IDEXX (IDXX) Q3 Earnings Top Estimates, '23 Sales View Down

IDEXX Laboratories, Inc. IDXX posted third-quarter 2023 earnings per share (EPS) of $2.53, up 17.7% year over year. The figure surpassed the Zacks Consensus Estimate by 6.8%.

In the third quarter of 2023, comparable constant-currency EPS of $2.50 improved 16.3% year over year.

Revenues in Detail

Third-quarter revenues increased 8.8% year over year to $915.5 million. Organically, growth was 8%. However, the metric missed the Zacks Consensus Estimate by 0.8%.

The year-over-year upside was primarily driven by 9% reported and 8% organic growth in Companion Animal Group (“CAG”) revenues and Water revenue growth of 9% reported and 7% organic.

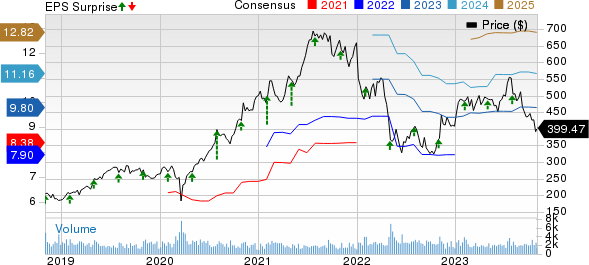

IDEXX Laboratories, Inc. Price, Consensus and EPS Surprise

IDEXX Laboratories, Inc. price-consensus-eps-surprise-chart | IDEXX Laboratories, Inc. Quote

CAG Diagnostics’ recurring revenues increased 10% on a reported basis and 9% on an organic basis, supported by the sustained benefits of IDEXX execution drivers and also reflects double-digit organic revenue growth in the United States and international regions.

Veterinary software, services and diagnostic imaging systems’ revenues increased 14% on a reported basis and 13% organically, reflecting continued high growth in recurring revenues and ongoing momentum in cloud-based software placements.

Segmental Analysis

IDEXX derives revenues from four operating segments — CAG, Water, Livestock, Poultry and Dairy (“LPD”) and Other.

In the third quarter, CAG revenues rose 9% on a reported and 8% on an organic basis year over year to $837.2 million. Our model projected the segment’s revenues to be $840.6 million.

The Water segment’s revenues increased 9% (up 7% organically) year over year to $44.5 million. This figure compares with our model’s segmental projection of $38.3 million for the third quarter.

For the third quarter, LPD revenues increased 5% on a reported basis (up 2% organically) to $29.7 million. Per our model, projected revenues from this segment were $25.5 million.

Revenues in the Other segment fell 43.5% on a reported basis to $4.2 million. The figure missed our segmental projection of $7.7 million for the third quarter.

Margins

The gross profit in the third quarter rose 8.2% to $548 million. The gross margin contracted 34 basis points (bps) to 59.9% on a 9.7% rise in the cost of revenues to 367.5 million.

Sales and marketing expenses rose 4.4% to $136 million, while G&A expenses increased 6.3% to $89 million. R&D expenses dropped 0.1% to $48 million.

Overall, the operating profit in the reported quarter was $275.3 million, up 12.4% year over year. The operating margin in the quarter expanded 98 bps to 30.1%.

Financial Position

IDEXX exited the third quarter of 2023 with cash and cash equivalents of $331.7 million compared with $132.8 million at the end of the second quarter. The total debt (including the current portion) at the end of the third quarter of 2023 was $768.8 million, sequentially down from $771.8 million at the end of the second quarter.

The cumulative net cash provided by operating activities at the end of the third quarter of 2023 was $656.7 million compared with $506.9 million in the prior-year comparable period.

2023 Guidance

IDEXX provided an updated outlook for the full year 2023.

The company expects total revenues to grow in the range of $3.635 billion-$3.650 billion (the earlier projection was in the band of $3.660 billion-$3.715 billion). This suggests growth of 7.9%-8.4% on a reported basis and 8.3%-8.8% on an organic basis, down from the earlier projected growth of 8.5%-10%, both reported and organically. The Zacks Consensus Estimate is currently pegged at $3.67 billion.

IDEXX’s full-year EPS guidance is now pegged in the range of $9.74-$9.90 (up from the previous band of $9.64-$9.90). This updated guidance indicates reported growth of 21%-23%, compared to the previous projected growth of 20%-23%. The Zacks Consensus Estimate for the full-year EPS is currently pegged at $9.8.

Our Take

IDEXX exited the third quarter of 2023 with an earnings beat, while revenues missed estimates. However, revenues increased year over year, driven by the benefits of IDEXX’s key execution drivers and solid growth in the global premium instrument platform installed base.

Across testing modalities, IDEXX achieved strong global growth in the third quarter. In addition, the strong demand for cloud-based products continues to support momentum in software solution placements and customer gains. The expansion of the operating margin further buoys optimism.

However, the company’s reduced revenue guidance for the full year reflects persisting headwinds to clinical visit growth rates globally. Mounting expenses further raise our concern.

Zacks Rank and Key Picks

IDEXX Laboratories currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Inari Medical NARI, Insulet PODD and Cencora, Inc. COR.

Inari Medical, carrying a Zacks Rank #2 (Buy), reported a second-quarter 2023 adjusted EPS of 4 cents, beating the Zacks Consensus Estimate by a staggering 128.6%. Revenues of $119 million outpaced the consensus estimate by 2.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inari Medical has an estimated earnings growth rate of 725% for the next year. Inari Medical’s earnings surpassed estimates in all the trailing four quarters, the average being 66.8%.

Insulet, carrying a Zacks Rank #2, reported a second-quarter 2023 adjusted EPS of 38 cents, which beat the Zacks Consensus Estimate by 58.3%. Revenues of $396.5 million outpaced the consensus estimate by 3.3%.

Insulet has an estimated long-term earnings growth rate of 41.5% compared with the industry’s 14.4% growth. PODD’s earnings surpassed estimates in all the trailing four quarters, the average being 126.9%.

Cencora reported third-quarter fiscal 2023 adjusted earnings of $2.92, which beat the Zacks Consensus Estimate by 3.2%. Revenues of $66.9 billion surpassed the Zacks Consensus Estimate by 5.6%. It currently has a Zacks Rank #2.

Cencora has an earnings yield of 6.8% compared with the industry’s -1.1%. COR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report