ICF International (ICFI) Rises 7.4% in 3 Months: Here's How

ICF International, Inc. ICFI has had an impressive run over the past three months. The stock has gained 7.4%, outperforming the 4.8% rally of the industry it belongs to and the 2.8% rise of the Zacks S&P 500 composite.

Reasons for the Upside

ICF has put on an impressive earnings performance in the past four quarters. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average surprise of 9.2%.

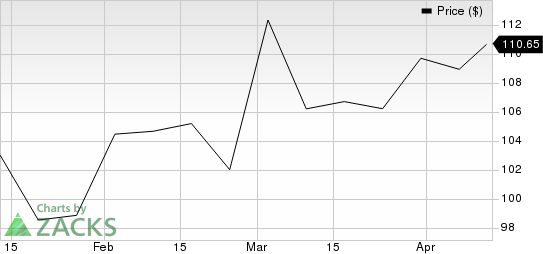

ICF International, Inc. Price

ICF International, Inc. price | ICF International, Inc. Quote

The company sees steady demand trends among federal and state/local government clients, and remains focussed on deepening its presence in the core U.S. federal and state and local government markets, expanding commercial business and strengthening technology-based offerings.

There are considerable project win opportunities for ICF, with a substantial increase in funds received by the Department of Health and Human Services, its largest client so far. Also, the company is well-positioned to assist the Centers for Disease Control and Administration for Strategic Preparedness and Response in post-pandemic response.

ICF is providing technical assistance and communication and management support for Infrastructure and Jobs Act programs and is well-positioned for contract wins.

The company is seeing a significant increase in revenues from its high-growth markets, which include IT modernization/digital transformation, public health, disaster management, utility consulting, climate, environment and infrastructure services. A 1.32 trailing 12-month book-to-bill ratio and an $8.5-billion new business pipeline at the end of the fourth quarter of 2022 provide good revenue visibility for the near term.

Strategic acquisitions have helped reduce the company’s dependency on government spending. In addition, the acquisitions have expanded its offerings and provided scale in certain geographies. Past and future acquisitions are also expected to contribute to growth of ICF’s EBITDA and free cash flow.

Zacks Rank and Other Stocks to Consider

ICF currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks in the Zacks Business Services sector are ExlService EXLS and Maximus MMS.

For first-quarter 2023, ExlService’searnings are expected to increase 13.4% year over year to $1.61 per share. In 2023, the company’s bottom line is expected to increase 12.5% on a year-over-year basis. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Maximus’s first-quarter and 2023 earnings is pegged at 78 cents per share and $4.16, respectively. The consensus mark for the first quarter has been revised 8.2% downward in the past 60 days. The consensus estimate for 2023 has been revised 2.7% upward in the past 60 days. The company currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ExlService Holdings, Inc. (EXLS) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report