Imagine Owning China Environmental Technology and Bioenergy Holdings (HKG:1237) And Trying To Stomach The 95% Share Price Drop

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Imagine if you held China Environmental Technology and Bioenergy Holdings Limited (HKG:1237) for half a decade as the share price tanked 95%. We also note that the stock has performed poorly over the last year, with the share price down 51%. The falls have accelerated recently, with the share price down 23% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for China Environmental Technology and Bioenergy Holdings

China Environmental Technology and Bioenergy Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years China Environmental Technology and Bioenergy Holdings saw its revenue shrink by 2.3% per year. That's not what investors generally want to see. The share price fall of 44% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

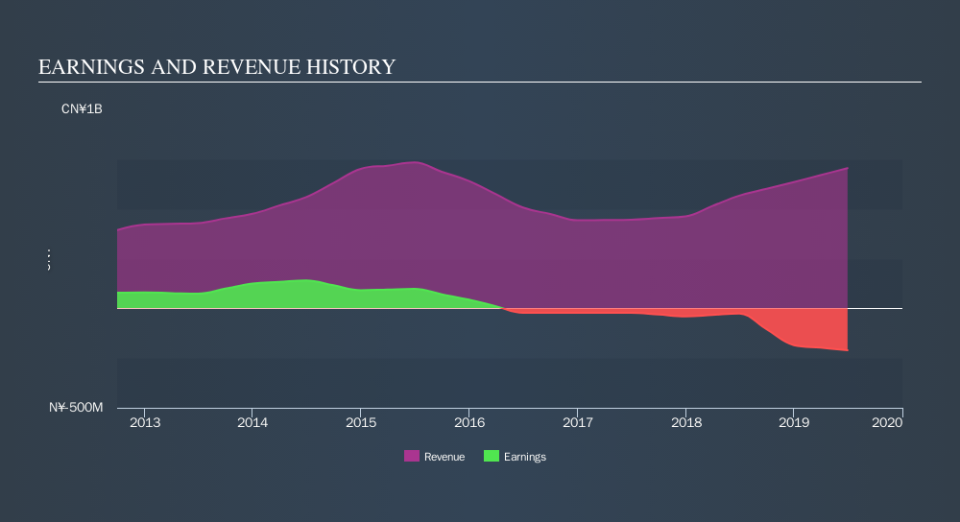

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on China Environmental Technology and Bioenergy Holdings's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 1.9% in the last year, China Environmental Technology and Bioenergy Holdings shareholders lost 51%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 44% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course China Environmental Technology and Bioenergy Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.