Imagine Owning United Community Banks (NASDAQ:UCBI) And Wondering If The 22% Share Price Slide Is Justified

United Community Banks, Inc. (NASDAQ:UCBI) shareholders should be happy to see the share price up 14% in the last week. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 22% in one year, under-performing the market.

Check out our latest analysis for United Community Banks

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the United Community Banks share price fell, it actually saw its earnings per share (EPS) improve by 0.6%. It's quite possible that growth expectations may have been unreasonable in the past.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

Revenue was fairly steady year on year, which isn't usually such a bad thing. But the share price might be lower because the market expected a meaningful improvement, and got none.

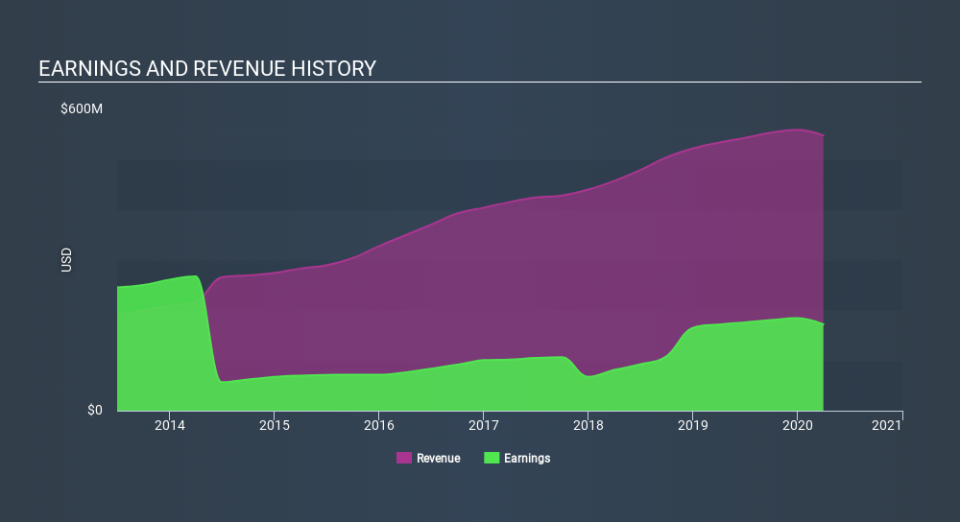

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling United Community Banks stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, United Community Banks's TSR for the last year was -20%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

United Community Banks shareholders are down 20% for the year (even including dividends) , but the market itself is up 9.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand United Community Banks better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for United Community Banks you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.