ICICI Bank (IBN) Stock Gains as Q2 Earnings Rise on Higher NII

Shares of ICICI Bank IBN have gained almost 1% on NYSE since the release of its second-quarter fiscal 2024 (ended Sep 30) results. Net income was INR102.61 billion ($1.2 billion), up 35.8% from the prior-year quarter.

Results were driven by a rise in net interest income (NII), non-interest income, growth in loans and deposits, and higher rates. However, higher operating expenses posed as the undermining factor.

NII & Fee Income Improve, Expenses Rise

NII jumped 23.8% year over year to INR183.08 billion ($2.2 billion). The net interest margin was 4.53%, up 22 basis points.

Non-interest income (excluding treasury income) was INR58.61 billion ($706 million), up 14%. Fee income increased 14.2% to INR52.04 billion ($627 million).

In the reported quarter, IBN incurred a treasury loss of INR0.85 billion ($10 million).

Operating expenses totaled INR98.55 billion ($1.2 billion), rising 20.8% year over year.

Loans & Deposits Increase

As of Sep 30, 2023, ICICI Bank’s total advances were INR11,105.42 billion ($133.7 billion), up 18.3% year over year. Growth was primarily driven by a solid rise in retail loan balances, business banking loans and SME loans.

Total deposits grew 18.8% to INR12,947.42 billion ($155.9 billion).

Credit Quality Decent

As of Sep 30, 2023, net non-performing assets (NPA) ratio was 0.43%, down from 0.61% in the prior-year period. Recoveries and upgrades (excluding write-offs and sale) of NPAs were INR45.71 billion ($550 million) in the quarter.

In the fiscal second quarter, there were net additions of INR1.16 billion ($14 million) to gross NPA. Gross NPA additions were INR46.87 billion ($546 million), while gross NPA written-off was INR19.22 billion ($231 million).

Provisions (excluding provision for tax) decreased 64.5% to INR5.83 billion ($70 million). As of Sep 30, 2023, the bank held a total contingency provision of INR131 billion ($1.6 billion).

Capital Ratios Strong

In compliance with the Reserve Bank of India's guidelines on Basel III norms, ICICI Bank's total capital adequacy was 17.59% and Tier-1 capital adequacy was 16.86% as of Sep 30, 2023. Both ratios were well above the minimum requirements.

Our Take

ICICI Bank’s quarterly performance was impressive on a robust rise in demand for consumer loans. Growth in NII was a major tailwind, which is expected to keep supporting the company's financial performance. However, elevated expenses and macroeconomic concerns are major near-term headwinds.

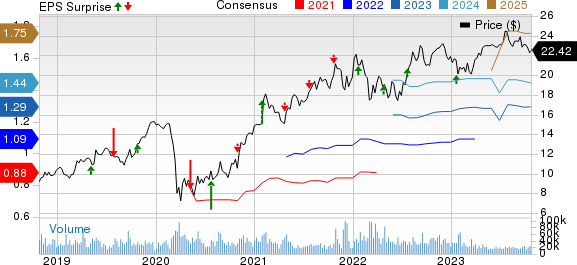

ICICI Bank Limited Price, Consensus and EPS Surprise

ICICI Bank Limited price-consensus-eps-surprise-chart | ICICI Bank Limited Quote

ICICI Bank currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Date of Other Foreign Banks

Barclays BCS reported a third-quarter 2023 net income attributable to ordinary equity holders of £1.27 billion ($1.61 billion), down 16% from the prior-year quarter.

BCS recorded an increase in revenues, along with higher credit impairment charges. Operating expenses increased marginally in the quarter under review.

HSBC Holdings plc HSBC is slated to announce its third-quarter 2023 numbers on Oct 30.

Over the past seven days, the Zacks Consensus Estimate for HSBC’s quarterly earnings has remained unchanged.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report