IDT Corp (IDT) Announces Mixed Q2 Fiscal Year 2024 Results with Stable EPS and Revenue Decline

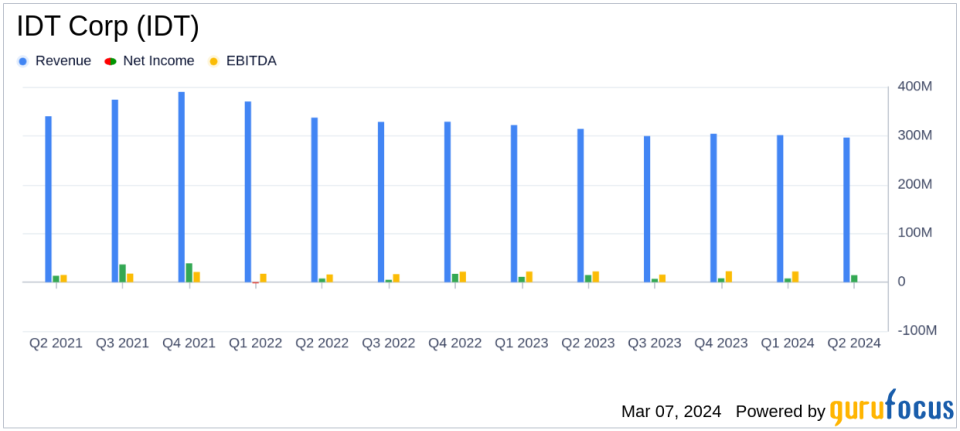

Revenue: Declined by 5.7% year-over-year to $296.1 million.

Gross Profit: Increased by 7.7% year-over-year to $97.4 million.

Net Income: Slightly decreased by $0.2 million to $14.4 million.

Earnings Per Share (EPS): Remained unchanged year-over-year at $0.57; Non-GAAP EPS increased to $0.67 from $0.62.

Gross Profit Margin: Improved significantly by 410 basis points to 32.9%.

Dividend: Initiated a quarterly dividend of $0.05 per share of Common Stock.

Liquidity: Cash, cash equivalents, debt securities, and current equity investments totaled $177.6 million.

On March 6, 2024, IDT Corp (NYSE:IDT) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024. IDT Corp, a multinational holding company with operations in telecommunications and payment industries, reported a year-over-year revenue decline of 5.7% to $296.1 million. However, the company's gross profit increased by 7.7% to $97.4 million, and gross profit margin saw a significant improvement, rising to 32.9%.

Performance Highlights and Challenges

IDT's CEO, Shmuel Jonas, highlighted the expansion of growth businesses, with both NRS and BOSS Money surpassing the $100 million annual revenue run rate milestone. The Fintech segment achieved Adjusted EBITDA break-even for the quarter, and net2phone increased subscription revenue by 19% year over year, reaching cash flow break-even. Despite these achievements, the company faced a decline in overall revenue, which may pose challenges in maintaining growth momentum.

Financial Achievements and Industry Significance

The initiation of a quarterly dividend reflects confidence in IDT's financial health and its ability to generate consistent cash flows, particularly from its Traditional Communications segment. The robust gross profit margin indicates effective cost management and operational efficiency, which is crucial in the competitive telecommunications services industry.

Segment Performance

The NRS segment saw a 28.5% increase in active POS terminals and a 30.4% increase in total recurring revenue. The net2phone segment's subscription revenue grew by 18.5%, and the Fintech segment's BOSS Money transactions increased by 37.1%, driving a 41.9% increase in revenue. However, the Traditional Communications segment experienced a revenue decline across all its categories.

Financial Position and Outlook

IDT's balance sheet remains strong with no outstanding debt and substantial liquidity. The company's cash flow from operations increased, and capital expenditures decreased, indicating prudent financial management. The introduction of a dividend signals a positive outlook and a commitment to returning value to shareholders.

"NRS, BOSS Money and net2phone no longer need new cash investments to fund their organic growth. In aggregate, they have become significant contributors to our bottom line. Meanwhile, we expect cash flows from our Traditional Communications segment to remain robust for years to come," said Shmuel Jonas, CEO of IDT.

IDT's mixed financial results demonstrate the company's resilience in a challenging market. While revenue has declined, the increase in gross profit and the initiation of a dividend are positive indicators of the company's strategic direction and financial stability. Investors and potential GuruFocus.com members may find IDT's ability to maintain profitability and shareholder value appealing, despite the revenue headwinds.

For a more detailed analysis and to participate in the earnings conference call, investors can visit the "Investors & Media" section of the IDT Corporation website or access the call replay using the provided passcode: 49825.

IDT Corp's commitment to innovation and strategic investments in growth segments, coupled with its disciplined financial management, positions the company to navigate the dynamic telecommunications landscape effectively.

Explore the complete 8-K earnings release (here) from IDT Corp for further details.

This article first appeared on GuruFocus.