IDEXX's (IDXX) Global Growth Continues, Currency Woes Persist

IDEXX Laboratories, Inc.’s IDXX strong global expansion and improved commercial capability aid growth. However, macroeconomic woes dent growth. The stock carries a Zacks Rank #3 (Hold).

IDEXX’s Diagnostics business is one of the fastest-growing areas in the veterinary clinic space since the determination of a patient's health status and the best treatment path often require testing. IDEXX provides advanced diagnostic capabilities that meet veterinarians’ diverse needs through a variety of modalities, including in-clinic diagnostic solutions and outside reference laboratory services. These diagnostic capabilities generate a mix of recurring and non-recurring revenues.

The continuing growth of Companion Animal Group’s (CAG) recurring diagnostic products and services depends upon volume growth at existing customers who are trying to increase their utilization of existing and new test offerings, acquire new customers, maintain high customer loyalty and retention, and realize modest annual price increases. Further, the company generates substantial revenues and margins from selling consumables used in IDEXX VetLab instruments.

In the fourth quarter of 2023, IDEXX's CAG Diagnostics recurring revenues increased 10% organically, supported by an average global net price improvement of 6% to 7%. Consistent with the past quarters, the growth remained above the sector’s growth levels. The results, supported by the sustained benefits from execution drivers, reflected a sequential improvement from the third-quarter volume growth levels and marked the strongest normalized volume growth quarter in 2023.

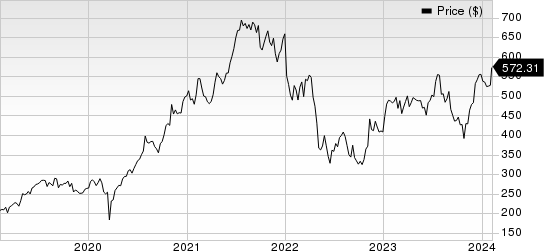

IDEXX Laboratories, Inc. Price

IDEXX Laboratories, Inc. price | IDEXX Laboratories, Inc. Quote

A key element of IDEXX’s customer engagement strategy is the expansion of its commercial footprint in a disciplined way. In late 2023, the company made its latest commercial expansion in the United States, the first in four years. It complements the seven targeted international expansions that IDEXX has undertaken since 2021. Across international markets, its business performance is reaping the benefits of its expanded global commercial capability. In 2023, the international premium installed base expanded 13%, driven by double-digit installed base growth across chemistry, hematology and urine sediment in clinic platforms.

IDEXX achieved solid organic gains across major testing modalities in the fourth quarter of 2023. IDEXX VetLab consumable revenues witnessed double-digit organic gains across the United States and international regions. Throughout this year, the global premium installed base reflected gains across the Catalyst, Premium Hematology and SediVue platforms.

Over the past year, shares of IDXX have improved 15.2% compared with the industry’s 4.6% growth.

On the flip side, global macroeconomic conditions, including inflation, supply chain disruptions, fluctuations in foreign currency exchange rates, and volatility in capital markets may continue to affect IDEXX’s operations results. These challenges, along with geopolitical instability, including the current war in Ukraine, have affected IDEXX’s supply chain operations globally.

With sustained inflationary pressure in the future, the company may struggle to keep its cost of revenues and operating expenses in check. During the fourth quarter of 2023, IDXX’s sales and marketing expenses increased 7.7%, while general and administrative expenses increased 19.3% year over year.

Further, the majority of IDEXX’s consolidated revenues are derived from the sale of products in international markets (international revenues accounted for 34.7% of total revenues in 2023). Thus, the strengthening of the rate of exchange for the U.S. dollar relative to other currencies had a negative impact on the company’s revenues derived in currencies other than the U.S. dollar and on profits from products manufactured in the United States and sold internationally. In 2023, foreign exchange reduced operating profits by $25 million (operating margin gains by 60 basis points) and earnings per share by 24 cents per share.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DaVita DVA. Each of them presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics’ stock has fallen 8.7% in the past year. Earnings estimates for Haemonetics have remained constant at $3.89 for fiscal 2024 and increased from $4.15 to $4.19 for fiscal 2025 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.91 to $1.97 in the past 30 days. Shares of the company have plunged 33.1% in the past year compared with the industry’s fall of 0.6%.

PODD’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DaVita’s 2023 earnings per share have remained constant at $8.07 in the past 30 days. Shares of the company have risen 30.7% in the past year compared with the industry’s 5.7% rise.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 36.6%. In the last reported quarter, it delivered an average earnings surprise of 48.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report