Is IDEX Corp (IEX) Modestly Undervalued? A Comprehensive Analysis

On July 27, 2023, IDEX Corp (NYSE:IEX) recorded a daily gain of 3.23%, with an Earnings Per Share (EPS) (EPS) of 7.72. This article aims to explore the question: Is IDEX Corp (NYSE:IEX) modestly undervalued? The following analysis, based on our proprietary GF Value metric, provides an in-depth examination of the company's valuation. We encourage you to read on for a comprehensive understanding of IDEX's current financial standing.

A Snapshot of IDEX Corp (NYSE:IEX)

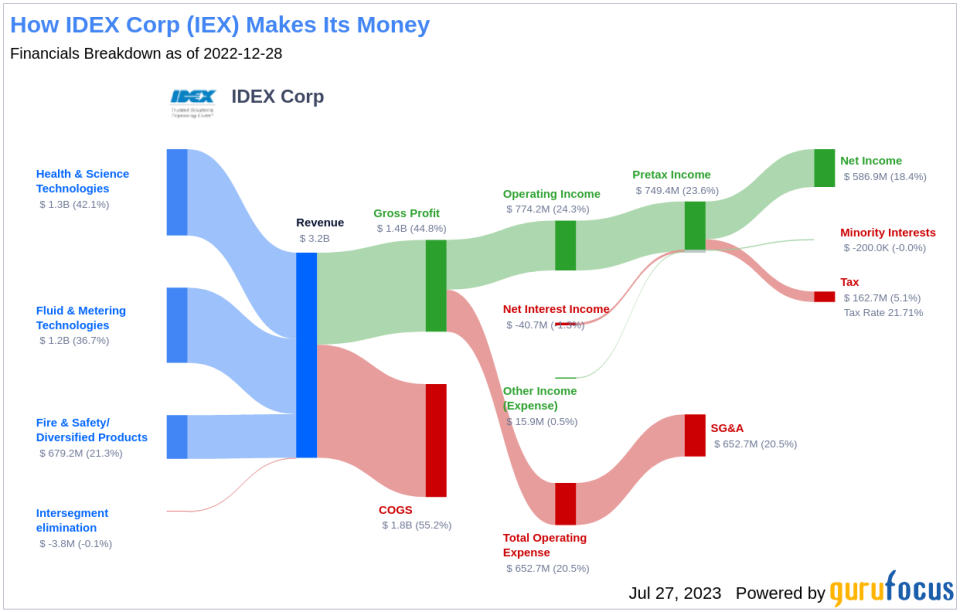

IDEX Corp (NYSE:IEX) is a renowned manufacturer of pumps, flow meters, valves, and fluidic systems for a diverse range of end markets, including industrial, fire and safety, life science, and water. The firm operates from Lake Forest, Illinois, and boasts manufacturing operations in over 20 countries with more than 7,000 employees. In 2022, IDEX generated $3.2 billion in revenue and $763 million in adjusted operating income.

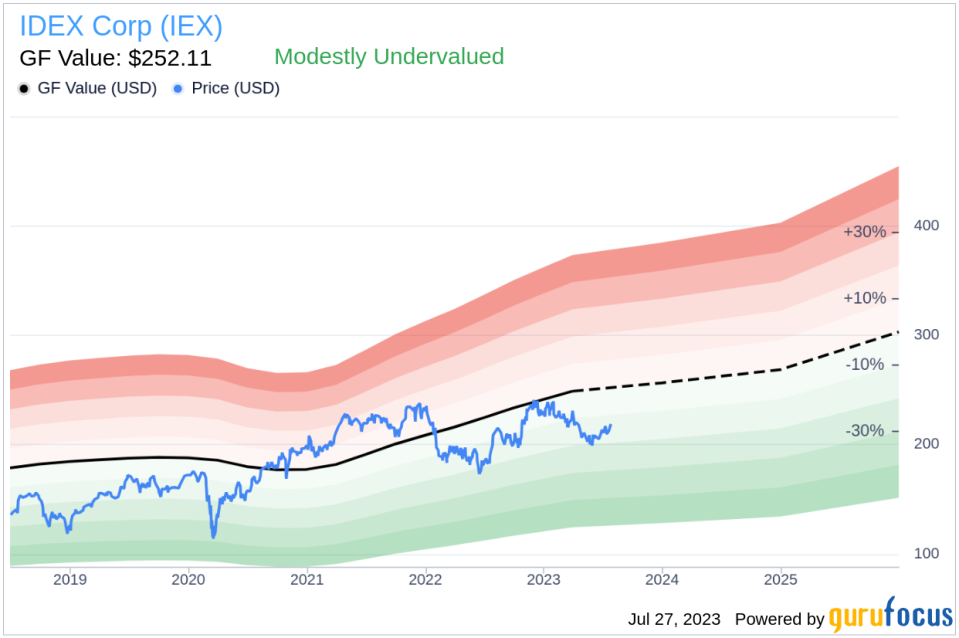

On July 27, 2023, IDEX's stock price was $218.82, while its GF Value, an estimation of fair value, was $252.11. This disparity suggests that IDEX appears to be modestly undervalued. The following sections delve deeper into the company's financial health, profitability, growth, and intrinsic value.

