ICF International (ICFI) Rises 12% in Six Months: Here's How

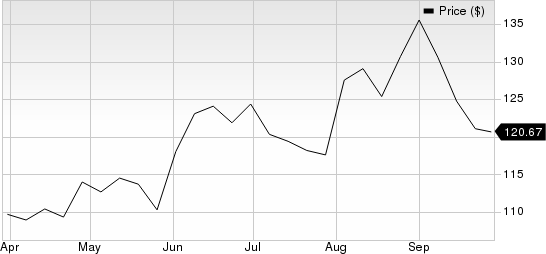

ICF International, Inc. ICFI has had an impressive run over the past six months. The stock has gained 12.4%, outperforming the 6.8% rally of the Zacks S&P 500 composite.

Reasons for the Upside

ICFI put on an impressive earnings performance in the past four quarters. Its earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average surprise of 7%.

ICF International, Inc. Price

ICF International, Inc. price | ICF International, Inc. Quote

The company sees steady demand trends among federal and state/local government clients and remains focused on deepening its presence in core U.S. federal and state and local government markets, expanding commercial business and strengthening technology-based offerings.

With a substantial increase in funds received by the Department of Health and Human Services, ICF International’s largest client by far, there are considerable project win opportunities. Also, the company is well-positioned to assist the Centers for Disease Control and Administration for Strategic Preparedness and Response in post-pandemic response.

Strategic acquisitions have helped to reduce the company’s dependency on government spending. In addition, the acquisitions have expanded its offerings and provided scale in certain geographies. Past and future acquisitions are also expected to contribute to the growth of ICFInternational’s EBITDA and free cash flow.

Zacks Rank and Stocks to Consider

ICFI currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the broader Business Service sector that investors may consider:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the four previous quarters and matched once, with an average surprise of 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, indicating an 8.2% decrease from the year-ago reported figure. Its earnings are pegged at $5.71 per share for 2023, suggesting 14% growth from the year-ago reported figure. VRSK currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently carries a Zacks Rank of 2. The company beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies year-over-year growth of 6.3% and 11.1%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report