ICICI Bank's (IBN) Domestic Loans, High Rates Aid Amid Cost Woes

ICICI Bank Ltd IBN is well-poised for growth, driven by increasing dependence on domestic loans and higher rates. Further, the adoption of digital banking services and digitization of banking operations is expected to support fee income. However, elevated expenses and weak credit quality are major headwinds.

ICICI Bank is making commendable progress in improving digital banking services for both retail and corporate clients. The increasing adoption of the bank’s mobile banking app — iMobile Pay — is helping garner solid market share, with 9 million activations of iMobile Pay from non-ICICI Bank users till Mar 31, 2023.

The company’s digital platform for businesses, InstaBIZ, along with supply chain platforms, has witnessed tremendous growth in the past few quarters. These efforts are leading to a rapid increase in end-to-end digital sanctions and disbursements across various products.

Moreover, IBN has been successfully leveraging its technological initiatives to augment the contribution of non-interest income toward its top line. In fiscal 2023, almost 36% of the company’s mortgage loan sanctions and 39% of its personal loan disbursements, by volume, were end-to-end digital. Driven by these efforts, non-interest income grew 13% in fiscal 2023. Efforts to digitize operations and a rise in mobile banking transactions will likely continue to help the company garner more fee income going forward.

Though ICICI Bank has wide international loan coverage, domestic loans represent a substantial part of its overall loans (96.7% as of Mar 31, 2023). As a result, the company is secure with respect to loans and is less likely to be affected by global concerns. The bank has been marketing retail deposits on a large scale, primarily to lower its cost of funds and create a stable funding base. At the end of fiscal 2023, retail loans grew 23%, while in both fiscal 2022 and fiscal 2021, the same grew 20%.

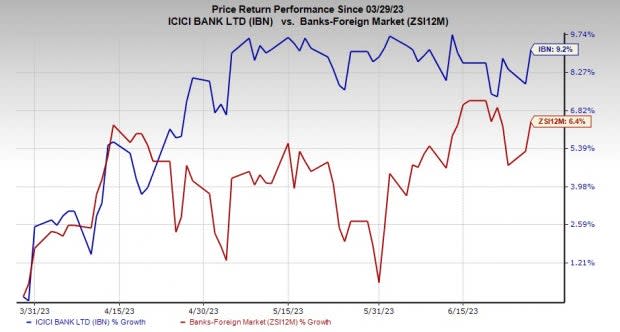

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 9.2% compared with the industry’s rise of 6.4%.

Image Source: Zacks Investment Research

However, with rising inflation and tighter monetary policy across the globe, ICICI Bank’s asset quality might come under pressure. Likewise, its credit quality worsened in fiscal 2020 and fiscal 2021 due to the global and domestic economic slowdown, the coronavirus-related concerns, and the significant slump in commodity prices. While the bank’s provisions declined in fiscal 2023 and fiscal 2022, the same, along with non-performing assets, have increased significantly over the past several quarters.

Increasing operating expenses are expected to drag ICICI Bank’s bottom line. In fiscal 2023 and 2022, operating expenses surged 23% and 24%, respectively. Expenses are likely to remain elevated in the near term, owing to the bank’s ongoing expansion in branch networks and ATMs, as well as technology investments aimed at driving revenues.

Foreign Banks Worth a Look

A couple of better-ranked stocks from the same space are BNP Paribas BNPQY and Nordea Bank NRDBY, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for BNP Paribas’ current-year earnings has been revised 15.3% upward over the past 60 days. Its shares have gained 6% in the past three months.

Earnings estimates for Nordea Bank for 2023 have been revised 4.4% upward over the past 30 days. In the past three months, NRDBY shares have gained 1.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

BNP Paribas SA (BNPQY) : Free Stock Analysis Report

Nordea Bank AB (NRDBY) : Free Stock Analysis Report