Illinois Tool Works Inc Reports Steady Earnings Amidst Market Challenges

Revenue: Reported a slight increase to $16.1 billion for the full year 2023.

Operating Margin: Achieved a record 25.1% for the year, a 130 bps improvement.

GAAP EPS: Grew to $9.74, marking a 6% increase excluding divestiture gains.

Free Cash Flow: Surged by 59% to a record $3.1 billion for the year.

2024 Guidance: Anticipates revenue growth of 2 to 4% with GAAP EPS between $10.00 and $10.40.

On February 1, 2024, Illinois Tool Works Inc (NYSE:ITW) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The diversified global manufacturer, known for its specialized industrial equipment, consumables, and related services, reported a steady performance despite a challenging macroeconomic environment.

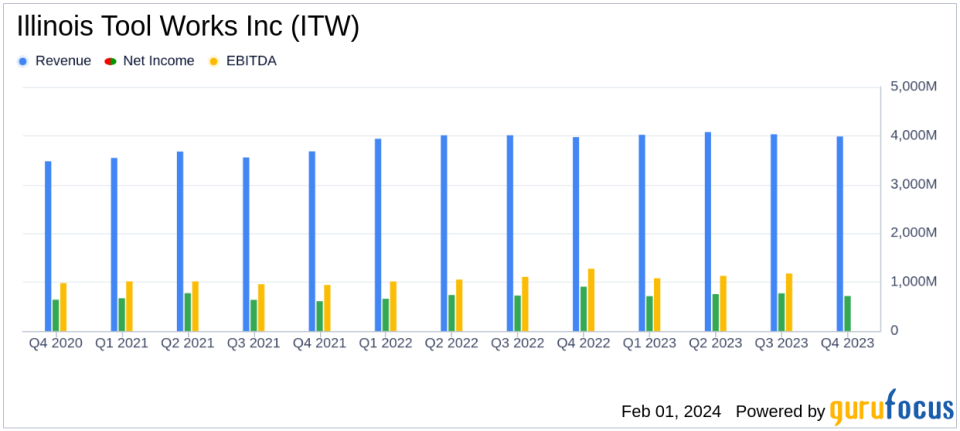

For the fourth quarter, ITW's revenue remained essentially flat at $4.0 billion, with a slight organic decline of 0.5%. The company's operating margin for the quarter stood at 24.8%, benefiting from 150 basis points contributed by enterprise initiatives. GAAP EPS for the quarter was reported at $2.38, which included a $(0.04) impact from the devaluation of Argentinas currency.

ITW's full-year performance highlighted its resilience, with a 1% increase in revenue to $16.1 billion and a 2% organic growth. The operating income rose by 7% to $4 billion, and the operating margin expanded by 130 basis points to a record 25.1%. The company's GAAP EPS increased by 6% to $9.74, excluding $0.60 of divestiture gains in 2022. Notably, ITW's free cash flow soared to a record $3.1 billion, a 59% increase, with a conversion rate of 104% to net income.

Financial Highlights and Segment Performance

ITW's robust operating margin and free cash flow underscore its operational efficiency and financial discipline. The company's decentralized and entrepreneurial culture, coupled with its 80/20 operating process, continues to drive profitability across its segments. The Automotive OEM segment, for instance, delivered an operating margin of 17.3% for the full year, while the Welding segment achieved an impressive 31.8%.

On the balance sheet, ITW maintained a strong financial position with $1.065 billion in cash and equivalents as of December 31, 2023. The company's commitment to shareholder returns was evident in its $3.1 billion distribution through dividends and share repurchases, with a 7% increase in dividend per share.

Looking Ahead: 2024 Prospects

Looking forward, ITW provided guidance for 2024, projecting revenue growth of 2 to 4% with organic growth of 1 to 3%. The company anticipates an operating margin between 25.5% and 26.5%, with enterprise initiatives contributing approximately 100 basis points. GAAP EPS is expected to range from $10.00 to $10.40, representing a 5% increase at the mid-point. ITW also plans to continue its shareholder-friendly capital allocation, with an estimated $1.5 billion in share repurchases.

Christopher A. OHerlihy, President and CEO of ITW, expressed confidence in the company's momentum and positioning for 2024. He commended the ITW team for their dedication and excellence in executing the company's strategy, which has been instrumental in navigating the macro demand environment and achieving record results.

Value investors may find ITW's consistent performance, strong cash flow generation, and disciplined capital allocation strategy appealing. The company's ability to maintain and grow its margins, despite market headwinds, positions it as a resilient player in the industrial products sector.

For a detailed breakdown of ITW's financials and forward-looking guidance, investors can refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Illinois Tool Works Inc for further details.

This article first appeared on GuruFocus.