Can You Imagine How Ecstatic Intelligent Systems's (NYSEMKT:INS) Shareholders Feel About Its 2932% Share Price Increase?

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Intelligent Systems Corporation (NYSEMKT:INS) shares for the last five years, while they gained 2932%. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen 13% in thirty days. We note that Intelligent Systems reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Intelligent Systems

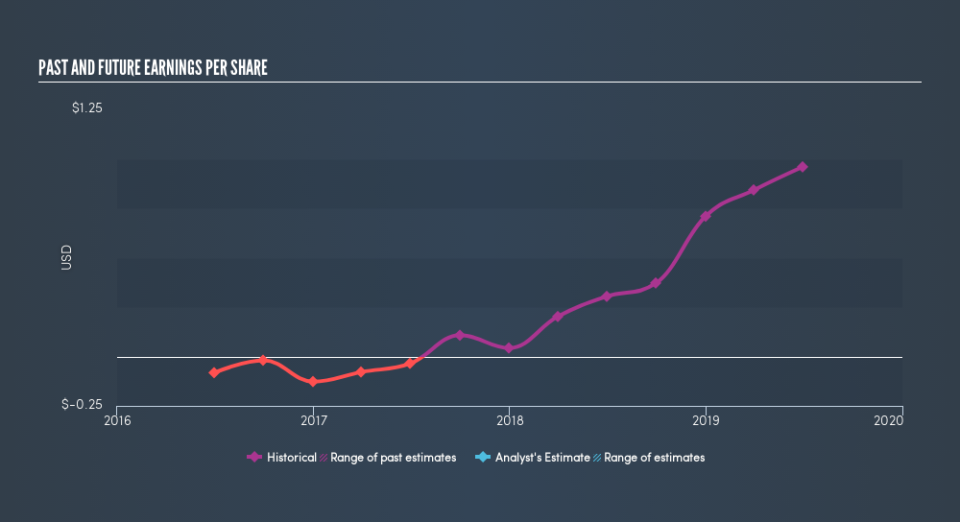

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Intelligent Systems became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Intelligent Systems's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Intelligent Systems's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Intelligent Systems hasn't been paying dividends, but its TSR of 3276% exceeds its share price return of 2932%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Intelligent Systems shareholders have received a total shareholder return of 239% over the last year. That gain is better than the annual TSR over five years, which is 102%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before deciding if you like the current share price, check how Intelligent Systems scores on these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.