Should We Follow Icahn in Selling Tenneco?

- By Praveen Chawla

Carl Icahn (Trades, Portfolio) is one of the greatest corporate raiders and among the world's richest people. The leader of Icahn Enterprises (IEP) rose from humble beginnings in Queens, New York to emerge as a powerful, if pugnacious, force in the business world. When looking at recent changes to the billionaire investor's portfolio, two big moves jump out. Icahn appears to be reducing his exposure to Tenneco Inc. (NYSE:TEN), a manufacturer of automotive components, while increasing his stake in Xerox Holdings Corp. (NYSE:XRX).

Since I own Tenneco, I will examine the stock in detail.

Icahn got into Tenneco via his purchase of unsecured Federal-Mogul bonds before its bankruptcy and eventually swapped them for equity as part of the company's reorganization plan. In early 2017, nearly a year after butting heads with other shareholders, Icahn took full ownership of Federal-Mogul in a roughly $300 million deal. Icahn Enterprises, through his indirect wholly owned subsidiary IEH FM Holdings LLC, sealed the deal after Federal-Mogul's second-largest shareholder, Gabelli Asset Management, tendered 7 million shares to Icahn, providing enough shares to take over the company outright. He then sold the company to Tenneco in a transaction valued at $5.4 billion. The deal was financed through $800 million in cash and about 29.5 million shares of Tenneco common stock (of which 23.8 million shares were non-voting B shares) flowing to Icahn and Tenneco assuming debt. At the time of closing, Icahn had 9.9% of the voting stock.

The plan was to separate Tenneco into two entities (Motor Parts and Ride Performance and Clean Air and Powertrain) after amalgamation with Federal-Mogul, but that plan was put on hold due to the pandemic. The spinoff of the two businesses from the parent is still expected to happen in 2021 and the company thinks it will result in multiple expansion for the growth business, which has been named Driv.

Icahn has the right to acquire up to 15% of the common voting A shares. It appears from my examination of his activities that Icahn is simultaneously converting his non-voting B shares to voting shares and selling off some voting A shares while maintaining his 15% voting control in Tenneco.

Tenneco's capital structure is highly leveraged. The balance sheet is a little scary looking with just a tiny sliver of equity (represented by the tiny green slice) and carrying a large debt load (in red).

The company has net debt of $4.5 billion, which it reduced by $460 million throughout 2020.

The company is also is the process of spreading out its debt maturity over a longer time frame.

While the company's bonds are not investment grade, they are not showing any obvious signs of distress.

Source: FINRA

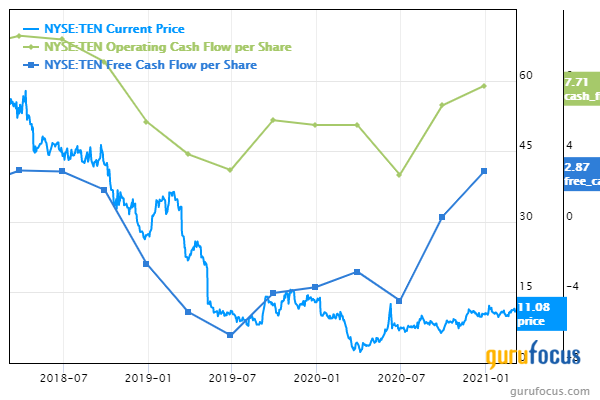

Cash flow per share is bouncing back after the acquisition of Federal-Mogul. The transaction closed on Oct. 1, 2018.

Conclusion

Morningstar is quite bullish on Tenneco, giving it a five-star rating, but it also has a high uncertainty rating and a fair value of $29. It is difficult to see that now with the price of only $12, but the company is capable of generating a lot of free cash flow. We can be sure that Icahn will be pushing management to deliver. While GuruFocus' proprietary GF Value score grades the company as modestly overvalued, I think it is a good turnaround situation.

I think investors are too enamoured by electric vehicle stocks currently and are counting out this tier-one traditional auto parts manufacturer out too quickly. Vehicles with internal combustion engines will be with us longer than many people think. With a price-to-free cash flow ratio of less than 4, I think its worth taking a chance on Tenneco and hope the company can reduce its high debt and leverage risk. The company is basically a leveraged buyout fund in drag. Its suitable only for investors with affinity for high risk-reward situations.

Disclosure: The author owns shares of Tenneco.

Read more here:

CEOs Buying Into Canadian Utilities

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.