Illinois Tool's (ITW) Board Approves 7% Hike in Dividend Rate

Illinois Tool Works Inc. ITW announced a 7% hike in the quarterly dividend rate. The improved rewards to shareholders seem to have boosted sentiments for the stock, as evident from a 0.3% hike in the share price on Aug 6. The trading session ended at $227.73 per share.

It is worth mentioning here that the dividend hike news came in after seven days of the release of the second-quarter 2021 results. The company’s quarterly earnings surpassed estimates by 1.45% and its sales exceeded the same by 3%.

We believe that such shareholder-friendly policies of Illinois Tool reflect a strong cash position and belief in future profitability.

Inside the Headlines

As noted, the company’s board of directors approved a hike of 8 cents per share in the quarterly dividend rate, which now stands at $1.22 per share. The previous quarterly dividend rate was $1.14. On an annualized basis, the dividend rate has been improved from $4.56 to $4.88.

The company will pay out the revised quarterly dividend, pertaining to the third quarter of 2021, on Oct 14, 2021, to shareholders of record as of Sep 30.

Sound Capital-Allocation Strategies

Illinois Tool follows sound capital-allocation strategies, aiming to improve values for shareholders. Free resources are primarily used for product development, improvement of services, end-market penetration, and rewarding shareholders through dividend payments and share buybacks.

In the first half of 2021, the company repurchased 2.3 million shares worth $500 million and paid out dividends totaling $721 million. In the year-ago period, share buybacks amounted to $706 million and dividend payouts were $680 million. Exiting the second quarter of 2021, the company had $740 million worth of share buyback authorization left from its 2018-approved program.

Also, this May, the company’s board of directors approved a $3-billion share buyback program. The entire authorization was left at the end of the second quarter of 2021.

Zacks Rank, Price Performance and Earnings Estimate Trend

With a market capitalization of $71.9 billion, Illinois Tool currently carries a Zacks Rank #3 (Hold). Strengthening demand, diversity in businesses, enterprise initiatives and effective pricing costs are likely to aid the company in the quarters ahead. However, a hike in raw material costs and disruptions in the supply chain are headwinds.

In the past three months, the company’s shares lost 4.8% compared with a 4.5% decline by the industry.

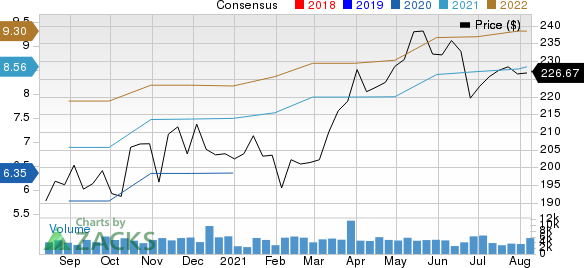

Image Source: Zacks Investment Research

Its Zacks Consensus Estimate for earnings is pegged at $8.56 for 2021 and $9.30 for 2022. The estimates reflect increases of 0.7% for 2021 and 0.4% for 2022 from the respective 30-day ago figures.

Illinois Tool Works Inc. Price and Consensus

Illinois Tool Works Inc. price-consensus-chart | Illinois Tool Works Inc. Quote

Stocks to Consider

Some better-ranked stocks in the industry are Kadant Inc. KAI, Altra Industrial Motion Corp. AIMC and Dover Corporation DOV. While Kadant currently sports a Zacks Rank #1 (Strong Buy), both Altra Industrial and Dover carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 33.11% for Kadant, 8.54% for Altra Industrial and 11.96% for Dover.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research