Illumina (ILMN) Hurt by Rising Costs, Tough Competition

Illumina ILMN faces significant competition in the sequencing, SNP genotyping, gene expression and molecular diagnostics markets with several large players already enjoying significant market share. Government budget cuts, including NIH funding issues, are a major headwind. The stock currently carries a Zacks Rank #4 (Sell).

During the fourth quarter of 2022, Illumina’s research and development expenses increased 75% year over year, whereas selling, general & administrative expenses rose a stupendous 42.9%. This rise in operating expenses pushed up operating costs by 55.8%. Escalating costs led to huge operating losses in the quarter and put significant pressure on the company’s bottom line.

In August 2021, Illumina closed the $7.1-billion impending acquisition of non-invasive, early detection liquid biopsy test provider GRAIL. However, during the European Commission's ongoing regulatory review, the company will hold GRAIL as a separate and independent unit. Illumina is positioned to abide by the final results reached in these legal processes by keeping GRAIL separate while proceedings continue. Further, the company is dedicated to working through the continuing FTC administrative process and will follow any decision the U.S. courts reach. At present, the phase II merger investigation is still going on.

Other than the uncertainty surrounding the Grail integration, these regulatory complications are raising the legal expenses for Illumina, thereby building pressure on the bottom line.

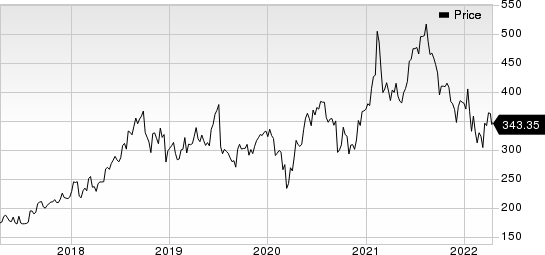

Illumina, Inc. Price

Illumina, Inc. price | Illumina, Inc. Quote

In addition, Illumina faces significant competition in the sequencing, SNP genotyping, gene expression and molecular diagnostics markets with several large players already enjoying significant market share, intellectual property portfolios and regulatory expertise. Such companies include the likes of Agilent Technologies, Pacific Biosciences of California, BGI, QIAGEN N.V., Roche Holding A.G. and Thermo Fisher Scientific, among others.

Further, the timing and amount of Illumina’s revenues from customers that rely on government and academic research funding may vary significantly due to factors that can be difficult to forecast. This may lead to significant uncertainty in government and academic research funding worldwide.

On a positive note, Illumina exited the fourth quarter of 2021 with better-than-expected results. The robust year-over-year improvement in Core Illumina businesses looks encouraging. Contributions from the recently-concluded GRAIL acquisition also buoy optimism.

NovaSeq consumable and instrument shipments reached new highs during the quarter, led by oncology testing, population sequencing and drug discovery initiatives. The bullish 2022 guidance with strong growth projections over 2021 instills investor confidence in the company. The solid long-term growth potential of the oncology space and worldwide expansion to drive growth also buoy optimism. A strong capital structure is an added plus.

In the past year, Illumina has outperformed its industry. The stock has declined 5.4% compared with the industry's 27.7% fall.

Key Picks

A few better-ranked stocks in the broader medical space are Owens & Minor, Inc. OMI, Abiomed, Inc. ABMD and McKesson Corporation MCK.

Owens & Minor has a long-term earnings growth rate of 8.8%. Owens & Minor’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 29.5%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Owens & Minor has outperformed the industry over the past year. OMI has gained 15.3% against a 15.6% industry decline in the said period.

Abiomed has an estimated long-term growth rate of 20%. Abiomed’s earnings surpassed estimates in the trailing four quarters, the average surprise being 9.2%. It currently carries a Zacks Rank #2 (Buy).

Abiomed has underperformed the industry over the past year. ABMD has lost 5.5% against the industry’s 1% growth over the past year.

McKesson has a long-term earnings growth rate of 11.8%. McKesson’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 20.6%, on average. It presently carries a Zacks Rank #2.

McKesson has outperformed the industry over the past year. MCK has gained 69.9% in the said period compared with 9.7% growth of the industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Owens & Minor, Inc. (OMI) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research