Imagine Owning Netfonds (FRA:NF4) And Wondering If The 13% Share Price Slide Is Justified

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Netfonds AG (FRA:NF4) share price slid 13% over twelve months. That falls noticeably short of the market return of around -2.0%. Netfonds hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The silver lining is that the stock is up 1.5% in about a week.

Check out our latest analysis for Netfonds

Netfonds isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Netfonds grew its revenue by 8.9% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 13% in a year. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

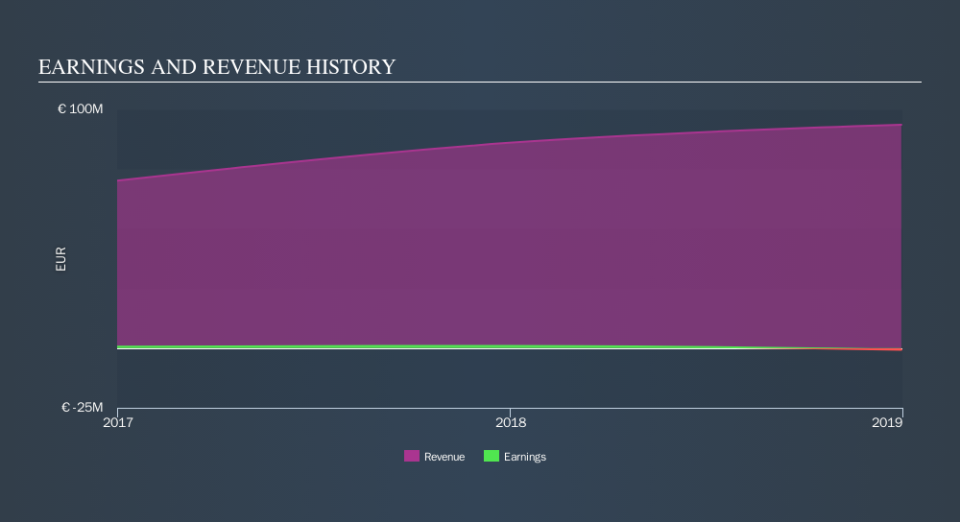

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Netfonds's financial health with this free report on its balance sheet.

A Different Perspective

Netfonds shareholders are down 12% for the year (even including dividends) , even worse than the market loss of 2.0%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 0.5% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Netfonds may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.