Imagine Owning American Renal Associates Holdings (NYSE:ARA) While The Price Tanked 53%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term American Renal Associates Holdings, Inc. (NYSE:ARA) shareholders. Regrettably, they have had to cope with a 53% drop in the share price over that period. Furthermore, it's down 21% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 24% decline in the broader market, throughout the period.

Check out our latest analysis for American Renal Associates Holdings

Because American Renal Associates Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, American Renal Associates Holdings grew revenue at 3.7% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 22% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

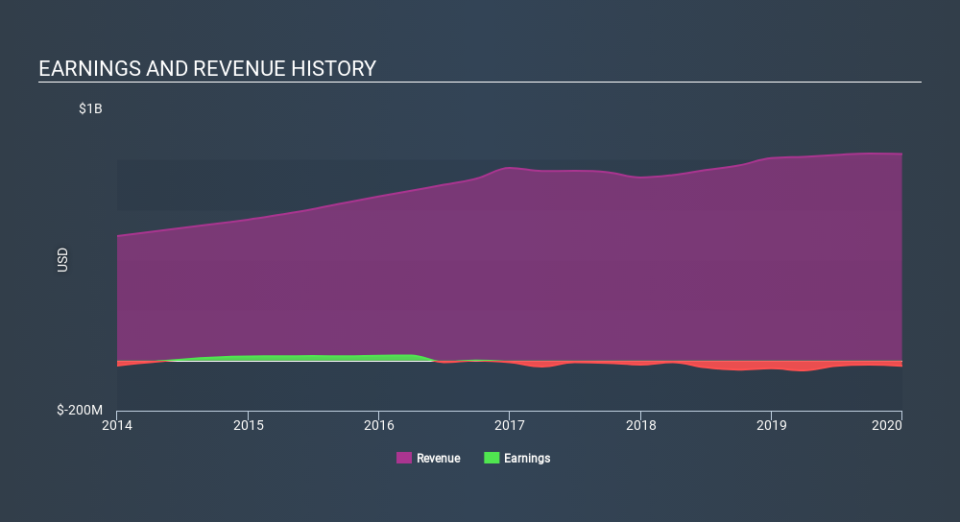

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that American Renal Associates Holdings shareholders have gained 31% (in total) over the last year. That certainly beats the loss of about 22% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand American Renal Associates Holdings better, we need to consider many other factors. For example, we've discovered 2 warning signs for American Renal Associates Holdings that you should be aware of before investing here.

We will like American Renal Associates Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.