ICU Medical Inc (ICUI) Posts Mixed Q4 Results; Provides 2024 Guidance

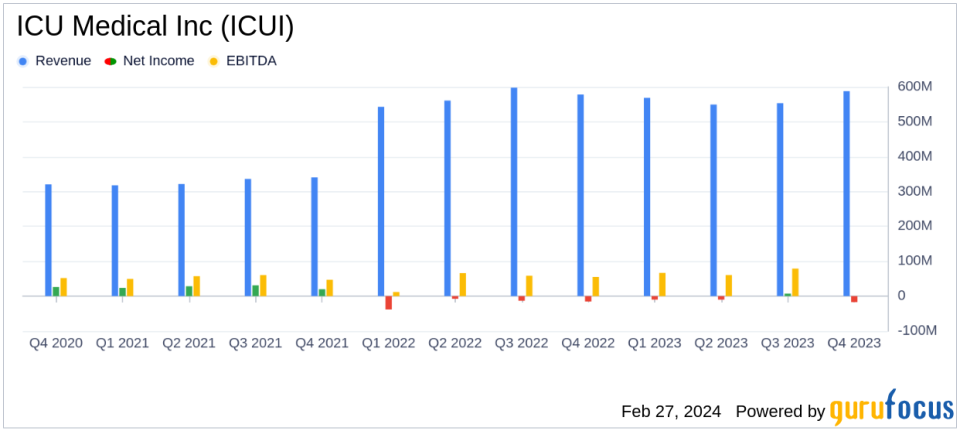

Revenue: Q4 revenue increased to $587.9 million from $578.0 million in the prior year.

Net Loss: GAAP net loss widened to $(17.1) million in Q4 2023 from $(15.5) million in Q4 2022.

Gross Margin: Gross margin decreased to 29% in Q4 2023 from 30% in the same period last year.

Adjusted EBITDA: Adjusted EBITDA decreased to $86.3 million in Q4 2023 from $96.4 million in Q4 2022.

2024 Guidance: GAAP net loss projected to be $(88) to $(71) million, with adjusted EBITDA expected between $330 million to $370 million.

On February 27, 2024, ICU Medical Inc (NASDAQ:ICUI) released its 8-K filing, announcing financial results for the fourth quarter ended December 31, 2023. The company, a leader in infusion therapy and critical care products, reported a slight increase in revenue but experienced a widening net loss compared to the same quarter in the previous year.

Company Overview

ICU Medical is a California-based, pure-play infusion therapy company that provides consumables, systems, and services for virtually every component of the IV continuum of care. ICU has become one of the largest players in its industry following its acquisition of Hospira Infusion Systems from Pfizer in 2017, and Smiths Medical from Smiths Group in 2022. It holds top-tier positions in its original reporting segments: infusion consumables (25% of 2022 revenue), IV solutions (16%), infusion systems (15%), and critical care (2%) as well as its new Smiths segments: Smiths infusion systems (15%), vascular access (14%), and vital care (12%). The combined entity remains primarily U.S. focused, generating over 64% of its sales domestically.

Financial Performance and Challenges

ICU Medical's Q4 revenue increased modestly to $587.9 million, up from $578.0 million in the prior year. However, the company's GAAP gross profit decreased to $171.6 million, resulting in a gross margin decline to 29% from 30%. The GAAP net loss for the quarter widened to $(17.1) million, or $(0.71) per diluted share, compared to a net loss of $(15.5) million, or $(0.65) per diluted share, for the same period last year. Adjusted diluted earnings per share slightly decreased to $1.57 from $1.60 year-over-year.

These financial results are critical as they reflect the company's ability to manage costs and maintain profitability in a competitive medical devices industry. The challenges faced, such as the decrease in gross margin and the widening net loss, may indicate pressures on the company's cost structure and the need for efficiency improvements.

Financial Achievements and Importance

Despite the challenges, ICU Medical's financial achievements include maintaining a steady revenue stream and controlling operating expenses. The company's performance in managing its revenue amidst industry headwinds is important as it demonstrates resilience and the potential for growth. Moreover, the ability to project a forward guidance suggests management's confidence in their strategic initiatives.

Key Financial Metrics

Key financial metrics from the income statement, balance sheet, and cash flow statement include:

- Total revenues for the twelve months ended December 31, 2023, were $2,259.1 million, a slight decrease from $2,280.0 million in the prior year.

- The balance sheet shows an increase in cash and cash equivalents to $254.2 million, up from $208.8 million at the end of 2022.

- Net cash provided by operating activities for the twelve months ended December 31, 2023, was $166.2 million, a significant improvement from the net cash used in operating activities of $(62.1) million in the prior year.

These metrics are important as they provide insights into the company's operational efficiency, liquidity position, and cash-generating ability, which are crucial for sustaining operations and funding future growth.

Vivek Jain, ICU Medicals Chief Executive Officer, said, Fourth quarter results were generally in line with our expectations."

Analysis of Performance

ICU Medical's performance in the fourth quarter shows a mixed outcome with a slight revenue increase but a decrease in profitability. The company's ability to generate positive cash flow from operations is a positive sign, indicating effective cash management. However, the decline in gross margin and the increased net loss highlight the need for the company to focus on cost reduction and operational efficiencies.

The company's guidance for fiscal year 2024 suggests a cautious outlook, with an anticipated GAAP net loss but an expected increase in adjusted EBITDA and adjusted diluted EPS. This guidance reflects management's focus on improving profitability and operational performance in the coming year.

For more detailed information and analysis on ICU Medical Inc's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from ICU Medical Inc for further details.

This article first appeared on GuruFocus.