IDEX Corp (IEX) Reports Mixed Fourth Quarter and Robust Full-Year 2023 Financial Results

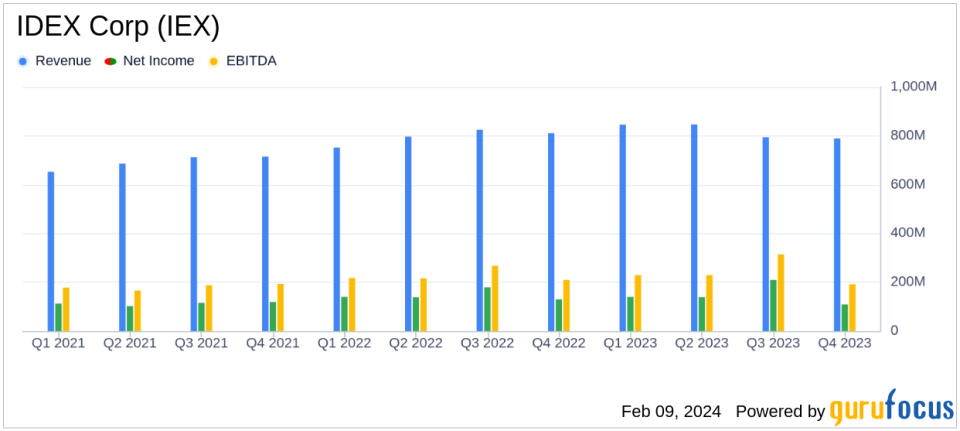

Fourth Quarter Sales: $789 million, a decrease of 3% from the previous year.

Full Year Sales: Record $3.3 billion, an increase of 3% from 2022.

Adjusted Diluted EPS: Q4 at $1.83, down 9%; Full Year at $8.22, up 1%.

Operating Cash Flow: Record $717 million for the year, up 29%.

Free Cash Flow: Record $627 million for the year, up 28%.

Acquisitions: Completed acquisition of STC Material Solutions for $202 million.

On February 7, 2024, IDEX Corp (NYSE:IEX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its diverse range of pumps, flow meters, valves, and fluidic systems, operates across three segments: fluid and metering technologies, health and science technologies, and fire and safety and diversified products. With over 7,000 employees and a global manufacturing presence, IDEX generated $3.3 billion in revenue in 2023, reflecting its significant role in the industrial products sector.

Performance and Challenges

IDEX faced a challenging year marked by global recalibration, which impacted its segments differently. CEO Eric D. Ashleman highlighted the company's resilience and the ability to deliver strong results despite these challenges. However, the company noted uncertainty in the timing of market recovery within its Life Sciences and Analytical Instrumentation businesses, which could moderate growth outlooks.

Financial Achievements

The company's financial achievements, particularly the record operating and free cash flow, underscore its operational efficiency and financial discipline. These metrics are critical for IDEX's ability to invest in growth opportunities, including strategic acquisitions like the recent purchase of STC Material Solutions.

Key Financial Metrics

IDEX reported a decrease in fourth-quarter sales by 3% to $789 million and a 6% organic sales decline. Full-year sales, however, reached a record $3.3 billion, up 3% from 2022. The company's adjusted diluted EPS for the fourth quarter fell by 9% to $1.83, while the full-year adjusted diluted EPS saw a slight increase of 1% to $8.22. Notably, IDEX achieved record operating cash flow of $717 million and record free cash flow of $627 million for the year, marking significant increases of 29% and 28%, respectively.

"IDEX businesses weathered an unprecedented year of global recalibration, which played out differently across our segments. Our teams agility and core execution capabilities, combined with the quality of our underlying assets, enabled us to deliver strong results in a challenging environment," said Eric D. Ashleman, IDEX Corporation Chief Executive Officer and President.

Analysis of Company's Performance

Despite the fourth-quarter sales dip, IDEX's full-year performance demonstrates the company's robustness, with record sales and cash flows indicating a solid financial position. The acquisition of STC Material Solutions aligns with IDEX's strategy to pursue growth in fast-growing markets, supported by a strong balance sheet. However, the company remains cautious about the recovery of certain segments and has projected a modest organic sales growth of 0% to 2% for 2024.

The company's balance sheet remains healthy, with an increase in cash and cash equivalents to $534.3 million as of December 31, 2023, up from $430.2 million the previous year. This financial strength positions IDEX well for future investments and shareholder returns.

For a more detailed analysis and to stay updated on IDEX Corp's (NYSE:IEX) financial journey, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from IDEX Corp for further details.

This article first appeared on GuruFocus.