Illinois Tool (ITW) Tops on Q1 Earnings, Increases 2021 View

Illinois Tool Works Inc. ITW has delivered impressive results for the first quarter of 2021. Its earnings surpassed estimates by 11.1, whereas sales beat the same by 3.3%. This was the eleventh consecutive quarter of impressive bottom-line results.

The industrial tool maker’s earnings in the reported quarter were $2.11 per share, surpassing the Zacks Consensus Estimate of $1.90. Also, the bottom line increased 19.2% from the year-ago reported number of $1.77 on the back of sales generation and operating margin improvement.

Revenue Details

Illinois Tool generated revenues of $3,544 million in the reported quarter, reflecting growth of 9.8% from the year-ago figure. Top-line results benefitted from a 6.1% increase in organic sales and a 3.7% contribution from movements in foreign currencies.

Also, the top line surpassed the Zacks Consensus Estimate of $3,430 million.

Illinois Tool reports revenues under the segments discussed below:

Test & Measurement and Electronics’ revenues in the first quarter increased 14% year over year to $552 million. Revenues from Automotive OEM (Original Equipment Manufacturer) grew 12.6% to $783 million. Food Equipment generated revenues of $451 million, decreasing 6.5% year over year.

Welding revenues were $401 million, growing 7.5% year over year. Construction Products’ revenues were up 20.2% to $469 million. Further, revenues of $457 million from Specialty Products reflected an increase of 10.4%. Polymers & Fluids’ revenues of $435 million grew 10.7% year over year.

Margin Profile

In the reported quarter, Illinois Tool’s cost of sales increased 9% year over year to $2,039 million. It represented 57.5% of the quarter’s revenues versus 58% in the year-ago quarter. Selling, administrative, and research and development expenses expanded 1.1% year over year to $566 million. It represented 16% of first-quarter revenues versus 17.4% in the year-ago quarter.

Operating margin was 25.5% in the quarter, up 190 basis points from the year-ago quarter. Enterprise initiatives contributed 120 bps to operating margin.

Interest expenses in the quarter increased 2% year over year to $52 million. Effective tax rate in the quarter was 22.4%.

Balance Sheet and Cash Flow

Exiting the first quarter, Illinois Tool had cash and cash equivalents of $2,484 million, down 3.1% from $2,564 million recorded at the end of the last reported quarter. Long-term debt decreased 2.2% sequentially to $7,599 million.

In the first quarter, the company generated net cash of $609 million from operating activities, reflecting a decline of 0.8% from the year-ago quarter. Capital spending on the purchase of plant and equipment was $68 million, up 13.3% year over year. Free cash flow was $541 million, reflecting a year-over-year decline of 2.3%.

Outlook

For 2021, Illinois Tool increased its financial projections. It now expects organic revenue growth of 10-12% as compared with an increase of 7-10% mentioned previously. Total revenues are projected to increase 12-14% versus 9-12% mentioned earlier.

Foreign currency translation is expected to positively impact sales by 2%.

Earnings (GAAP) are expected to be $8.20-$8.60 per share, up from $7.60-$8.00 mentioned previously. The revised projection suggests an increase of 27% (at the mid-point) from the year-ago .quarter.

Operating margin is expected to be 25-26% and enterprise initiatives are likely to contribute 100 bps. Free cash is anticipated to be in excess of 100% of net income. In the year, the company intends to buy back $1 billion worth of shares.

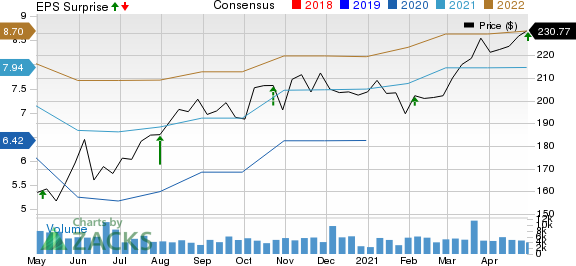

Illinois Tool Works Inc. Price, Consensus and EPS Surprise

Illinois Tool Works Inc. price-consensus-eps-surprise-chart | Illinois Tool Works Inc. Quote

Zacks Rank & Stocks to Consider

With a market capitalization of $72.8 billion, Illinois Tool currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industry are Dover Corporation DOV, Applied Industrial Technologies, Inc. AIT and Graco Inc. GGG. While Dover currently sports a Zacks Rank #1 (Strong Buy), both Applied Industrial and Graco carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 23.13% for Dover, 28.95% for Applied Industrial and 16.00% for Graco.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research