Is Ideanomics (IDEX) a Hidden Gem or a Value Trap? A Comprehensive Analysis

Value-focused investors are constantly on the lookout for stocks priced below their intrinsic value. One such stock that warrants attention is Ideanomics Inc (NASDAQ:IDEX). Despite its seemingly attractive valuation, certain risk factors associated with Ideanomics should not be ignored. These risks are primarily reflected through its low Piotroski F-score of 1, and the company's revenues and earnings have been on a downward trend over the past five years. Is Ideanomics a hidden gem or a value trap? This complexity underlines the importance of thorough due diligence in investment decision-making.

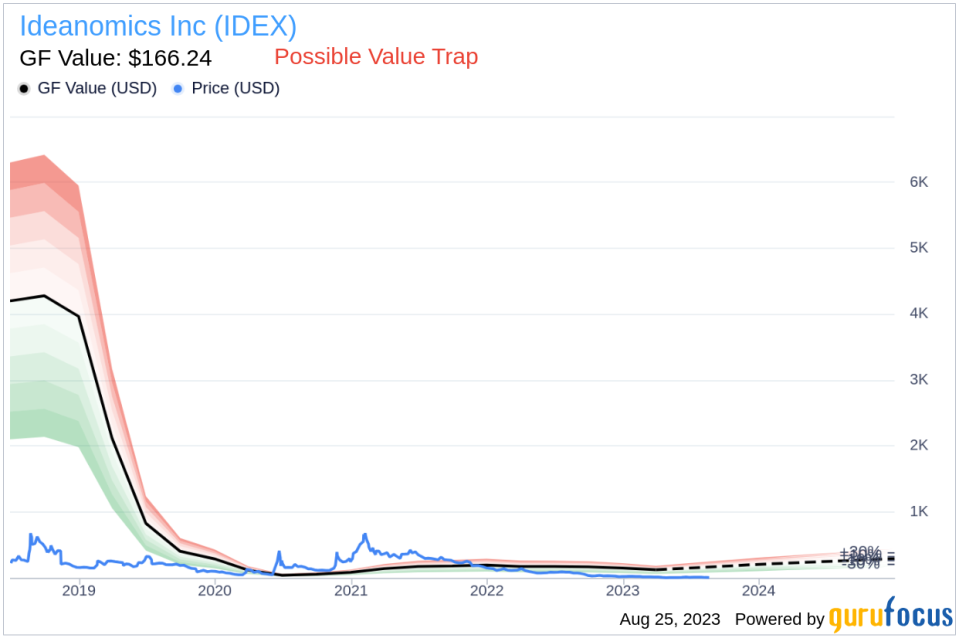

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors: Historical multiples that the stock has traded at, GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

Assessing Ideanomics's Financial Health

The Piotroski F-score, created by accounting professor Joseph Piotroski, is a tool used to assess the strength of a company's financial health. The score is based on nine criteria that fall into three categories: profitability, leverage/liquidity/ source of funds, and operating efficiency. Ideanomics's current Piotroski F-Score, however, falls in the lower end of this spectrum, indicating potential red flags for investors.

Company Introduction

Ideanomics Inc is an American multinational company engaged in accelerating the commercial adoption of electric vehicles. The company operates in North America, Asia, and Europe. Despite its global presence and involvement in the promising electric vehicle industry, the company's stock price is currently at a low of 3.7, significantly below its GF Value of $166.24. This discrepancy between the stock price and its estimated fair value necessitates a more profound exploration of the company's value and potential risks.

