Can You Imagine How ACM Research's (NASDAQ:ACMR) Shareholders Feel About The 70% Share Price Increase?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the ACM Research, Inc. (NASDAQ:ACMR) share price is up 70% in the last year, clearly besting than the market return of around 9.4% (not including dividends). So that should have shareholders smiling. We'll need to follow ACM Research for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for ACM Research

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

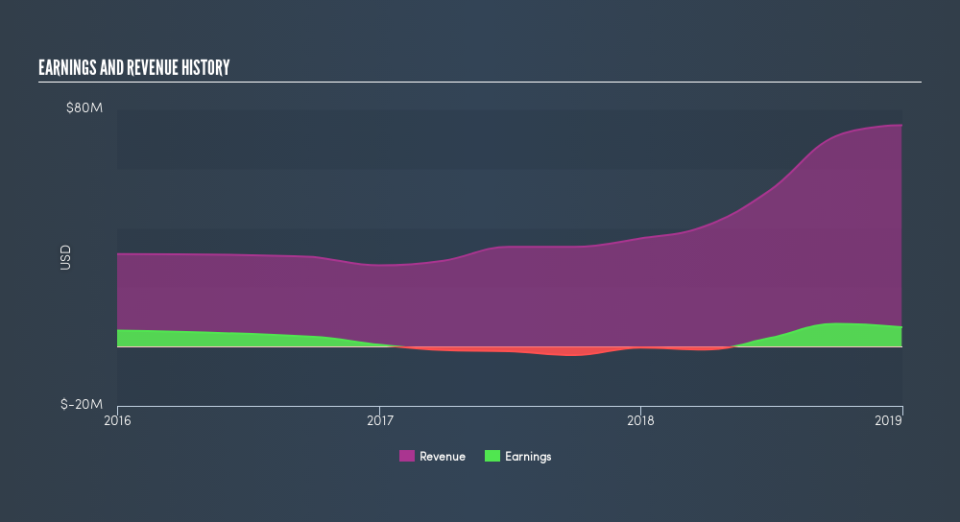

ACM Research went from making a loss to reporting a profit, in the last year. When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 104% would help. Many businesses do go through a faze where they have to forgo some profits to drive business development, and sometimes its for the best.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on ACM Research

A Different Perspective

ACM Research shareholders should be happy with the total gain of 70% over the last twelve months. And the share price momentum remains respectable, with a gain of 81% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. Is ACM Research cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.