Understanding the GF Value of IDEX

The GF Value is a unique metric that calculates the intrinsic value of a stock. It incorporates historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Based on our GF Value calculation, IDEX (NYSE:IEX) appears to be modestly undervalued. With a market cap of $16.5 billion and a current price of $218.82 per share, the long-term return of IDEX stock is likely to be higher than its business growth, considering its relative undervaluation.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength of IDEX

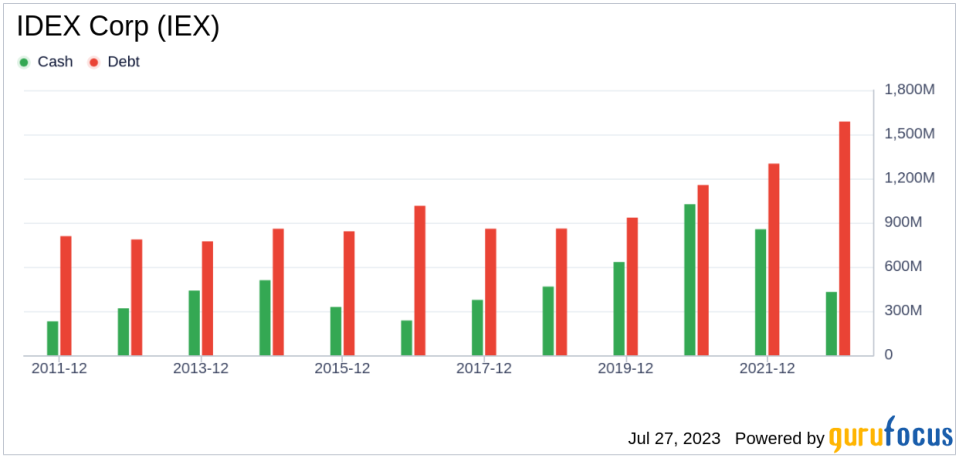

Investing in companies with solid financial strength mitigates the risk of permanent loss. Evaluating the cash-to-debt ratio and interest coverage can provide a clear picture of a company's financial health. IDEX's cash-to-debt ratio of 0.32 is lower than 76.54% of companies in the Industrial Products industry, suggesting fair financial strength with a rating of 7 out of 10.

Profitability and Growth of IDEX

Investing in profitable companies, especially those with consistent profitability over the long term, poses less risk. IDEX, with high profit margins and an impressive track record of profitability over the past 10 years, is a safer investment. The company's operating margin of 23.77% ranks better than 94.46% of companies in the Industrial Products industry, indicating strong profitability.

Growth is a crucial factor in the valuation of a company. IDEX's 3-year average revenue growth rate is better than 57.85% of companies in the Industrial Products industry, and its 3-year average EBITDA growth rate is 11.9%.

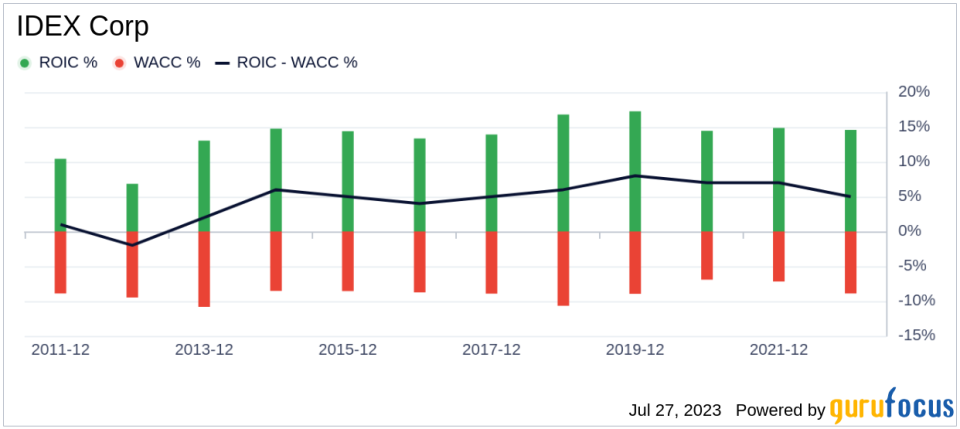

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. If the ROIC is higher than the WACC, the company is creating value for shareholders. Over the past 12 months, IDEX's ROIC was 14.53, while its WACC was 9.17, indicating value creation.

Conclusion

In conclusion, IDEX Corp (NYSE:IEX) appears to be modestly undervalued. The company's financial condition is fair, and its profitability is strong. Its growth ranks better than 55.19% of companies in the Industrial Products industry. To learn more about IDEX stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.