ICF International Inc (ICFI) Reports Solid Q4 and Full Year 2023 Results

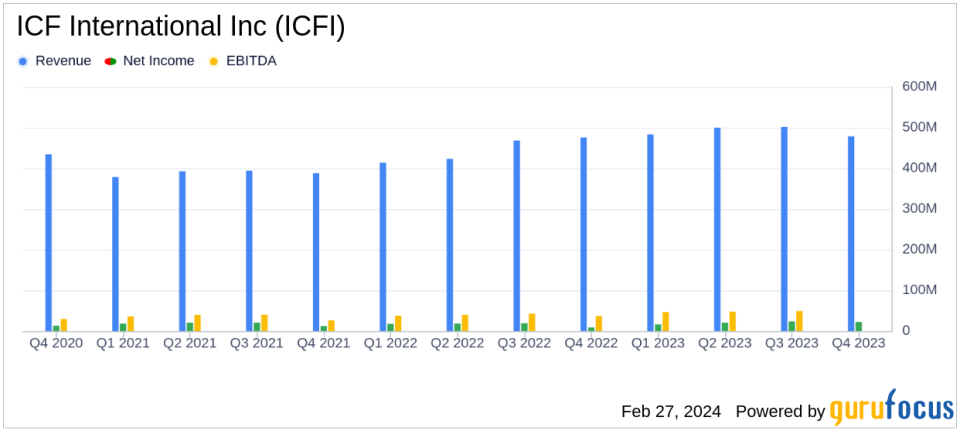

Revenue: Q4 increased 1% to $478 million; Full year increased 10% to $1.96 billion.

Net Income: Q4 was $22 million with diluted EPS of $1.16; Full year was $83 million with diluted EPS of $4.35.

Non-GAAP EPS: Q4 up 8% to $1.68; Full year up 13% to $6.50.

EBITDA: Q4 up 46% to $53.9 million; Full year up 25% to $197.0 million.

Contract Awards: Q4 were $611 million with a book-to-bill ratio of 1.3; Full year were $2.3 billion with a book-to-bill ratio of 1.2.

Operating Cash Flow: Full year was $152 million.

Guidance for 2024: High single-digit organic revenue growth expected with further margin expansion.

On February 27, 2024, ICF International Inc (NASDAQ:ICFI), a global consulting and digital services provider, released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year of 2023. ICFI, known for its professional services and technology-based solutions to government and commercial clients, reported a solid finish to the year with double-digit revenue growth, reflecting the strength of its diversified business model and expanded capabilities in key growth markets.

Financial Performance Overview

ICFI's fourth quarter revenue saw a modest increase of 1% to $478 million, with a 5% increase when excluding divestitures. The full year revenue grew by 10% to $1.96 billion, or 12% excluding divestitures, driven by double-digit growth from both government and commercial clients. Net income for the fourth quarter was reported at $22 million, translating to a diluted EPS of $1.16, which included $0.18 in tax-effected net special charges. For the full year, net income reached $83 million, with a diluted EPS of $4.35, inclusive of $0.71 in tax-effected net special charges.

Non-GAAP EPS for the fourth quarter increased by 8% to $1.68, while the full year saw a 13% increase to $6.50. EBITDA for the fourth quarter was up by a significant 46% to $53.9 million, with adjusted EBITDA growing by 3% to $57.0 million. The full year EBITDA increased by 25% to $197.0 million, with adjusted EBITDA up by 11% to $213.2 million. Operating cash flow for the year was reported at $152 million.

Contract Awards and Future Outlook

ICFI's contract awards for the fourth quarter amounted to $611 million, resulting in a book-to-bill ratio of 1.3. For the full year, the contract awards totaled $2.3 billion with a book-to-bill ratio of 1.2. The company's backlog at the end of the fourth quarter stood at $3.8 billion, with funded backlog accounting for approximately 47% of the total.

Looking ahead, ICFI anticipates high single-digit organic revenue growth from continuing operations in 2024, with further margin expansion. The company expects 2024 organic revenues to range from $2.03 billion to $2.10 billion, representing year-on-year growth of 5.2% at the midpoint when compared to reported 2023 and 8.5% at the midpoint on continuing operations. EBITDA is projected to range from $220 million to $230 million, reflecting year-on-year growth of 14.2% at the midpoint. The guidance for GAAP EPS is $5.25 to $5.55, excluding special charges, and for Non-GAAP EPS is $6.60 to $6.90.

Company Highlights and Recognitions

ICFI received several recognitions in 2023, including being named one of America's Best Employers for Women by Forbes for the second consecutive year and inclusion on Forbes' Americas Best Management Consulting Firms list for the eighth straight year. The company was also awarded a Climate Leadership Award by the Climate Registry and was ranked a Top Federal Industry Leader by Bloomberg in its BGOV200 rankings.

John Wasson, chair and chief executive officer of ICF, commented on the results, stating, "Fourth quarter results represented a solid finish to a year of double-digit revenue growth for ICF, which demonstrated the benefits of our expanded capabilities in key growth markets and the strength of our diversified business model." He also highlighted the company's strong financial performance, substantial contract awards, and robust business development pipeline, providing a substantial runway for future growth.

For more detailed information on ICF International Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from ICF International Inc for further details.

This article first appeared on GuruFocus.