ICF International (ICFI) Rises 41% in a Year: Here's How

ICF International, Inc. ICFI has had an impressive run over the past year. The stock has gained 41.2%, significantly outperforming the 32.6% growth of the Zacks S&P 500 composite.

Reasons for the Upside

ICFI put on an impressive earnings performance in the past four quarters. Its earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average surprise of 6%.

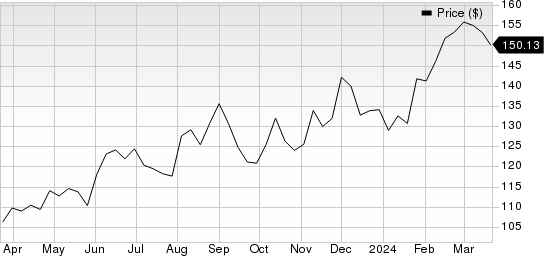

ICF International, Inc. Price

ICF International, Inc. price | ICF International, Inc. Quote

The company’s strong global presence in diverse markets and its robust, long-term relationships with clients continue to drive sales. ICFI sees steady demand trends among federal and state/local government clients and remains focused on deepening its presence in core U.S. federal and state and local government markets and strengthening technology-based offerings.

Increased government focus on environmental initiatives, efficiency and mission performance management, transparency and accountability, and heightened demand for integrating domain knowledge of client missions and programs with innovative technology-enabled solutions is driving demand for ICF International’s advisory services.

Strategic acquisitions have helped to reduce the company’s dependency on government spending. In addition, the acquisitions have expanded its offerings and provided scale in certain geographies. Past and future acquisitions are also expected to contribute to the growth of ICF International’s EBITDA and free cash flow.

Zacks Rank and Stocks to Consider

ICFI currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader Zacks Business Services sector are Booz Allen Hamilton BAH and Barrett Business Services BBSI.

Booz Allen Hamilton sports a Zacks Rank of 1 (Strong Buy) at present. BAH has a long-term earnings growth expectation of 12.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

BAH delivered a trailing four-quarter earnings surprise of 12.7%, on average.

Barrett Business Services currently carries a Zacks Rank of 2 (Buy). BBSI has a long-term earnings growth expectation of 14%.

BBSI delivered a trailing four-quarter earnings surprise of 77.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report