Ichor Holdings Ltd (ICHR) Faces Net Loss in Q4 Despite Revenue Growth

Revenue: Q4 revenue reached $203.5 million, aligning with the upper end of guidance.

Gross Margin: Gross margin reported at 10.0% on a GAAP basis and 10.4% on a non-GAAP basis.

Net Income: GAAP net loss of $11.9 million and non-GAAP net loss of $1.7 million in Q4.

Earnings Per Share: GAAP EPS stood at $(0.40), with non-GAAP EPS at $(0.06).

Cash Flow: Generated $38 million in cash flow from operations during the quarter.

Debt Reduction: Reduced total debt by $32 million in Q4.

Outlook: Anticipates similar revenue levels through mid-2024 with improvements in gross margins.

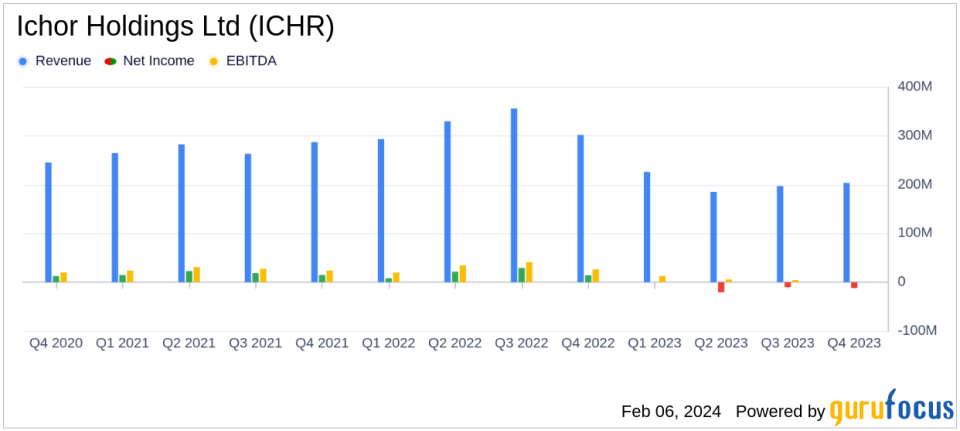

On February 6, 2024, Ichor Holdings Ltd (NASDAQ:ICHR), a key player in the semiconductor capital equipment industry, released its 8-K filing, disclosing its financial results for the fourth quarter and fiscal year 2023. The company, which specializes in the design, engineering, and manufacturing of critical fluid delivery subsystems and components, reported a revenue of $203 million for Q4, hitting the upper end of its previously communicated guidance range.

Despite the revenue growth, Ichor Holdings faced a net loss of $11.9 million on a GAAP basis and $1.7 million on a non-GAAP basis, with respective earnings per share (EPS) of $(0.40) and $(0.06). The company's gross margin stood at 10.0% on a GAAP basis and 10.4% on a non-GAAP basis, reflecting a less favorable product and customer mix that temporarily hindered the company's strategy to deliver consistent improvement in gross margins.

CEO Jeff Andreson commented on the results, stating:

"Within a relatively stable demand environment, revenues at the upper end of guidance exceeded our expectations; however, product and customer mix became less favorable, resulting in a temporary setback in our strategies to deliver consistent improvement in gross margins."

Andreson also expressed optimism about the future, anticipating revenue continuity at similar levels through mid-2024 with meaningful improvements in gross margins and profitability. The company is focusing on R&D investments to drive gross margin accretion and strong operating leverage as revenue levels rebound.

For the fiscal year 2023, Ichor Holdings reported a revenue of $811.1 million, a significant decrease from the $1,280.1 million in 2022. The net loss for the year was $43.0 million, a stark contrast to the net income of $72.8 million in the previous year. The non-GAAP net income for 2023 was $12.3 million, down from $104.9 million in 2022.

The company's balance sheet showed an increase in cash and cash equivalents to $80.0 million, up by $4.0 million from the previous quarter but down by $6.5 million from 2022. The cash flow from operations contributed positively with $37.6 million, offsetting net payments on credit facilities.

Looking ahead, Ichor Holdings provided a financial outlook for the first quarter of 2024, expecting revenue to range between $190 million and $210 million, with GAAP diluted EPS between $(0.24) and $(0.14), and non-GAAP diluted EPS between $(0.05) and $0.05.

The company's performance reflects the challenges within the semiconductor industry, including the impact of product mix on profitability. However, Ichor's focus on R&D and customer engagement in tool evaluations and qualifications may position it for improved financial performance in the coming years, particularly in the anticipated growth year of 2025.

For value investors, the company's efforts to improve gross margins and the reduction in total debt are notable, as these factors could contribute to a stronger financial position in the long term. The semiconductor industry's cyclical nature requires companies like Ichor Holdings to adapt and innovate continuously, and the company's strategic focus on new product development and operational efficiencies may offer potential for growth as market conditions evolve.

Explore the complete 8-K earnings release (here) from Ichor Holdings Ltd for further details.

This article first appeared on GuruFocus.