iHeartMedia Inc (IHRT) Faces Headwinds as Q4 Revenue Dips, Digital Audio Group Shines Amidst ...

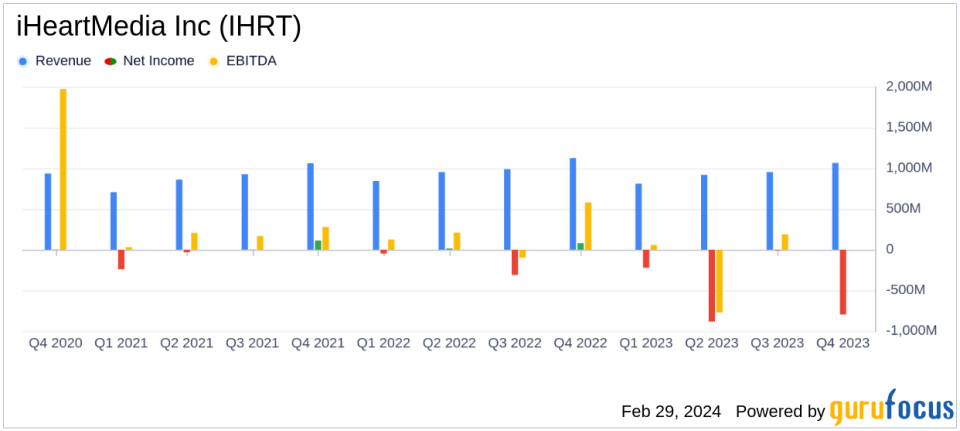

Q4 Revenue: $1,067 million, a decrease of 5.2% from the previous year.

GAAP Operating Income: Dropped to $80 million from $173 million in Q4 2022.

Adjusted EBITDA: $208 million, within the guidance range but down from $316 million in Q4 2022.

Free Cash Flow: Reported at $142 million, with an additional $3 million from real estate sales.

Digital Audio Group: Revenue up by 6% to $318 million, with Podcast Revenue increasing by 17%.

Multiplatform Group: Revenue down by 7% to $684 million, with a 39% drop in Segment Adjusted EBITDA.

Full Year Highlights: Revenue down 4% to $3,751 million, with a significant operating loss due to non-cash impairment charges.

On February 29, 2024, iHeartMedia Inc (NASDAQ:IHRT) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The diversified media and entertainment company, operating through segments such as the Multiplatform Group, Digital Audio Group, and Audio & Media Services Group, faced a challenging quarter with a decline in revenue and operating income.

Performance and Challenges

The company's Q4 revenue saw a 5.2% decrease to $1,067 million, slightly outperforming the guidance range of a high-single-digit decline. This dip was attributed to a challenging macroeconomic environment and a decrease in political advertising revenue, which is cyclical in nature. The GAAP operating income also fell sharply to $80 million from $173 million in the same quarter of the previous year. However, the Digital Audio Group was a bright spot, with revenue increasing by 6% and podcast revenue up by 17%, showcasing the segment's resilience and growth potential.

Financial Achievements and Importance

The company's financial achievements, particularly in the Digital Audio Group, underscore the strategic shift towards high-growth digital businesses. The Digital Audio Group's Adjusted EBITDA margin reached 36.7%, reflecting the success of this segment. These achievements are critical in an industry that is increasingly moving towards digital and on-demand audio content, positioning iHeartMedia Inc (NASDAQ:IHRT) favorably within the Media - Diversified sector.

Key Financial Metrics

Key financial metrics from the earnings report highlight the company's proactive capital structure improvement efforts. iHeartMedia Inc (NASDAQ:IHRT) reduced the outstanding principal balance of certain Senior Unsecured Notes from $1.45 billion to approximately $0.9 billion, expecting to generate about $45 million of annualized interest savings. The company's cash balance and total available liquidity stood at $346 million and $772 million, respectively, as of December 31, 2023.

"Were pleased to report that our fourth quarter results were in line with our previously provided Adjusted EBITDA and Revenue guidance ranges, said Bob Pittman, iHeartMedias Chairman and CEO. This quarter the Digital Audio Group achieved the highest Adjusted EBITDA and margin in its history, illustrating the success of this high growth business."

"We expect to see a significant year over year improvement in our 2024 financial performance, supported by our ongoing efficiency efforts and what is anticipated to be record-setting political advertising year, added Rich Bressler, iHeartMedias President, COO and CFO.

Analysis of Company's Performance

The company's performance in Q4 2023, while facing headwinds, shows signs of strategic realignment with a focus on digital growth. The proactive management of capital structure and cost-saving initiatives are expected to bolster the financial standing and support a recovery trajectory in 2024. The guidance for Q1 2024 anticipates flat to slightly lower consolidated revenue but an improvement in Consolidated Adjusted EBITDA, indicating cautious optimism for the year ahead.

For a detailed understanding of iHeartMedia Inc (NASDAQ:IHRT)'s financials and strategic direction, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from iHeartMedia Inc for further details.

This article first appeared on GuruFocus.