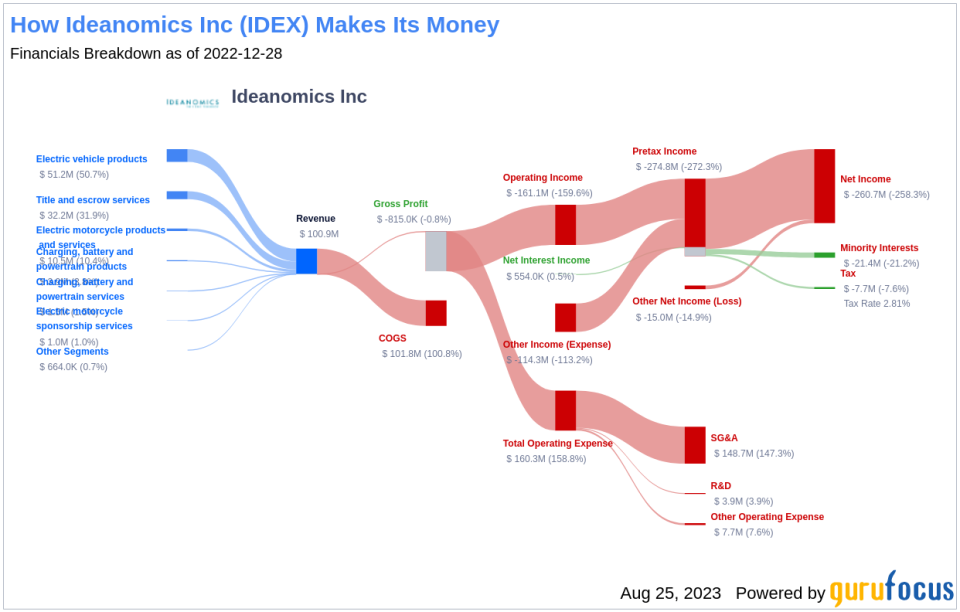

Analysis of Ideanomics's Profitability

A closer look at Ideanomics's ROA reveals a worrying trend of negative returns. This indicates the company's inability to generate profit from its assets - a fundamental concern for any investor. The cash flow from operations over the trailing twelve months (TTM) stands at $-109.32 million, whereas the net income in the same period is significantly higher at $-316.5 million. This discrepancy could indicate that the earnings quality is poor and the company might have difficulties sustaining its operations or financing its obligations.

Leverage, Liquidity and Source of Funds: A Worrying Trend

Operating Efficiency: A Darker Picture

Examining Ideanomics's Diluted Average Shares Outstanding over the past three years, it becomes evident that the company has issued more shares. This trend signals that the company has issued more shares, leading to the dilution of existing shares' value. This dilution occurs because the earnings of the company now have to be divided among a larger pool of shares, which could decrease Earnings Per Share (EPS).

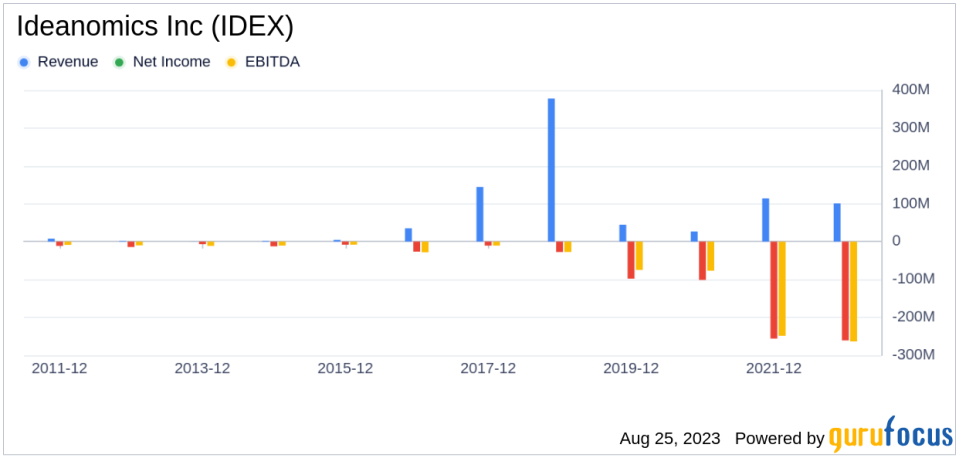

The Bearish Signs: Declining Revenues and Earnings

One of the telltale indicators of a company's potential trouble is a sustained decline in revenues. In the case of Ideanomics, both the revenue per share and the 5-year revenue growth rate (-47.2%) have been on a consistent downward trajectory. This pattern may point to underlying challenges such as diminishing demand for Ideanomics's products, or escalating competition in its market sector.

The Red Flag: Sluggish Earnings Growth

The company's earnings picture does not look much brighter. The 3-year EPS without NRI growth rate (14.6%) is sluggish, and the future 3 to 5-year EPS growth estimate (0%) does not show a promising uptick. These indicators could suggest the company is struggling to translate sales into profits effectively, a critical element of a successful business model.

Conclusion

Despite its low price-to-fair-value ratio, Ideanomics's falling revenues and earnings cast a long shadow over its investment attractiveness. A low price relative to intrinsic value can indeed suggest an investment opportunity, but only if the company's fundamentals are sound or improving. In Ideanomics's case, the declining revenues, EBITDA, and earnings growth suggest that the company's issues may be more than just cyclical fluctuations. Without a clear turnaround strategy, there's a risk that the company's performance could continue to deteriorate, leading to further price declines. In such a scenario, the low price-to-GF-Value ratio may be more indicative of a value trap than a value opportunity.

GuruFocus Premium members can find stocks with high Piotroski F-score using the following Screener: Piotroski F-score screener . Investors can find stocks with good revenue and earnings growth using GuruFocus' Peter Lynch Growth with Low Valuation Screener.

This article first appeared on GuruFocus.