focus on activist investing and strategic asset management remains central to IEP's approach to creating long-term value for its unitholders.

Investors and potential members of GuruFocus.com are encouraged to review the detailed financial results and consider the resilience and strategic direction of Icahn Enterprises LP as part of their investment analysis.

For more in-depth analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Icahn Enterprises LP for further details.

This article first appeared on GuruFocus.